‘Volatile times’: C2FO targets capital access to businesses rattled by global tariff disruptions

June 13, 2025 | Startland News Staff

Companies — especially small businesses with limited banking options — need liquidity during times of global economic uncertainty, said Sandy Kemper, detailing C2FO’s fruitful efforts to meet growing demand for fast capital amid unpredictable tariff-related disruptions.

Kansas City-based C2FO funded $18 billion through its global working capital platform to businesses worldwide during the first quarter of 2025, the company reported Thursday, including $3.2 billion to companies in developing nations.

“While we are always happy to grow with our customers,” said Kemper, founder and CEO of C2FO. “I’m most proud of our success when it comes at a time when they need us the most — and we rise to meet those demands in a challenging economic environment.”

On average, C2FO customers accessed capital 32 days earlier than standard payment terms, at a lower cost than most traditional funding options, the company reported, noting customer satisfaction was affirmed by a record-high Net Promoter Score (NPS) of 78 in the first quarter, up from 75 the previous quarter.

C2FO continues to lead customer-centric brands like Costco (NPS of 53), Apple (61) and Google (58), as reported by Comparably, a division of ZoomInfo.

“This momentum is more than a reflection of platform growth — it’s a validation of C2FO’s core philosophy: putting our customers’ needs at the center of working capital innovation,” said Kemper, noting recent C2FO customer surveys ranked the platform highly in flexibility, transparency and control — above other financing options.

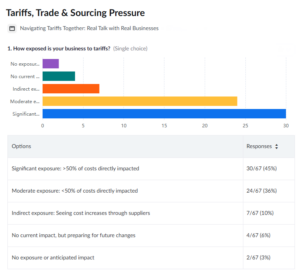

In a recent C2FO webinar with 100 U.S. business leaders, nearly half reported that tariffs affect more than 50 percent of their total costs.

“To navigate this uncertainty without hurting customer relationships or competitive standing, many leaders said they are reassessing purchasing timelines, evaluating cash positions and taking calculated risks in capital and inventory management to ensure consistent delivery,” the company said.

C2FO enables such businesses to maintain healthy cash flow without taking on additional debt or committing to rigid strategies ill-suited to a shifting economy, added Daniel Trost, product manager at C2FO.

The platform recently introduced enhanced features that go beyond the rigid, one-size-fits-all models common in early payment and supply chain finance programs, he added. Companies can now:

- Automate recurring early payment requests tailored to their invoicing cycles.

- Customize liquidity access based on unique cash flow needs and seasonal trends.

- Use improved price discovery tools to identify the most cost-effective capital options in real time.

“During volatile times, C2FO must be there for customers and continue to raise the bar to help them meet their cash flow needs as quickly and easily as possible,” Trost said. “That’s why we’ve dedicated development resources to improving the experience, transparency and usability of the platform.”

2025 Startups to Watch

stats here

Related Posts on Startland News

H&R Block must reconnect with startup energy, innovation, CEO Jeff Jones says

Jeff Jones’ journey to Kansas City — winding through hangouts with popstar Justin Timberlake, dinner with Oprah, and a stint driving one of the world’s most dominant sharing economy companies — has been transformative, the H&R Block CEO said. And if the homegrown corporate juggernaut he now leads is to meet its stretch potential, the…

From Cake to Google: Musician-turned-tech leader composes career between keyboards

Well into a music career — but noticing friends who were still trying to find gigs to make ends meet — Ben Morss faced a life-altering pivot. “I got sick of it and I turned to programming full time,” said Morss, a developer advocate at Google. “As a musician, I was trying to call people…

Idle Smart posts Series A round with KCRise Fund, multimillion-dollar investment support

A multi-million dollar investment round has Kansas City-grown Idle Smart revving its engine and accelerating toward rapid growth in 2019, revealed Jeff Lynch, company president. “I think it’s a reflection of what the team has been able to create over the past few years,” Lynch said of Idle Smart’s completion of a milestone Series A…

LaunchKC winner Erkios: Hacking attacks will come from inside — Fortifi intellectual property

Tinkering with old technology defined childhood for Philip Van Der Straeten, COO of Kansas City tech startup Erkios Systems. Such adventures could one day provide a nationwide payoff for his company, he said. “Our organization was built by tinkerers and critical thinkers attempting to break things down and get a better grasp of what they…