KC Tech Council celebrates tax fix in Trump’s ‘One Big Beautiful Bill’ that boosts growing businesses

July 23, 2025 | Tommy Felts

A tax fix included in the recently signed “One Big Beautiful Bill” — sprawling legislation meant to overhaul taxes in the United States — marks a major win for Kansas City’s tech and innovation economy, said Kara Lowe.

At issue: a long-awaited change to Section 174 research and development expensing that now allows businesses to fully and permanently expense such investments, explained Lowe, CEO of KC Tech Council, which championed the fix alongside TECNA (Technology Councils of North America).

Additionally, companies with less than $31 million in receipts can retroactively claim refunds on past expenses as part of the fix, she noted.

“Hopefully, we’ll see any reticence around research and development evaporate, increasing innovation and allowing for more growth in our small and midmarket tech sector,” Lowe told Startland News.

The One Big Beautiful Bill Act became law July 4 with President Donald Trump’s signature.

KC Tech Council has supported reforming the expensing rule for years, once the long-term impact of previous tax alterations became clear to tech advocacy organizations, Lowe said.

“In 2017, a legislative change to the tax code allowed for companies to immediately deduct R&D expenses in the same year they were incurred,” she explained. “That change expired a couple years back, meaning that companies had to wait for R&D expenses to be deducted by amortizing over a period of years.”

“This makes it very difficult for companies to access the savings created under the previous structure, creating cash flow problems and disincentivizing R&D expenses, stifling innovation,” Lowe continued. “Together with our federal advocacy partners, we’ve been working to reinstate full deduction of R&D expenses since the expiration.”

KC Tech Council members were among those feeling the pain of the deduction allowance expiration, which created significant cash flow challenges when paying taxes, she said.

“For some companies, that meant a slower hiring period because cash flow was tight. For others, it meant that R&D was stalled since expenses related to it could no longer be tax deductible in that same year,” Lowe said. “This was especially profound at early-stage and SMB tech companies.”

Jennifer Young, CEO of TECNA, welcomes the U.S.-Canadian delegation to Montreal earlier in July at the TECNA (Technology Councils of North America) summer conference in Quebec; courtesy photo

Coordinating with larger groups like TECNA on policy goals allows the KC Tech Council to advocate for Kansas City businesses while also reflecting a unique and unified voice on behalf of the tech industry, she emphasized. Lowe was appointed to the TECNA board of directors in January 2024, and now serves as treasurer of the organization.

Coordinating with larger groups like TECNA on policy goals allows the KC Tech Council to advocate for Kansas City businesses while also reflecting a unique and unified voice on behalf of the tech industry, she emphasized. Lowe was appointed to the TECNA board of directors in January 2024, and now serves as treasurer of the organization.

“The 60+ member councils (within TECNA) serve their individual states and regions, and know them well. Our collective membership base numbers tens of thousands of companies, most of which are SMB, midmarket, growing tech employers,” Lowe said. “This is where the vast majority of tech talent works, and is responsible for a significant part of our GDP. Our collective voice runs both wide and deep into our communities, making for a powerful legislative partner and advocate.”

And that policy work continues well after any one piece of legislation is passed or defeated, she added.

“In a federally unregulated AI landscape, we’ll advocate for risk-based, consumer- and innovation-friendly AI regulation that mitigates the possible future of a busy patchwork of state statutes,” Lowe said. “TECNA, as a North American organization, also represents a unified effort between U.S.-based and Canadian-based organizations, allowing for open dialogue and collaboration between our countries’ tech organizations during a complicated period geopolitically.”

2025 Startups to Watch

stats here

Related Posts on Startland News

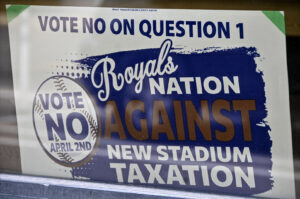

Crossroads small biz owners to Royals: Come back with a better plan (and put it in writing)

It didn’t have to be this way, said Crossroads business owners, blaming Tuesday’s failed stadium sales tax initiative on what they viewed as a lack of transparency and legally binding agreements, too many last-minute deals and changes, and a disregard for community input. Most, however, hope the conversation isn’t entirely finished. Jackson County voters this…

These founders just earned Digital Sandbox KC funds; next comes proving their concepts

A trio of newly funded Digital Sandbox KC companies includes a closely-guarded startup launched by an exited Pipeline founder who also helped bring headline-grabbing sports tech to the forefront of the Kansas City innovation scene. Mission Hills, Kansas-based Chemniscient (pronounced kemʹniSH(Ə)nt) is currently operating confidentially and is not disclosing any product information to the public…

Voters hand Royals, Chiefs a resounding defeat on sales tax that would’ve funded stadium projects

Editor’s note: The following story was published by KCUR, Kansas City’s NPR member station, and a fellow member of the KC Media Collective. Click here to read the original story or here to sign up for KCUR’s email newsletter. The 3/8th-cent sales tax extension would have helped build a new Kansas City Royals stadium downtown as well as fund renovations…

Kelce Jam returning to KC in May with Lil Wayne, Diplo, 2Chainz (plus Takis and Uncrustables)

Travis Kelce’s celebration of the Kansas City Chiefs’ back-to-back Super Bowl championships not only flexes the star tight end’s pull with top-tier artists, but showcases his ability to attract major brand deals. Kelce Jam returns Saturday, May 18 to Azura Amphitheater in Bonner Springs, Kansas, with musical performances personally curated by the three-time Super Bowl…