Small biz in Africa needs capital to grow; here’s how C2FO, World Bank member are bringing ‘much-needed liquidity’

October 29, 2024 | Startland News Staff

A new strategic partnership between Kansas City-built C2FO and IFC, a member of the World Bank Group, is expected to enhance financing for local enterprises in Africa — bolstering job growth and economic prosperity in an underserved segment of the global market.

Sandy Kemper, founder and CEO of C2FO, speaks during a panel conversation at the 2024 SME Finance Forum in São Paulo, Brazil; photo courtesy of C2FO

“C2FO is honored and delighted to collaborate with IFC to broaden the global impact of our working capital finance model throughout Africa,” said Sandy Kemper, founder and CEO of C2FO. “We believe this innovative approach will provide much-needed liquidity to MSMEs (micro, small, and medium enterprises), helping them to grow and succeed.”

The partnership will see IFC and C2FO jointly develop, test, and deploy a specialized, web-based multinational working capital platform for MSMEs across Africa — beginning in Nigeria, where it is estimated that a national supply chain finance platform could unlock about $25 billion in annual financing for such businesses.

“It’s only natural that this work begins in Africa’s most populated country, Nigeria, which has an especially promising small business sector,” added Kemper.

This is IFC’s first dedicated supply chain financing facility in Africa for smaller businesses.

Leawood-based C2FO — an on-demand working capital platform, providing fast, flexible and equitable access to low-cost capital to businesses worldwide — recently was lauded with a global honor: the SME Financier of the Year-North America Award by the SME Finance Forum managed by the IFC.

ICYMI: Worlds’ biggest financial leaders applaud C2FO for job-creating capital access

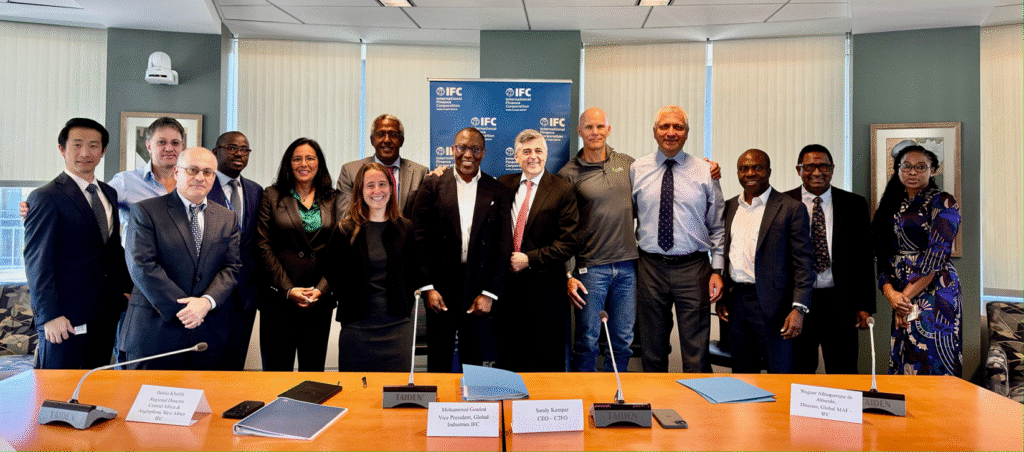

Sandy Kemper, C2FO, center, meets with IFC officials during a signing event for the organization’s new strategic partnership; photo courtesy of C2FO

In countries like Nigeria, Indonesia, and Brazil where community and regional banks don’t commonly exist — and the few available big banks don’t have time for small businesses — there’s an opening for companies like C2FO to create opportunities, Kemper told Startland News previously.

“For every million dollars that you put into the hands of a small or mid-sized business, 16.3 jobs are created,” he said, citing figures backed by the IFC.

And while small business accounts for about half the GDP of the world, it makes up 90 percent of ventures and 80 percent of jobs across the African continent. That makes the strategic partnership between C2FO and IFC even more salient, said Ajay Banga, president of World Bank Group, noting such financing is critical for helping build more sustainable economic ecosystems, and for strengthening food security.

By utilizing C2FO’s patented technology and dynamic discounting model, the platform will connect MSME suppliers and their buyers with global and local financial institutions, enabling suppliers to improve their access to working capital through the financing of their accounts receivable.

“IFC is committed to addressing the financing challenges faced by SMEs in Africa,” said Makhtar Diop, managing director for IFC. “By partnering with C2FO, we aim to unlock significant funding opportunities for these enterprises, enabling them to thrive and contribute to economic growth.”

2024 Startups to Watch

stats here

Related Posts on Startland News

KC’s first innovation officer reflects on work, city’s tech future

After more than two years of service, Ashley Hand is leaving the driver’s seat of Kansas City’s innovation efforts. Hand, who soon will be departing as Kansas City’s chief innovation officer, was tasked with implementing innovative strategies to improve how city government can better serve Kansas Citians. The city will be accepting applications for the…

Welcome to Startland News

Scrappy. Determined. Gritty. Those often were the words attributed to the Kansas City Royals as the team unexpectedly surged into the 2014 World Series and captured the national spotlight. Those very words are apt for this city, which has been built on the grit and determination of successful entrepreneurs like Ewing Kauffman, Joyce Hall, Henry…

Kansas budget woes render uncertainty for angel tax credits

As state budgetary concerns loom in the background, early-stage firms in Kansas are hoping a bill to extend the Sunflower State’s Angel Investor Tax Credit program will become a priority for legislators. Scheduled to sunset after the 2016 fiscal year, the program annually allocates $6 million in credits to entice investments in early-stage, growth-oriented companies…

KC virtual reality firm partners with KU, NFL coaches

A Kansas City-based virtual reality company hopes some marquee partnerships will plug it into a market projected to reach $150 billion in five years. Founded in 2013, Eon Sports VR recently landed the University of Kansas football team as a client for its mobile virtual reality platform to help players train without the risk of…