Grit Road plants $11M venture fund to cultivate homegrown ag tech solutions across Midwest

September 19, 2023 | Nikki Overfelt Chifalu

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro.

OMAHA — The precision guide for Grit Road Partners — a Nebraska-based venture fund — is investing in ag tech companies that are solving Midwest producer problems, said Mike Jung, noting no shortage of ideas ready to be developed.

“But yet when it gets to the farm gate, it fails. It doesn’t truly understand what the producer needs or the processor wants,” continued Jung, managing partner for Grit Road. “And so as my partner would always say, ‘There’s a graveyard of ag tech companies out there that just fell short from getting to the root of the problem.’”

Grit Road — which launched in August 2021 under the Burlington Capital umbrella but spun off as a partnership between Jung and Invest Nebraska at the end of 2022 — closed an $11 million funding round this summer, according to Jung, who worked within the ag initiatives and investments verticals for Burlington for 18 years.

“We’re excited and relieved,” he continued. “Whenever you look back on when we initially set out to achieve this and set the goal of raising $11 million and then ultimately hitting that goal — and then over subscribing — it’s exciting to be able to kind of sit back and say, ‘Man, this was great. We actually did what we said we were going to do.’”

Grit Road has already made 12 investments, he shared, including five startups in Nebraska, three in Iowa, and one in Minnesota, Wyoming, and Texas (Corral Technologies, Grain Weevil, Birds Eye Robotics, LandTrust, Sentinel Fertigation, Marble Technologies, Distynct, Clayton Farms, EIO Diagnostics, HerdDogg, Continuum Ag, and Vane).

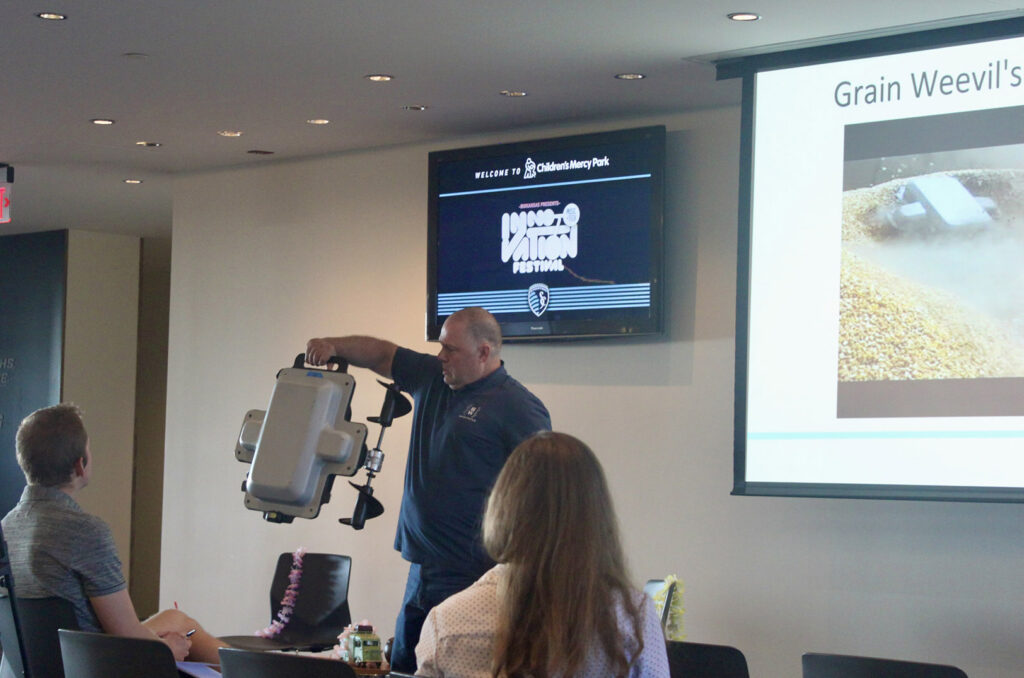

Chad Johnson, co-founder of Aurora, Nebraska-based Grain Weevil — a portfolio company of Grit Road Partners — presents his startup during the 2022 Innovation Festival at Children’s Mercy Park in Kansas City, Kansas; photo courtesy of Grit Road Partners

When looking for investors for the fund, Jung noted, his team wanted it to be an ag-heavy focus as Nebraska and the Midwest are filled with outstanding industrial ag players.

“We felt it was important for us to have that heavy ag-centric investor base because, as we’re looking at deploying capital and looking at investing opportunities, we want to make sure we create this bench of resources that we can tap to help us,” he said. “If we’re looking at technology that’s in the animal space, we want to make sure we’re talking with our feedlot partners. If we’re looking at something in the grain production space, we can talk to producers and co-ops in that area to help us in making sure that the investments we’re doing are the right ones.”

This strategy also involves bringing in institutional ag partners, he added.

“We wanted to make sure we were bringing in these people that are on the front line of ag — who are truly moving the needle when it comes to kind of ag production, ag processing — as partners, as well others who have kind of been there and done whether it’s in ag or other sorts of tech or startup initiatives,” he explained.

This partner network, Jung noted, is what sets Grit Road apart.

“(My partners and I) live here in Nebraska; we’re from this area,” he continued, “But we’re never going to mislead anybody to think that we know all the ins and outs of what is going on in the ag value chain. And we lean heavily on our partners to help us and guide us in doing our due diligence and betting opportunities for the fund.”

In January 2022, Jung shared, they also started an Ag Tech Deal Flow Network, which is a community of like-minded investors in the ag tech space that meets once a month to share deal flow opportunities and investments that are looking for additional capital, additional partners, and additional resources.

“We really want to make sure our initiative or this platform can help strengthen and build and serve as a catalyst to further develop the ag tech ecosystem here in the Midwest,” he said. “There’s a lot of great entrepreneurs that are around these areas and we just want to make sure that — not only through us but if they’re investors or if they’re partners — that these ag tech entrepreneurs have the resources and the support here in the middle of the country to achieve their goals and objectives.”

Featured Business

2023 Startups to Watch

stats here

Related Posts on Startland News

Lenexa studio joins national coworking relief effort for Nepal

Despite the nearly 8,000 miles between them, a Kansas City-area coworking studio is helping with relief efforts in Nepal after a 7.8 magnitude earthquake destroyed hundreds of buildings and claimed thousands of lives. Lenexa-based Plexpod has joined the international “Coworking for Nepal” movement that has attracted dozens of studios to encourage fundraising for Nepal relief…

KC’s first innovation officer reflects on work, city’s tech future

After more than two years of service, Ashley Hand is leaving the driver’s seat of Kansas City’s innovation efforts. Hand, who soon will be departing as Kansas City’s chief innovation officer, was tasked with implementing innovative strategies to improve how city government can better serve Kansas Citians. The city will be accepting applications for the…

Welcome to Startland News

Scrappy. Determined. Gritty. Those often were the words attributed to the Kansas City Royals as the team unexpectedly surged into the 2014 World Series and captured the national spotlight. Those very words are apt for this city, which has been built on the grit and determination of successful entrepreneurs like Ewing Kauffman, Joyce Hall, Henry…

Kansas budget woes render uncertainty for angel tax credits

As state budgetary concerns loom in the background, early-stage firms in Kansas are hoping a bill to extend the Sunflower State’s Angel Investor Tax Credit program will become a priority for legislators. Scheduled to sunset after the 2016 fiscal year, the program annually allocates $6 million in credits to entice investments in early-stage, growth-oriented companies…