UMKC, Kauffman launch $100K resiliency grant fund for minority-owned businesses hit by COVID

August 5, 2020 | Startland News Staff

Editor’s note: The Ewing Marion Kauffman Foundation is a financial sponsor of Startland News. This report was produced independently by Startland News’ nonprofit newsroom.

[divide]

A new $100,000 fund is expected to help minority-owned Kansas City businesses — left out of initial rounds of COVID-19 relief — to build resiliency and come back stronger as the pandemic persists.

“COVID-19 has negatively impacted our entire small business community. However, entrepreneurs of color haven’t been able to access disaster financing and relief funding at the same rate as other business owners,” read an announcement of the Kansas City Minority Business Resiliency Grant.

The fund is expected to award up to $5,000 to at least 20 racial/ethnic minority-owned businesses. The grants are funded by the Ewing Marion Kauffman Foundation and administered by the UMKC Innovation Center in partnership with local financial institutions.

Applications for the fund open noon Monday, Aug. 17. Click here for application details.

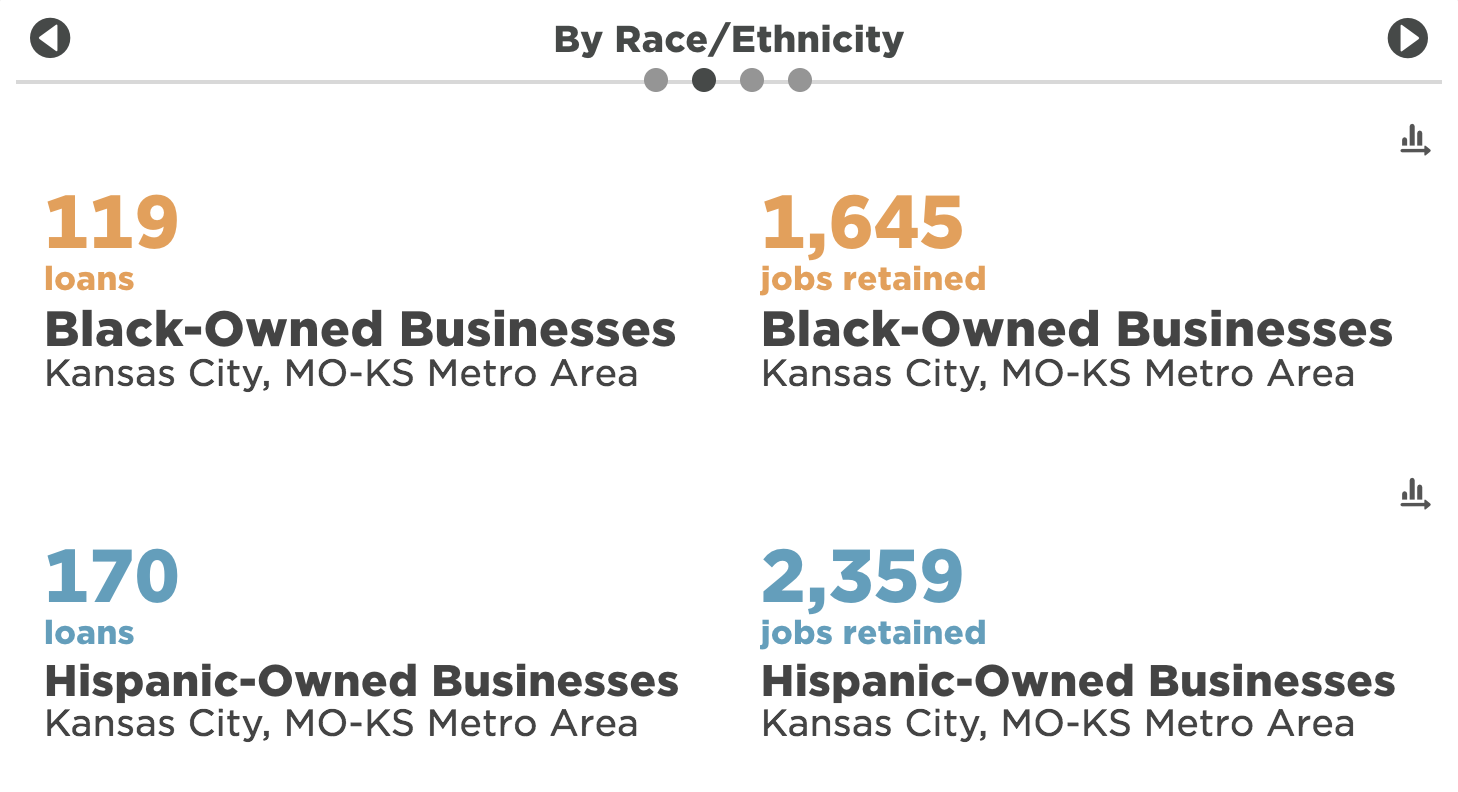

A report produced in June by mySidewalk on behalf of the Kauffman Foundation emphasized the COVID-19 relief gap, specifically examining Paycheck Protection Program recipients. Of the 32,705 loans given to Kansas City businesses, only 119 were awarded to Black-owned businesses and 170 to Hispanic-owned businesses, according to the mySidewalk data.

Click here to review mySidewalk’s PPP findings.

Only businesses that are majority owned by racial/ethnic minority entrepreneurs, as defined by federal regulations, are eligible for the Kansas City Minority Business Resiliency Grant. Click here for guidelines on groups designated as socially disadvantaged.

Eligibility also is based on a business’ location with the Kansas City Metropolitan Statistical Area; documented sales in 2019 that don’t exceed $250,000; negative impact from COVID-19; and no ongoing or previous relationship with the UMKC Innovation Center, UMB Bank, Bank of Blue Valley, Alt-Cap, Bank of Labor, Central Bank of the Midwest or the Kauffman Foundation.

Click here for more information on eligibility and application guidelines.

Recipients can use the funds to help them reopen their businesses, buy supplies to keep their customers and employees safe, open an online shop or channel for their businesses, organize their back office, and otherwise build future resiliency, according to UMKC’s Innovation Center.

Grant awardees will have zero financial repayment — the funds are not a loan — but they will be expected to report on how the funds impacted their businesses. Those results will help incent future financial support for similar grant projects, administrators of the fund said.

Featured Business

2020 Startups to Watch

stats here

Related Posts on Startland News

RECAP: 1 Million Cups panel offers decision-making advice

Three entrepreneurs took the stage at 1 Million Cups this week to offer advice on navigating the tough world of entrepreneurship. Alex Altomare, co-founder of BetaBlox, Linda Buchner, co-founder and president of Minddrive, and Ben Kittrell, co-founder and CTO of Doodlekit, all spoke about the variety of hard choices entrepreneurs face. On handling tough decisions……

Sprint Accelerator startup raises $85K (and counting)

Hidrate, a startup at the Kansas City-based Sprint Mobile Health Accelerator, rapidly surpassed its fundraising goal before a pitch to investors and nearly 2,000 Kansas Citians. The Minneapolis-based company’s Kickstarter campaign has already raised nearly $85,000 in two days, which more than doubles its goal to fundraise $35,000 in 42 days. Hidrate created a Bluetooth-enabled water bottle that tracks…

Sprint Accelerator Demo Day preview (part III)

The second class of the Sprint Mobile Health Accelerator is gearing up for its much-anticipated Demo Day, which serves as a culminating event and is expected to draw a crowd of nearly 2,000 people. Led by Boulder-based Techstars, the Kansas City-based accelerator is now hosting 10 mobile health tech startups from around the world for its…

KC finance tech firm Lending Standard nabs nearly $500K

Kansas City-based Lending Standard recently raised nearly $500,000 to further develop its software and hire additional employees. The financial tech company snagged the funds from regional investors, and with it has hired two additional technical staff, bringing its total headcount to eight people. Lending Standard created a platform on which organizations can receive and collaborate…