5 considerations for startups grappling with new overtime rules

August 10, 2016 | Dan Schmidt

Editor’s note: This column was co-written by EBCFO founder Dan Schmidt and Mark Opara, a general business and corporate law attorney at Seigfreid Bingham. The authors’ opinions are theirs alone.

Low pay, long hours, and maybe some future benefits — it’s the startup way!

In early stage companies, it’s a tradeoff of current pain for future gain (or is that the CrossFit motto?), and the chance to be involved with projects that might change the world.

But what happens when the startup world itself is disrupted?

Such is the case with the new federal overtime regulations. The regulations, which go into effect Dec. 1, 2016, raise the minimum salary for an employee to be considered “exempt” — i.e., not subject to overtime regulations — from $23,660 to $47,476.

With the estimated impact of the new regulation at a whopping $295 million per year in the first 10 years, small and big businesses alike are scrambling to figure out a game plan. After all — especially in the world of startups — a 40-hour work week just doesn’t happen.

That means overtime will quickly become a juggle of cash flow and burn rates. Here are some of the options you’ll want to consider:

1. Determine your status.

If you’re a sole proprietor, partner or LLC member with no employees, you’re likely exempt from the new regulations. If you’ve made the decision to set up as a Delaware corporation, however, you may also be classified as an employee, and therefore subject to the labor standards. Either way, talk to your accountant to be sure.

2. Pay more — it’s the first and easiest solution.

And most of the time, a $50,000 salary is considered a living wage anyway. But there are times, especially in pre-revenue startups, that this could pose a significant cash flow problem.

3. Consider giving employees quarterly bonuses to meet the threshold.

Bonuses must be “non-discretionary” — i.e., commissions and bonuses tied to profitability or productivity. They must be paid at least quarterly, and can only make up 10 percent — or $4,747 — of the required salary amount.

4. Employers can make a “catch-up” payment at the end of each quarter to fill the gap.

If the company doesn’t have a bonus/commission sale, or if certain employees haven’t qualified for enough in bonuses, quarterly “catch-up” payments are the way to go. If not made, employees are entitled to be paid for all overtime hours worked that quarter.

5. Hire additional part-time employees to cover the workload and keep everyone at 40 hours or less.

Of course, this does have the effect of increasing your total payroll expense to cover the additional, now-paid hours, but it avoids the overtime pay. Either way, it’s not doing much for your burn rate.

In summary, for most growth-stage companies, this likely won’t cause many difficulties. This will hit the small, early-stage firms the hardest — they’re the ones working long, long hours but with little cash flow.

In general, we do not expect this change to have a significant impact on Kansas City’s startup ecosystem. Many positions at early stage companies are on the tech side, and salaries for these nearly always range higher than the new threshold.

One specific place the new rule might be problematic is in a new company with only founders that has chosen to be a corporation. Since the founders may be deemed to be employees of the corporation — rather than partners in a partnership — they may need to comply with the overtime rules. And as we well know, founders work overtime. Usually a lot of overtime.

Dan Schmidt is the founder and CEO of The Emerging Business CFO, a virtual business accounting and financial advisory firm that works to free founders and entrepreneurs from the stress of managing the daily operational grind. The company offers bookkeeping, accounting, cash flow management, payroll and CFO services.

Mark Opara is a general business and corporate law attorney at Seigfreid Bingham in Kansas City, specializing in healthcare and mergers and acquisitions. Outside of his passion for law, Mark loves to travel and vacation with his wife at tropical resorts, and recently became a “dog dad.

Featured Business

2016 Startups to Watch

stats here

Related Posts on Startland News

Smart city leader: Can technology predict deadly shooters before it’s too late?

A smart city is a safe city, Herb Sih said. And technology can help. “If you don’t have safety, you don’t have anything,” said Sih, managing partner at Think Big Partners, one of the key collaborators in Kansas City’s $15.7 million public-private Smart City initiative. Having grown up in St. Louis, Sih said he has…

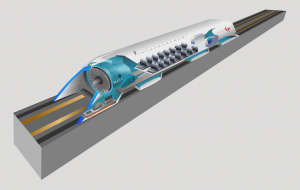

Looping back? Missouri partners with Hyperloop to study 23-minute KC-St Louis route

Missouri’s prospects for landing a Hyperloop route apparently aren’t off the rails after all. Despite the company revealing four U.S. finalist routes in September — which did not include a proposed route through the Show Me State – Hyperloop One announced Tuesday it has entered into a public-private partnership with the State of Missouri to conduct…

Immigration debate could stall Moran’s revived Startup Act, again

Federal legislation geared toward boosting entrepreneurship would make it easier for foreign-born innovators to obtain permanent resident status in the United States. “The newly-introduced Startup Act promotes public policies that would change our KC startup community for the better,” said Melissa Roberts, vice president of communications and outreach for Enterprise Center of Johnson County, which…