LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

October 15, 2018 | Austin Barnes

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement.

Rachael Qualls, Venture360, Liquifi

“The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for 10-12 years.”

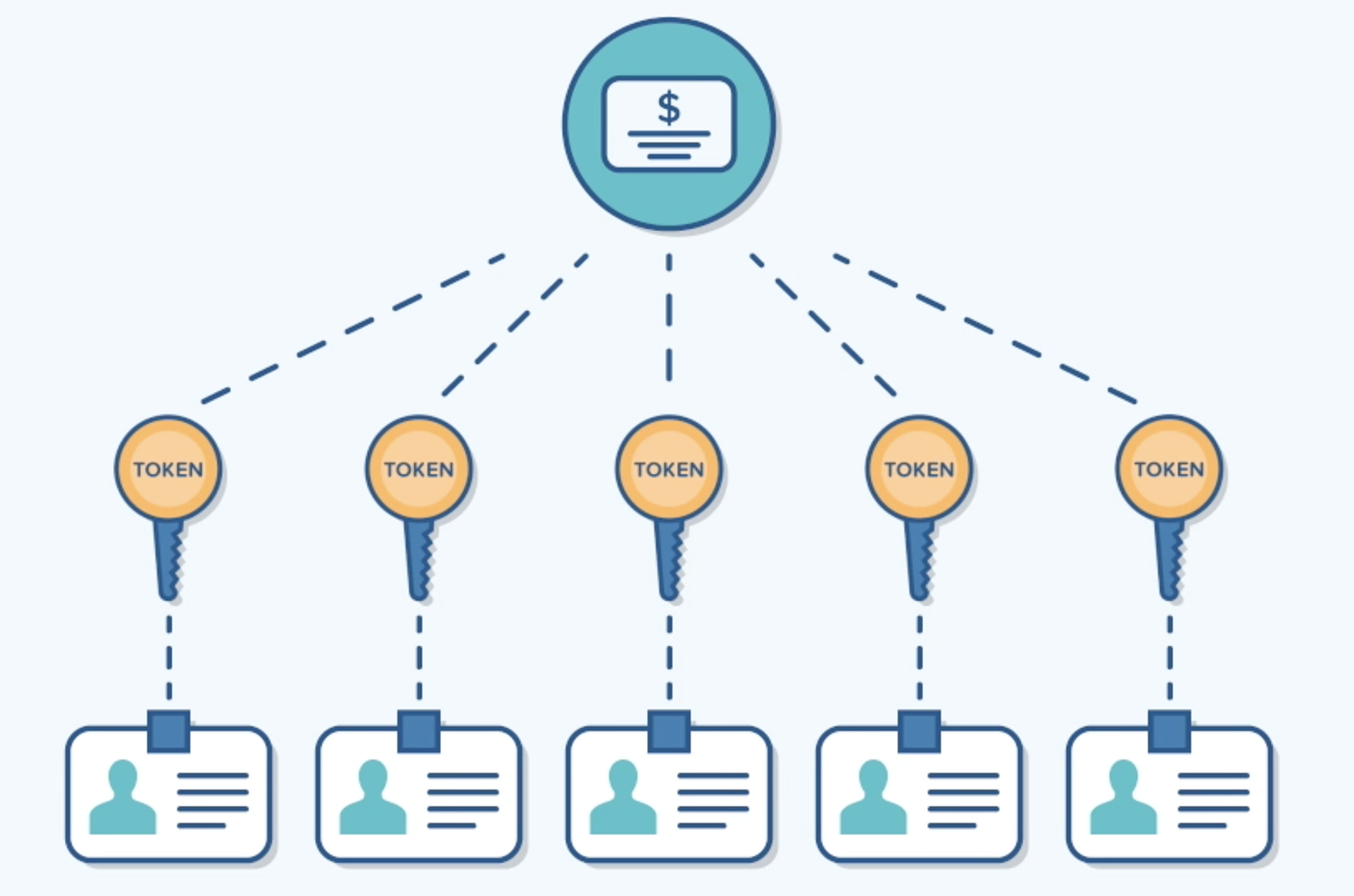

Part of a three-tier plan, executed over the past 12 years — a span that has included the launch of Angel Investor Group and Venture360 — Liquifi technology allows companies to solve capital’s “final frontier.” It’s a disruptive opportunity to build and control companies’ own private stock exchanges, initiate a capital raise, verify investors’ identities, execute closing documents, collect payments, and issue security tokens, Qualls explained.

“A very small number of people control the capital in private equity, and I think it’s important for companies to be able to access the capital they need to be successful,” she said of her latest venture, launched as a product of Venture360.

A LaunchKC finalist, Qualls pitched Liquifi to a panel of judges during Techweek Kansas City this month. The entrepreneur walked away with a $50,000 grant from the program, which is coordinated by the Economic Development Corporation of Kansas City and the Downtown Council of Kansas City.

“Everything about building disruptive technology and bringing it to market is incredibly difficult,” Qualls said Monday, reflecting on her LaunchKC win. “Making it easy to buy and sell private company stock changes the innovation game.”

Qualls plans to use her prize money to amplify marketing efforts for Liquifi, in an industry that fears change, she said.

Click here for more on the 2018 LaunchKC winners.

Disrupting the industry further, Liquifi-enabled investors can invest using cryptocurrencies — another barrier removed between capital and startups, Qualls reiterated.

“I know this will level the playing field and bring more amazing technology to market for our society,” she said.

As Liquifi goes to market, Qualls said she feels an incredible sense of pride in her team and confidence in the ability of Liquifi to alter the way companies access asset created cash.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

From Mizzou to Spike TV, Tommy Saunders’ ab rollers hit national stage

Tommy Saunders is serious about fitness — one glance at his eight-pack and pythons for arms makes that clear. But the Kansas City entrepreneur is also serious about business, a fact he plans to prove as part of a reality-competition series debuting Tuesday on Spike TV. A former University of Missouri football standout, Saunders recently…

Blooom co-founder dissects $4M raise

Financial tech firm Blooom recently snagged one of the Kansas City area’s largest funding rounds in months. QED Investors from Alexandria, Va., led Blooom’s $4 million Series A round, which also included investments from DST Systems Inc., Commerce Ventures, Hyde Park Venture Partners and UMB. The Leawood-based firm plans to use the funds to hire new sales…

Events Preview: Athena League, Village Fall Fest

There are a boatload of entrepreneurial events hosted in Kansas City on a weekly basis. Whether you’re an entrepreneur, investor, supporter or curious Kansas Citian, we’d recommend these upcoming events for you. WEEKLY EVENT PREVIEW Athena League October VOX When: October 15 @ 5:30 pm – 7:30 pm Where: C2FO Join us for our October VOX, All…

Blooom to expand with $4M Series A

Financial tech firm Blooom is blossoming into a local startup success story. The Leawood-based company announced Thursday that it raised $4 million in a Series A round to expand its operations. QED Investors from Alexandria, Va., led the round, which also included DST Systems Inc., Commerce Ventures, Hyde Park Venture Partners and UMB. Blooom created an online…