C2FO marks $300B in funding for businesses as entrepreneurs navigate ongoing credit crunch

August 24, 2023 | Startland News Staff

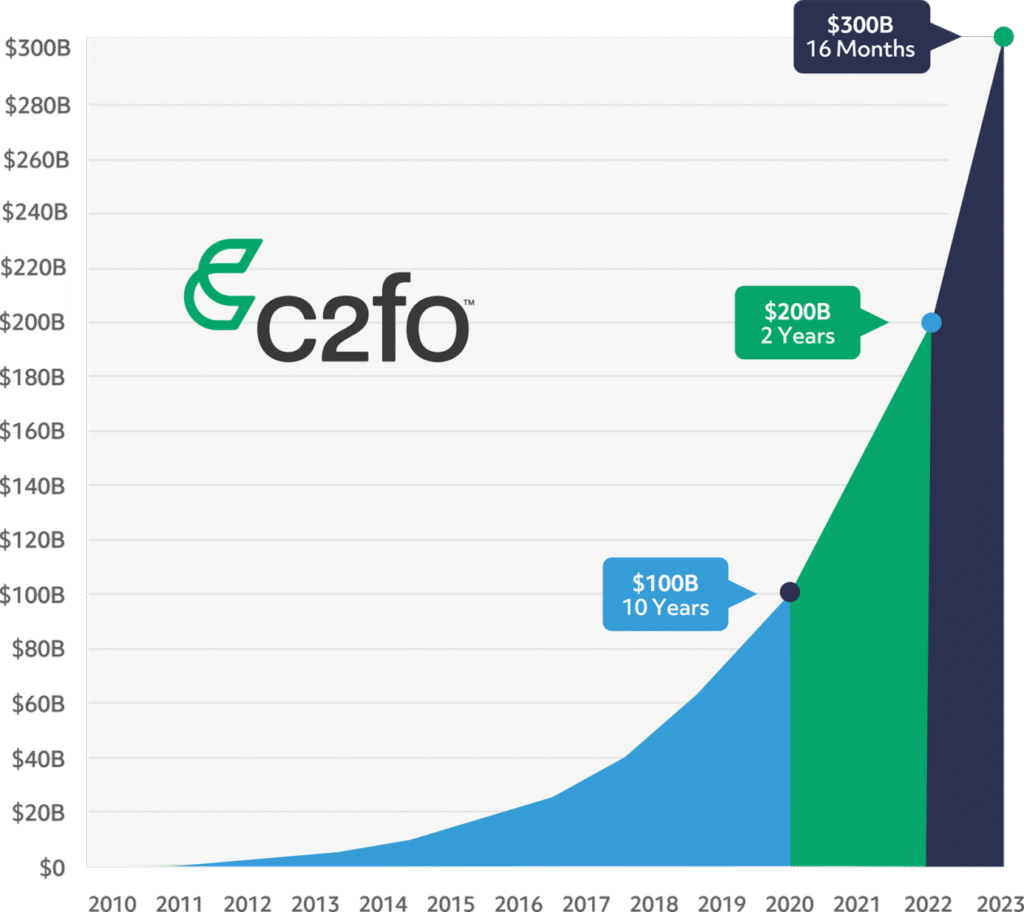

Rapid marketplace expansion in the first half of 2023 helped push Leawood-based C2FO — the world’s on-demand working capital platform — past the $300-billion mark in total funding to its customers.

This record funding amount reflects invoices paid an average of 31 days early via C2FO’s platform. C2FO gets vital, low-cost capital into customers’ hands quickly so they can take advantage of growth opportunities and plan for today’s changing and often challenging times, the company said in a press release.

“Between January 2022 and August 2023, C2FO launched over 50 marketplaces for enterprises and their suppliers worldwide. This has added hundreds of thousands of invoices to our platform as they flow between buyers and suppliers,” Alex Donnelly, COO, Americas, C2FO, told Startland News. “Our continued ability to offer competitive rates despite interest rate hikes and the inflation-driven rise in invoice amounts is also a key factor in our customer retention and loyalty.”

The company’s mission of ensuring every company around the world has the capital needed to thrive is the cornerstone of its business, C2FO officials said.

C2FO reached $300 billion in accelerated funding July 21 — less than 1.5 years after surpassing $200 billion in funding in March 2022. This recent milestone demonstrates the continued strong demand for more efficient and affordable sources of working capital for businesses.

“When we celebrated our first accelerated invoice in 2010, we knew we had created something that might have a shot at redefining working capital finance for the better,” said Alexander “Sandy” Kemper, founder and CEO of C2FO. “This $300 billion is money businesses didn’t have to borrow, personally guarantee or pay interest on. Instead, they can focus on what matters most: adding jobs, creating new products and building for the future. It really is just two clicks to cash, so why borrow working capital when it can be accelerated instead?”

Recent surveys from the Federal Reserve and the European Central Bank confirm that banks are tightening their lending standards, C2FO said in a press release. While predictions of a 2023 recession have lessened, businesses are still facing increased challenges when it comes to securing loans and lines of credit, the company continued, noting businesses face reduced access to funding and an increased cost for that funding with limited support from the traditional financial system.

“Despite initial fears of a U.S. recession due to rising rates and weakened consumer spending, the economy has been resilient in the past year,” Donnelly detailed. “This has prompted economists to predict a favorable “soft landing” in 2024. If this trend continues, businesses will likely navigate an environment of low growth, high interest, above-average inflation, and low unemployment in 2024.”

Such an environment could sustain strong consumer spending, benefiting goods-focused businesses and driving increased inventory demand, she continued.

“While this is good for the suppliers, it also presents a significant challenge,” Donnelly added. “This is because these suppliers are bound by agreements requiring them to wait for extended periods, typically between 30 to 120 days, for payment. Payment delays severely restrict a business’s liquidity and ability to invest in additional inventory. Amid tighter credit conditions, businesses turn to alternatives like C2FO for fast, flexible, and affordable capital, ensuring operations, capitalizing on the market’s ascent, and seizing growth opportunities amid the complex economic landscape.”

C2FO eliminates risk-based underwriting and allows businesses to access low-cost, convenient capital on their terms, the company said, noting that win-win model enables its buyers to improve their margins and provide fast, impactful help to their supply chains.

In the first half of 2023, the average C2FO enterprise buyer customer enjoyed more than $1 million in improved EBITDA, the company reported. During that same time, the platform delivered more than $35 billion in funding to supplier customers — capital that helped them grow and become stronger participants in the global supply chain.

Click here to learn more about C2FO.

2023 Startups to Watch

stats here

Related Posts on Startland News

SNAP cuts are ‘worse than they look on paper’: Food access advocates warn shelves could go bare overnight

Chef Shanita McAfee-Bryant doesn’t mince words about perceptions of the hungry Kansas Citians she serves daily through her award-winning culinary social venture. “These are the people who — if you listen to the rhetoric — are deemed ‘lazy,’” the founder of The Prospect KC’s NourishKC Community Kitchen told Startland News. “We know the narratives being…

LISTEN: Fermenting a clean future through products from meat alternatives to skin creams and baby formula

On this episode of Startland News’ Plug and Play Topeka founder podcast series, we chat with Francesca Gallucci of Natáur, a Baltimore-based biotech company that’s reimagining how essential nutrients are made. Combining synthetic biology, metabolic engineering, and eco-friendly fermentation, they’re producing bio-based taurine (and other naturally occurring sulfur compounds) without relying on petroleum. Gallucci takes…

KCMO slashes fees for outdoor dining permits, launches dining trail for grant winning projects

Kansas City has officially eliminated outdoor dining permit fees, reducing the cost from $850 to zero, thanks to the momentum created by a city-led initiative to encourage investment in outdoor dining experiences, city leaders announced this week, unveiling new plans to promote funded businesses and their projects. Launched in 2024, the Outdoor Dining Enhancement Program…

World Cup will produce KC small biz millionaires in just weeks, leaders say, but it’s only the start

Kansas City can’t look at the World Cup in 2026 as one big event where businesses are going to make good money for a while, and then everything goes back to normal, said Wes Rogers. “This has to be the beginning of the next chapter of our city,” the 2nd District Councilman for Kansas City,…