CB Insights calls KCRise most active VC in Kansas; Fund credits work of small team, innovative portfolio startups

February 7, 2019 | Austin Barnes

Kansans don’t fear hard work, said Darcy Howe.

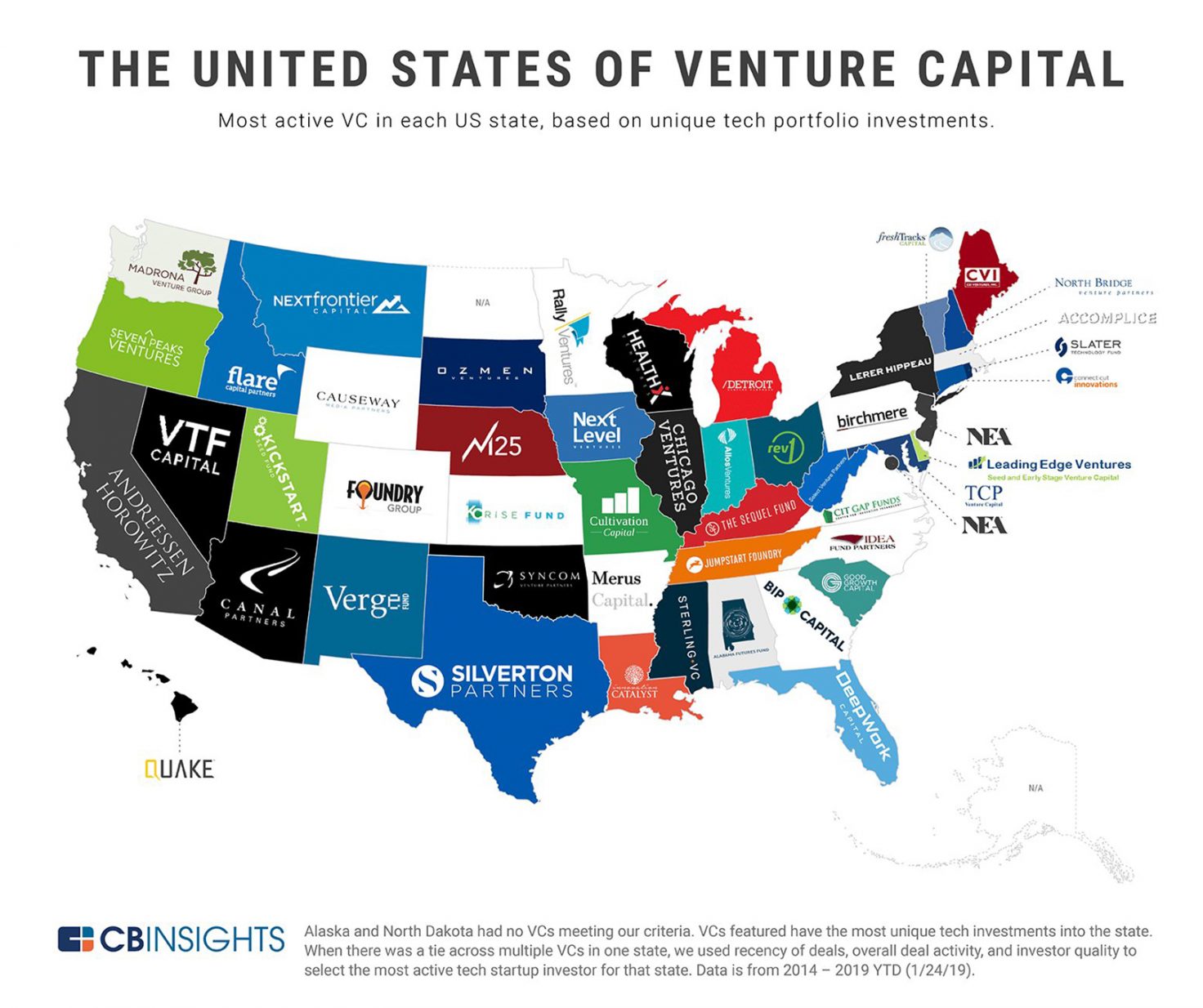

An investment in such a mindset has come with big returns for the KCRise Fund, newly proclaimed the most active venture capital fund in the Sunflower State, according to CB Insights.

Darcy Howe, KCRise Fund

“Perhaps overused but Margaret Mead’s quote, ‘Never doubt that a small group of thoughtful, committed citizens can change the world,’” Howe said in response to the distinction.

Deposited into Kansas City’s startup scene in 2016, the KCRise Fund was born when civic leaders came together in attempt to solve economic malaise in the metro, calling for more support behind the KC Rising initiative — a 20 year vision plan for Kansas City prosperity and economic growth, launched in 2014 — Howe explained.

“They asked business and civic folks to come problem solve together,” she said of what sets the KCRise Fund and Kansas City apart from other VC matching firms.

Notable KCRise portfolio companies in Kansas include: ShotTracker, SquareOffs, and Life Equals –– all companies that earned spots on Startland’s list of 12 Kansas City Startups to Watch in 2019, based largely on their likelihood of big news this year.

Click here to read more about Startups to Watch in 2019, which also included the fund’s portfolio firm Pepper IoT on the Missouri side of the state line.

“Promising entrepreneurs are coming to us every day with disruptive ideas in sectors like transportation, logistics, agriculture tech and IoT – verticals where KC already has a national reputation. We know KCRise can continue to be a conduit to capital nationwide and open doors for the next generation of KC startups,” added Ed Frindt, KCRise fund principal.

KCRise Fund additionally boasts such KCMO success stories as Backlot Cars — which posted an $8 million Series A funding round in late 2018 — and PayIt, named a GovTech 100 company three years running, the fund said.

“This is not only a testament to KCRise Fund, but to the many innovative companies being built by inspiring entrepreneurs in the KC region,” said Chad Feather, KCRise Fund analyst. “I am excited not only about the future of KCRise Fund, but the future of the entire KC entrepreneurial ecosystem.”

St. Louis-based Cultivation Capital was named the most active fund in Missouri, the report said.

2019 Startups to Watch

stats here

Related Posts on Startland News

Lenexa studio joins national coworking relief effort for Nepal

Despite the nearly 8,000 miles between them, a Kansas City-area coworking studio is helping with relief efforts in Nepal after a 7.8 magnitude earthquake destroyed hundreds of buildings and claimed thousands of lives. Lenexa-based Plexpod has joined the international “Coworking for Nepal” movement that has attracted dozens of studios to encourage fundraising for Nepal relief…

KC’s first innovation officer reflects on work, city’s tech future

After more than two years of service, Ashley Hand is leaving the driver’s seat of Kansas City’s innovation efforts. Hand, who soon will be departing as Kansas City’s chief innovation officer, was tasked with implementing innovative strategies to improve how city government can better serve Kansas Citians. The city will be accepting applications for the…

Welcome to Startland News

Scrappy. Determined. Gritty. Those often were the words attributed to the Kansas City Royals as the team unexpectedly surged into the 2014 World Series and captured the national spotlight. Those very words are apt for this city, which has been built on the grit and determination of successful entrepreneurs like Ewing Kauffman, Joyce Hall, Henry…

Kansas budget woes render uncertainty for angel tax credits

As state budgetary concerns loom in the background, early-stage firms in Kansas are hoping a bill to extend the Sunflower State’s Angel Investor Tax Credit program will become a priority for legislators. Scheduled to sunset after the 2016 fiscal year, the program annually allocates $6 million in credits to entice investments in early-stage, growth-oriented companies…