Investor market turns Midwest conservative: ‘Everyone here is feeling a changing landscape’

November 15, 2024 | Taylor Wilmore

After years of soaring valuations across the startup scene, venture firms like M25 are observing a shift to more risk-averse investors and stricter examinations of even the most-exciting company’s worth, said Abhinaya Konduru.

Abhinaya Konduru, M25, right, speaks during a panel conversation at the MidxMidwest conference; photo by Nikki Overfelt Chifalu, Startland News

“We’re seeing a new normal,” said Konduru, a principal on the influential Chicago-based M25 team and a panelist at Thursday’s MidxMidwest event in Kansas City. “In the Midwest, we’ve always been cautious. Now, it feels like the broader market is starting to follow suit.”

This recalibration, she noted, could pave the way for sustainable growth — but it also presents new hurdles.

ICYMI: Startup hubs are slowing; why KC could be losing ground to Midwest neighbors

Phil Reynolds, founder of program and portfolio management software platform DevStride and a fellow MidxMidwest panelist, emphasized how lower valuations impact early-stage startups that haven’t yet gotten a needed jump start.

“Those high valuations from 2019 to 2021 just weren’t going to last,” he agreed, “but now, some of that capital scarcity could slow down early innovation unless we find a balance.”

Panelists take the stage during the 2024 MidxMidwest event; photo by Nikki Overfelt Chifalu, Startland News

Economic shifts and market recalibration are revealing a new world for those seeking and deploying capital, said Maggie Kenefake, a key organizer of the MidxMidwest conference — a gathering that aims to connect investors and founders for conversation, collaboration, and potential dealflow.

“Everyone here is feeling a changing landscape,” said Kenefake, kicking off a discussion with panelists that spanned topics from tech trends to the Midwest’s distinct opportunities for growth.

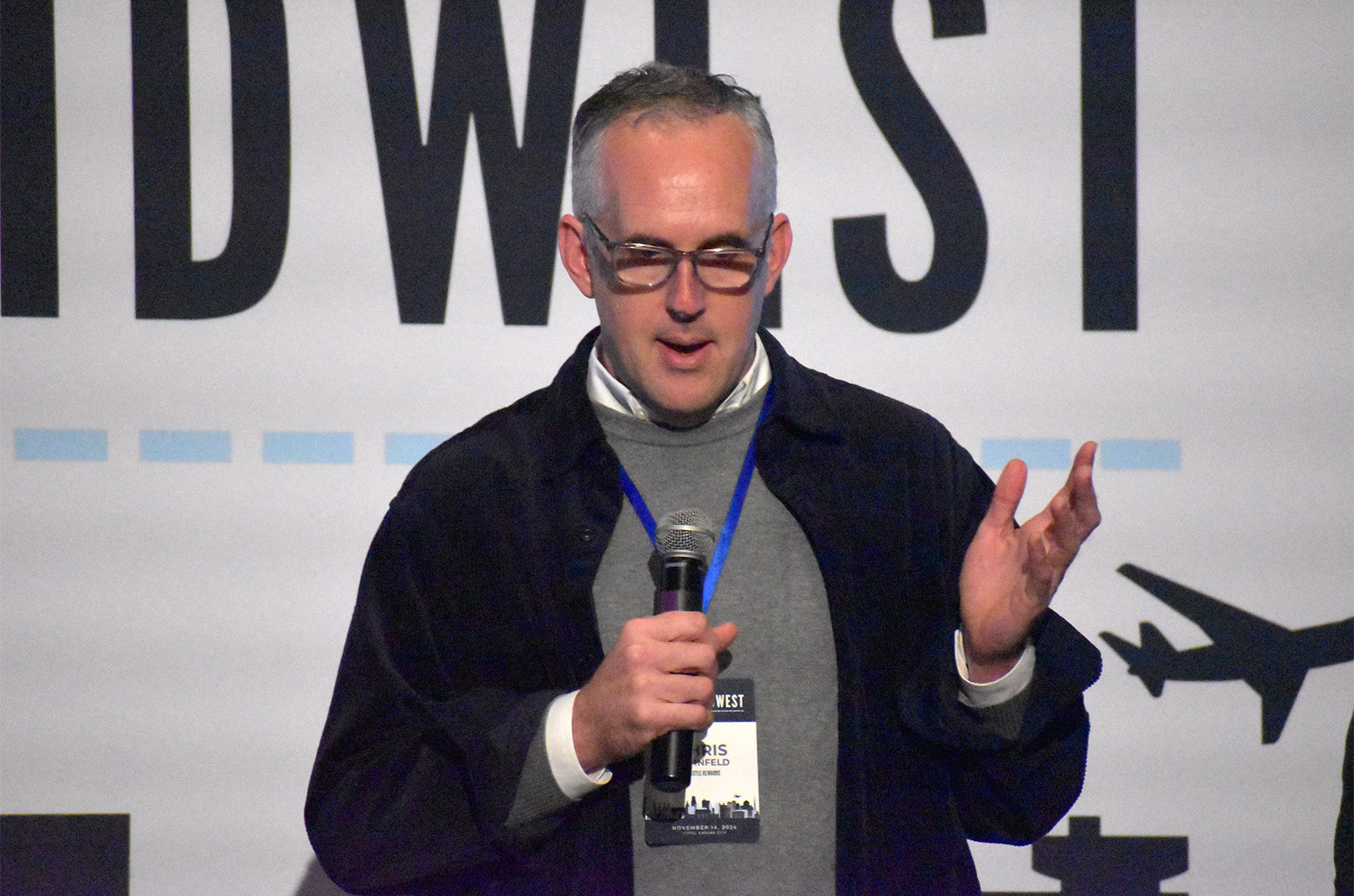

Chris Greco, former CEO of Storewise, center, speaks during a MidxMidwest panel conversation; photo by Nikki Overfelt Chifalu, Startland News

Overhyped: Into the metaverse and beyond

Chris Greco, former CEO of Storewise, expressed skepticism about the hype around supposed-marvels in tech like the metaverse — virtual worlds in which humans interact via computer-generated avatars.

Taylor Clauson, Abstraction Capital, joins in a panel conversation at MidxMidwest; photo by Taylor Wilmore, Startland News

“Post-pandemic, people are craving in-person connections again,” he said. “The metaverse just isn’t captivating people in the way it was predicted to.”

On artificial intelligence, panelist Taylor Clauson, founder of Abstraction Capital, took a balanced view.

“Technology doesn’t usually replace jobs outright — it reshapes them,” he said, acknowledging AI’s transformative potential.

Clauson projected that AI would advance industries without creating the workforce disruptions many people fear.

“AI is likely to enhance roles rather than eliminate them,” he added.

An audience of investors, startup founders, ecosystem builders and champions listens to a panel conversation during the 2024 MidxMidwest event; photo by Nikki Overfelt Chifalu, Startland News

Geopolitics and cross-border investments

Rising geopolitical tensions also came into focus during MidxMidwest, with panelists discussing how shifts on an international scale impact tech and trade.

Chris Dornfeld, founder of St. Louis-based Whistle, speaks during a MidxMidwest panel conversation; photo by Taylor Wilmore, Startland News

“The world is becoming more siloed,” said Chris Dornfeld, founder of St. Louis-based Whistle.

He observed that regions like North America and Europe are increasingly pulling back into more insulated tech ecosystems to protect national interests.

“Geopolitical risks are no longer a side issue,” Dornfeld emphasized. “They’re central to investment decisions.”

Greco expanded on these thoughts, sharing that political changes ahead for the U.S. could affect cross-border collaborations and regulations, especially in areas like semiconductors.

RELATED: Why Trump might drop plans to repeal Biden’s CHIPS Act

“Investors are going to have to think harder about sector and geography together,” Greco said. “We can’t just assume global interdependency is the default anymore.”

Sectors to watch in 2025

Despite challenges on the horizon, promising factors are emerging, panelists said.

Phil Reynolds, DevStride, speaks during a MidxMidwest panel conversation; photo by Taylor Wilmore, Startland News

Reynolds highlighted potential within cybersecurity and enterprise tech, seeing the industries as critical alongside growing data protection demands.

“With so much sensitive data at risk, there’s an urgent need for stronger cybersecurity,” Reynolds said.

Clauson pointed to regulatory tech as another area with opportunity at hand. Evolving privacy laws create demand for compliance solutions, he noted.

“It’s no longer just about innovation — it’s about keeping up with legal frameworks,” Clauson said.

Dornfeld noted that construction and industrial tech also are poised for growth, driven by U.S. infrastructure investments.

“We’re in a time where we need to work smarter in how we build and maintain infrastructure,” he said. “This is where industrial tech can thrive.”

Jason Sinnarajah, COO of the Kansas City Royals, joins MidxMidwest organizer Dan Kerr, Flyover Capital, for a fireside chat at the conference; photo by Taylor Wilmore, Startland News

Wrapping the event’s midday programming Thursday, MidxMidwest featured a fireside chat between conference organizer Dan Kerr of Flyover Capital and Jason Sinnarajah, COO of the Kansas City Royals.

Sinnarajah emphasized the Midwest’s potential to create a resilient tech ecosystem by leveraging its strengths, staying aligned with global trends, and keeping true to regional values.

Featured Business

2024 Startups to Watch

stats here

Related Posts on Startland News

Fresh in the tin: Crossroads cafe targets TikTok generation for laid-back canned seafood cuisine

A new venue specializing in “sangria, tins and snacks” pairs viral tastes with inspiration from a classic culinary voice, said longtime Kansas City restaurateur Shawn McClenny, whose Crossroads “taverna” is expected to open by mid-November. “It will be more of a Spanish cafe, very informal, no reservations,” said McClenny, describing the future Lilico’s Taverna slated…

Lula bets on responsible growth to hit profitability; why the startup’s most valuable property is room to scale

Lula opened 2025 by announcing a hefty funding round; the momentum has only continued to build, founder Bo Lais shared. On top of its $28 million Series A round in early February, the Kansas City-based proptech startup expanded to more than 50 markets nationwide and had eight straight months of record gross merchandise value and…

World Cup hosts launch KC Game Plan for entrepreneurs; heat map, cultural insights on global visitors warming up next

Kansas City boasts no better roster of ambassadors than the region’s small business owners, said Tracy Whelpley, announcing a new KC2026 “Game Plan” for entrepreneurs who are eager to put cleats to streets ahead of the incoming FIFA World Cup. “There’s so many entrepreneurial people out there and they really represent what our community is…

Just funded: Trio of startups join Digital Sandbox KC, emerging onto competitive innovation scene

Not only will proof-of-concept funding from one of Kansas City’s most pivotal startup supporters help CEO Gharib Gharibi rapidly iterate development of his company, the Archia founder said; Digital Sandbox KC connects him to a thriving local tech ecosystem at a crucial inflection point for his artificial intelligence-based solutions. “We are excited to leverage both…