‘Volatile times’: C2FO targets capital access to businesses rattled by global tariff disruptions

June 13, 2025 | Startland News Staff

Companies — especially small businesses with limited banking options — need liquidity during times of global economic uncertainty, said Sandy Kemper, detailing C2FO’s fruitful efforts to meet growing demand for fast capital amid unpredictable tariff-related disruptions.

Kansas City-based C2FO funded $18 billion through its global working capital platform to businesses worldwide during the first quarter of 2025, the company reported Thursday, including $3.2 billion to companies in developing nations.

“While we are always happy to grow with our customers,” said Kemper, founder and CEO of C2FO. “I’m most proud of our success when it comes at a time when they need us the most — and we rise to meet those demands in a challenging economic environment.”

On average, C2FO customers accessed capital 32 days earlier than standard payment terms, at a lower cost than most traditional funding options, the company reported, noting customer satisfaction was affirmed by a record-high Net Promoter Score (NPS) of 78 in the first quarter, up from 75 the previous quarter.

C2FO continues to lead customer-centric brands like Costco (NPS of 53), Apple (61) and Google (58), as reported by Comparably, a division of ZoomInfo.

“This momentum is more than a reflection of platform growth — it’s a validation of C2FO’s core philosophy: putting our customers’ needs at the center of working capital innovation,” said Kemper, noting recent C2FO customer surveys ranked the platform highly in flexibility, transparency and control — above other financing options.

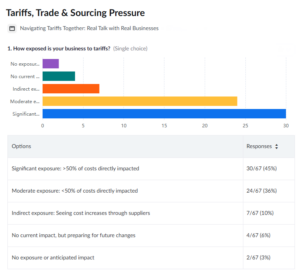

In a recent C2FO webinar with 100 U.S. business leaders, nearly half reported that tariffs affect more than 50 percent of their total costs.

“To navigate this uncertainty without hurting customer relationships or competitive standing, many leaders said they are reassessing purchasing timelines, evaluating cash positions and taking calculated risks in capital and inventory management to ensure consistent delivery,” the company said.

C2FO enables such businesses to maintain healthy cash flow without taking on additional debt or committing to rigid strategies ill-suited to a shifting economy, added Daniel Trost, product manager at C2FO.

The platform recently introduced enhanced features that go beyond the rigid, one-size-fits-all models common in early payment and supply chain finance programs, he added. Companies can now:

- Automate recurring early payment requests tailored to their invoicing cycles.

- Customize liquidity access based on unique cash flow needs and seasonal trends.

- Use improved price discovery tools to identify the most cost-effective capital options in real time.

“During volatile times, C2FO must be there for customers and continue to raise the bar to help them meet their cash flow needs as quickly and easily as possible,” Trost said. “That’s why we’ve dedicated development resources to improving the experience, transparency and usability of the platform.”

2025 Startups to Watch

stats here

Related Posts on Startland News

Smart KCMO takes holistic approach to digital-physical infrastructure, city manager says

Kansas City’s downtown streetcar project showcases the KC smart community’s ability to tackle multiple infrastructure projects at once, said Troy Schulte, city manager. But it isn’t the only example, he told Chelsea Collier, founder of Digi.City, Friday during a Smart Metro Summit at Plexpod Westport Commons. The event was coordinated by Digi.City, the Enterprise Center…

With big KC hiring plans, Aussie-born SafetyCulture prioritizes community engagement

Though SafetyCulture is headquartered 9,000 miles away, its new North American hub in Kansas City is being intentional about driving positive local change — particularly in education, said Ross Reed. “We really want to get into the community to make an impact,” said Reed, SafetyCulture’s North American president. “We’re going to continue to get out…

Catapult International co-founder launches Swivel Software from Lenexa HQ

Online shoppers can track orders the moment they’re placed, shipped and delivered. That kind of visibility along the supply chain — from a product’s beginnings in a factory to its final destination on the shelf — is vital for freight forwarders and importers to be efficient in the international shipping industry, Matt Motsick said. For…

AltCap banks $55M in tax credits to bolster KC’s underserved entrepreneurs

A huge award will enable AltCap to make a broader entrepreneurial impact in low- to moderate-income communities throughout Kansas City. AltCap — a Kansas City-based community development financial institution that focuses on underserved populations — has received a $55 million new markets tax credit award from the U.S. Department of the Treasury. The award enables…