Crowdfunding sites won’t pay your medical bills, Sickweather CEO says, launching reciprocating donation platform

June 10, 2019 | Tommy Felts

Crowdfunding can help, but such tactics are unlikely to cover the medical bills of a person struggling with mounting healthcare costs, Graham Dodge said.

“The unrealistic amount of self promotion needed to reach people outside your own personal network — which can happen if the media picks up on your story — is the main reason 90 percent of GoFundMe campaigns don’t reach their goals,” said Dodge, CEO of Sickweather, a real-time illness forecasting platform. “One-third of those campaigns are for medical bills. There are also issues around HIPAA compliance on these platforms (in that there is none), so sharing personal health information is at the user’s own risk.”

Dodge’s new startup, Garnish Health, is meant to fill the gaps created by the increasingly high premiums and out-of-pocket costs for health insurance, which force many people onto donation sites like GoFundMe, or peer-to-peer payment platforms like Venmo, for financial relief in affording their medical bills, he said.

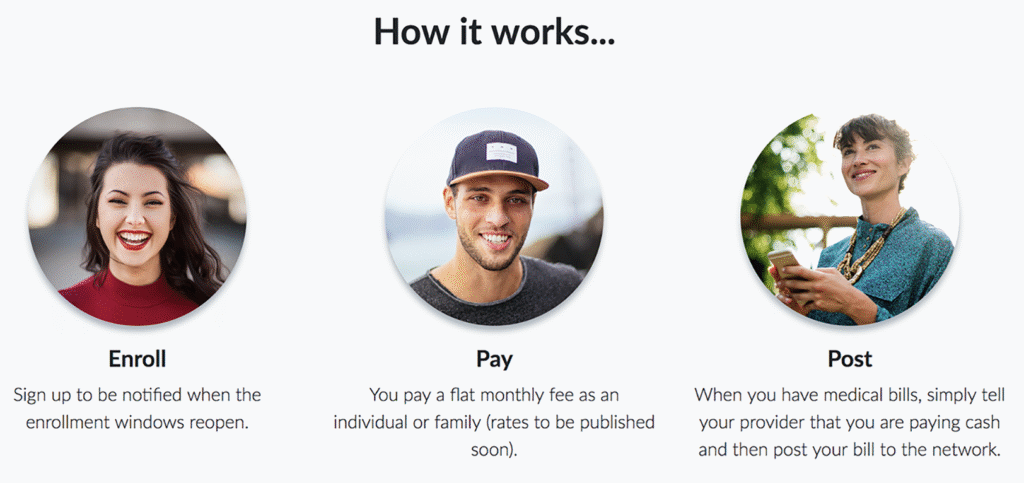

Click here to learn more about Garnish, a reciprocating donation platform where all members automatically share in each other’s costs.

With the Affordable Care Act eliminating the mandatory insurance penalty, exemptions provided by Health Cost Sharing Ministries (HCSMs) are no longer required, opening the door for other non-religious options for health cost sharing, like Garnish, Dodge said.

“My family and I were briefly members of a HCSM called Samaritan Ministries when we were in between insurance policies,” he said. “I was impressed by how affordable (nearly half the cost of our ACA insurance) and comprehensive it was and wondered why there wasn’t a secular version of it available to everyone. I learned that reason was regulatory due to religious exemptions, but that has since changed.”

Dodge took inspiration from the HCSM model, but noted room for improvement in eligibility and technology infrastructure, he said. Using population health data, he intends to power “smart enrollment windows” based on these trends.

“Simply put, when more people are sick in a region, the window closes in an effort to protect those already within the network from insolvency,” he said. “When the risk is lowest, the window reopens and new members can join.”

Smart enrollment windows address potential regulatory concerns related to how health cost sharing services in the U.S. can’t deny eligibility based on location alone — for example, if a provider offers coverage in Florida, then it also must offer coverage in Alaska — so the added dimension of time helps narrow that gate, Dodge said.

Click here to register for alerts when the first enrollment window opens in your area.

Such a platform also prevents a stampede of claims during times when new members are more likely to be getting sick or injured, he said, protecting the network from insolvency, which ultimately allows the network to accept more new members with pre-existing conditions, since risk of the co-morbidities and co-infections associated with those conditions would also be lower.

“My experience with Sickweather has proven how these risks can be effectively measured in real-time and at hyper-local levels,” Dodge said.

The impact of unpaid medical bills goes beyond the obvious, he added, referencing the December 2018 suicide of his cousin, retired U.S. Marine Col. James Flynn Turner IV.

Turner fatally shot himself while wearing his dress uniform and sitting atop his medical records in a parking lot outside the Bay Pines Veterans Affairs complex, according to media reports. He was the fifth person to kill himself at the Florida medical treatment facility.

“His suicide note specifically mentioned his ongoing medical bills, which was very surprising to me since he was a veteran,” Dodge said.

Garnish Health — now in its a pre-registration soft launch phase — is intended to target gig-economy workers and other 1099 contractors, as well as their families, he said.

“But really it’s for anyone who can’t afford insurance premiums or out-of-pocket medical expenses,” Dodge said.

2019 Startups to Watch

stats here

Related Posts on Startland News

Fresh in the tin: Crossroads cafe targets TikTok generation for laid-back canned seafood cuisine

A new venue specializing in “sangria, tins and snacks” pairs viral tastes with inspiration from a classic culinary voice, said longtime Kansas City restaurateur Shawn McClenny, whose Crossroads “taverna” is expected to open by mid-November. “It will be more of a Spanish cafe, very informal, no reservations,” said McClenny, describing the future Lilico’s Taverna slated…

Lula bets on responsible growth to hit profitability; why the startup’s most valuable property is room to scale

Lula opened 2025 by announcing a hefty funding round; the momentum has only continued to build, founder Bo Lais shared. On top of its $28 million Series A round in early February, the Kansas City-based proptech startup expanded to more than 50 markets nationwide and had eight straight months of record gross merchandise value and…

World Cup hosts launch KC Game Plan for entrepreneurs; heat map, cultural insights on global visitors warming up next

Kansas City boasts no better roster of ambassadors than the region’s small business owners, said Tracy Whelpley, announcing a new KC2026 “Game Plan” for entrepreneurs who are eager to put cleats to streets ahead of the incoming FIFA World Cup. “There’s so many entrepreneurial people out there and they really represent what our community is…

Just funded: Trio of startups join Digital Sandbox KC, emerging onto competitive innovation scene

Not only will proof-of-concept funding from one of Kansas City’s most pivotal startup supporters help CEO Gharib Gharibi rapidly iterate development of his company, the Archia founder said; Digital Sandbox KC connects him to a thriving local tech ecosystem at a crucial inflection point for his artificial intelligence-based solutions. “We are excited to leverage both…