Crowdfunding sites won’t pay your medical bills, Sickweather CEO says, launching reciprocating donation platform

June 10, 2019 | Tommy Felts

Crowdfunding can help, but such tactics are unlikely to cover the medical bills of a person struggling with mounting healthcare costs, Graham Dodge said.

“The unrealistic amount of self promotion needed to reach people outside your own personal network — which can happen if the media picks up on your story — is the main reason 90 percent of GoFundMe campaigns don’t reach their goals,” said Dodge, CEO of Sickweather, a real-time illness forecasting platform. “One-third of those campaigns are for medical bills. There are also issues around HIPAA compliance on these platforms (in that there is none), so sharing personal health information is at the user’s own risk.”

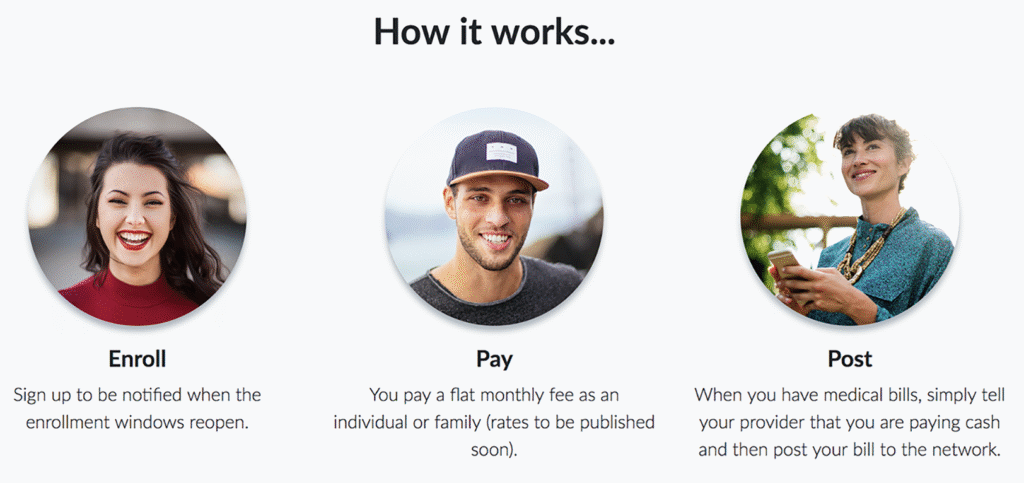

Dodge’s new startup, Garnish Health, is meant to fill the gaps created by the increasingly high premiums and out-of-pocket costs for health insurance, which force many people onto donation sites like GoFundMe, or peer-to-peer payment platforms like Venmo, for financial relief in affording their medical bills, he said.

Click here to learn more about Garnish, a reciprocating donation platform where all members automatically share in each other’s costs.

With the Affordable Care Act eliminating the mandatory insurance penalty, exemptions provided by Health Cost Sharing Ministries (HCSMs) are no longer required, opening the door for other non-religious options for health cost sharing, like Garnish, Dodge said.

“My family and I were briefly members of a HCSM called Samaritan Ministries when we were in between insurance policies,” he said. “I was impressed by how affordable (nearly half the cost of our ACA insurance) and comprehensive it was and wondered why there wasn’t a secular version of it available to everyone. I learned that reason was regulatory due to religious exemptions, but that has since changed.”

Dodge took inspiration from the HCSM model, but noted room for improvement in eligibility and technology infrastructure, he said. Using population health data, he intends to power “smart enrollment windows” based on these trends.

“Simply put, when more people are sick in a region, the window closes in an effort to protect those already within the network from insolvency,” he said. “When the risk is lowest, the window reopens and new members can join.”

Smart enrollment windows address potential regulatory concerns related to how health cost sharing services in the U.S. can’t deny eligibility based on location alone — for example, if a provider offers coverage in Florida, then it also must offer coverage in Alaska — so the added dimension of time helps narrow that gate, Dodge said.

Click here to register for alerts when the first enrollment window opens in your area.

Such a platform also prevents a stampede of claims during times when new members are more likely to be getting sick or injured, he said, protecting the network from insolvency, which ultimately allows the network to accept more new members with pre-existing conditions, since risk of the co-morbidities and co-infections associated with those conditions would also be lower.

“My experience with Sickweather has proven how these risks can be effectively measured in real-time and at hyper-local levels,” Dodge said.

The impact of unpaid medical bills goes beyond the obvious, he added, referencing the December 2018 suicide of his cousin, retired U.S. Marine Col. James Flynn Turner IV.

Turner fatally shot himself while wearing his dress uniform and sitting atop his medical records in a parking lot outside the Bay Pines Veterans Affairs complex, according to media reports. He was the fifth person to kill himself at the Florida medical treatment facility.

“His suicide note specifically mentioned his ongoing medical bills, which was very surprising to me since he was a veteran,” Dodge said.

Garnish Health — now in its a pre-registration soft launch phase — is intended to target gig-economy workers and other 1099 contractors, as well as their families, he said.

“But really it’s for anyone who can’t afford insurance premiums or out-of-pocket medical expenses,” Dodge said.

2019 Startups to Watch

stats here

Related Posts on Startland News

A St. Joe CEO handed him a franchise after graduation; two years later, the risk is paying off

Spencer Engelman’s expectations for his post-college career were shredded by an offer he couldn’t refuse. The Northwest Missouri State University graduate was awarded a business of his own — minus the franchise fee — by a veteran entrepreneur who had visited one of his classes. “It’s a crazy opportunity,” said Engelman, who now operates a DocuLock…

What a catch: Kansas City fandom creates custom appeal for taco-loving cartoonist vibe

Drawing from Kansas City’s spotlight moments — whether trendy and new or iconic and timeless — W. Dave Keith balances a quirky aesthetic with a practical focus on what will actually sell. “I’ve slowly learned that if I want to make money off this business, I need to make stuff that people want to buy,”…

Power through purpose: How a winding journey led this eco devo steward to deep-rooted impact

Editor’s note: The following story was written and first published by the Economic Development Corporation of Kansas City, Missouri (EDCKC). Click here to read the original story. [divide] Going behind the scenes of CCED with the people who make it happen Some people are drawn to city-building because of the bricks and steel, the architecture, the skyline, the…

Missouri’s weapon in the AI race with China: KC tech companies, says GOP lawmaker

As artificial intelligence reshapes the way Kansas City works, civic and elected leaders want to ensure small businesses and the region’s tech community have seats at the table. Federal regulation could help, said Eric Schmitt. “For me, [it’s about] making sure that the big tech companies don’t block out a lot of the innovators, say…