KC capital implants cattle tech startup with fuel to scale, expanding IVF labs, headcount

September 20, 2022 | Nikki Overfelt Chifalu

Livestock production has seen a remarkable transformation since Kerryann Kocher was growing up on her family’s sixth-generation farm in northeast Iowa, the Vytelle CEO said.

Instead of just selecting the cow that looks best and bringing in the neighbor’s bull for breeding, as she remembers it, Kocher and Vytelle — a Kansas City-based precision livestock company — are helping producers drive genetic progress forward with data capture and in vitro fertilization.

“We want to advance genetics to be more productive, more sustainable, more profitable at producing exactly what the consumers want from a meat and milk perspective,” she said.

Vytelle’s cattle tech launched in 2020, announced a $13.2 million funding round in September 2021, and is currently working with cattle producers in 21 countries.

Click here to learn more about Vytelle’s 2021 funding.

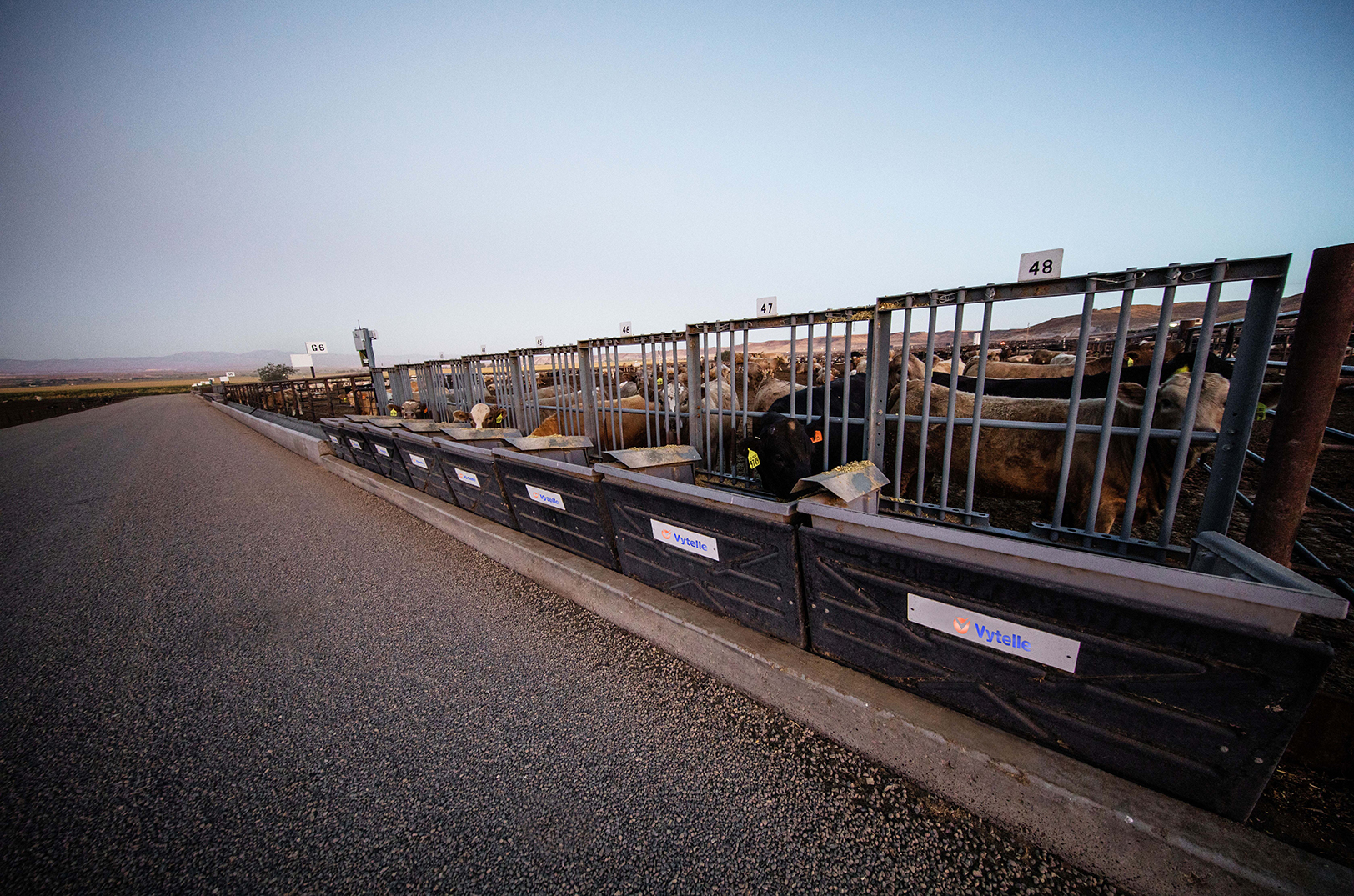

Vytelle is an integrated technology platform built to accelerate genetic progress in cattle; photo courtesy of Vytelle

Kansas City and beyond

The company’s 2021 funding round has allowed Vytelle to scale operations, Kocher said. Since then, the startup has added four new IVF labs. Three of those are in the U.S. — Brock, Texas, Gainesville, Florida, and Albany, New York. The other one is in Hamilton, New Zealand.

“It’s our first company-owned lab outside the U.S.,” she added. “And we started production this week.”

The oversubscribed funding round worth $13.2 million was co-led by Overland Park-based Ag-tech venture-based Fulcrum Global Capital and the private equity firm Open Prairie, through the Open Prairie Rural Opportunities Fund. The financing also included participation from Kansas City’s KCRise Fund II and Innovation In Motion, Illinois-based Serra Ventures, and existing investor UK-based Wheatsheaf Group.

It was a big deal for the startup that a significant portion of the funding came from local investors, Kocher said.

“We’re really proud to be Kansas City-based,” she continued. “We wanted some hometown support. And here in the Kansas City region, where we sit with nearly 300 animal health companies in the region, we feel that support and we appreciate that ecosystem that exists.”

Vytelle is recognized on Startland News’ 2022 Kansas City Venture Capital-Backed Companies Report. Click here to check out the full report.

Vytelle plans to open several additional labs before the end of this year, according to Kocher, and they will also be focusing on optimization to support their growth this upcoming year.

“We continue to be on a strong growth trajectory, and I don’t see that changing,” she added.

Click here to read more from venture experts on the impact of coastal investors versus Kansas City capital.

Utilizing the most modern in vitro fertilization (IVF) technique, Vytelle helps move cattle herds forward quickly by multiplying offspring from elite-performing animals, shortening generation intervals and improving reproductive efficiency; photo courtesy of Vytelle

Access through tech

Kocher, who went to school for agriculture education, joined Vytelle in 2020 after spending 15 years in the animal health industry.

“(I) have really dedicated my entire career to livestock production and serving farmers, ranchers, producers in some capacity or another,” she said.

One way Vytelle does so: gathering data through its SENSE platform.

“The only way that you can identify the most genetically elite animals is by measuring what we call their phenotype — all of the things that they do all day long and compare them to others — so we can identify the most elite, feed-efficient genetics,” she explained. “When we think about feed-efficient genetics, it’s the rate in which we can produce meat to pounds a feed. Feed is the largest cost of producing an animal and so we want to reduce that while producing more meat.”

Vytelle’s SENSE technology monitors how much a cow or bull eats and how much it weighs throughout the day.

“So we can measure their growth and compare it to others to identify the elite ones,” she added.

Once the elite cattle are identified, Kocher said, they can use IVF to help the producers reproduce elite calves more quickly.

“For example — a bull and a cow — they make one calf a year,” she continued. “What we’re able to do is take an elite bull and an elite female and collect their oocytes, take them back to our lab, fertilize those oocytes, and produce many embryos that we are able to put back into surrogate cows. This allows us to really reproduce the right genetic factor.”

This isn’t just helpful for the producer, she said, it’s also important for the consumer.

“We want to continue to produce a more sustainable production so that we can have low cost meat and milk available for all those who partake in the world,” she added.

What sets Vytelle apart, Kocher said, is its accessibility. The company lowers the entry bar for producers seeking to gain access to technology. Eliminating hormones used during the IVF process is one path to making tech more approachable.

“We’re able to do a collection process without that use of hormones,” she said, “which means it’s less labor; it’s less handling of the animals; it’s better for the animals. And that allows more people to be willing to try that technology.”

Vytelle also uses outcome-based pricing, she noted. Typically in the industry, producers are charged for each step of the process, no matter if the IVF is successful.

“What we do is we produce embryos, and we charge on a per-embryo basis,” she explained. “So if we don’t produce any, then we don’t make any money. So we really share in the risk of that.”

[divide]

This story is possible thanks to support from the Ewing Marion Kauffman Foundation, a private, nonpartisan foundation that works together with communities in education and entrepreneurship to create uncommon solutions and empower people to shape their futures and be successful.

For more information, visit www.kauffman.org and connect at www.twitter.com/kauffmanfdn and www.facebook.com/kauffmanfdn

2022 Startups to Watch

stats here

Related Posts on Startland News

Sprint Accelerator Demo Day preview (part III)

The second class of the Sprint Mobile Health Accelerator is gearing up for its much-anticipated Demo Day, which serves as a culminating event and is expected to draw a crowd of nearly 2,000 people. Led by Boulder-based Techstars, the Kansas City-based accelerator is now hosting 10 mobile health tech startups from around the world for its…

KC finance tech firm Lending Standard nabs nearly $500K

Kansas City-based Lending Standard recently raised nearly $500,000 to further develop its software and hire additional employees. The financial tech company snagged the funds from regional investors, and with it has hired two additional technical staff, bringing its total headcount to eight people. Lending Standard created a platform on which organizations can receive and collaborate…

Sprint Accelerator Demo Day preview (part II)

The second class of the Sprint Mobile Health Accelerator is gearing up for its much-anticipated Demo Day, which serves as a culminating event and is expected to draw a crowd of nearly 2,000 people. Led by Boulder-based Techstars, the Kansas City-based accelerator is now hosting 10 mobile health tech startups from around the world for its…

Study: Lack of funding curbs early-stage biz growth in Kansas City

The Kansas City metro area is losing out on millions of dollars in investment funding that could be helping to add jobs and grow businesses in the region, according to a new study. In recent years, area early-stage businesses’ progress has been stymied thanks to Kansas City’s lacking of microloans, seed capital and locally-based venture…