‘Volatile times’: C2FO targets capital access to businesses rattled by global tariff disruptions

June 13, 2025 | Startland News Staff

Companies — especially small businesses with limited banking options — need liquidity during times of global economic uncertainty, said Sandy Kemper, detailing C2FO’s fruitful efforts to meet growing demand for fast capital amid unpredictable tariff-related disruptions.

Kansas City-based C2FO funded $18 billion through its global working capital platform to businesses worldwide during the first quarter of 2025, the company reported Thursday, including $3.2 billion to companies in developing nations.

“While we are always happy to grow with our customers,” said Kemper, founder and CEO of C2FO. “I’m most proud of our success when it comes at a time when they need us the most — and we rise to meet those demands in a challenging economic environment.”

On average, C2FO customers accessed capital 32 days earlier than standard payment terms, at a lower cost than most traditional funding options, the company reported, noting customer satisfaction was affirmed by a record-high Net Promoter Score (NPS) of 78 in the first quarter, up from 75 the previous quarter.

C2FO continues to lead customer-centric brands like Costco (NPS of 53), Apple (61) and Google (58), as reported by Comparably, a division of ZoomInfo.

“This momentum is more than a reflection of platform growth — it’s a validation of C2FO’s core philosophy: putting our customers’ needs at the center of working capital innovation,” said Kemper, noting recent C2FO customer surveys ranked the platform highly in flexibility, transparency and control — above other financing options.

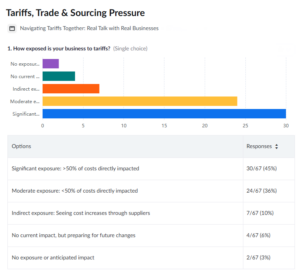

In a recent C2FO webinar with 100 U.S. business leaders, nearly half reported that tariffs affect more than 50 percent of their total costs.

“To navigate this uncertainty without hurting customer relationships or competitive standing, many leaders said they are reassessing purchasing timelines, evaluating cash positions and taking calculated risks in capital and inventory management to ensure consistent delivery,” the company said.

C2FO enables such businesses to maintain healthy cash flow without taking on additional debt or committing to rigid strategies ill-suited to a shifting economy, added Daniel Trost, product manager at C2FO.

The platform recently introduced enhanced features that go beyond the rigid, one-size-fits-all models common in early payment and supply chain finance programs, he added. Companies can now:

- Automate recurring early payment requests tailored to their invoicing cycles.

- Customize liquidity access based on unique cash flow needs and seasonal trends.

- Use improved price discovery tools to identify the most cost-effective capital options in real time.

“During volatile times, C2FO must be there for customers and continue to raise the bar to help them meet their cash flow needs as quickly and easily as possible,” Trost said. “That’s why we’ve dedicated development resources to improving the experience, transparency and usability of the platform.”

2025 Startups to Watch

stats here

Related Posts on Startland News

Serial builder uses sensor tech to ‘see’ inside problem-prone properties with Particle Space

Passion for building breathes life into a successful startup and the collective ecosystem, said David Biga. “[Builders] are a critical piece to our startup community,” said Biga, founder of Kansas City-based SaaS firm Particle Space. “If you don’t have people who care to build and offer things to those before you — then why come…

Duo designs Paloma Post greeting cards for more inclusive representation of couples

As she stood flipping through an endless sea of birthday cards, Julie Korona couldn’t find a single one that would send the right message to her then-fiancé, Tyler, she recalled. “All of the cards that I was looking through either said ‘husband’ or were super generic,” said Korona, co-founder of Paloma Post — a newly…

Artist who won rare Jayhawk licensing deal — scoring a $150K payday — set to rebound

Seemingly routine for many Kansas fans, crimson and blue are once again among the colors flooding the canvas of the 2019 NCAA tournament. But for artist Megh Knappenberger, the Jayhawks’ familiar palate has painted an entrepreneurial journey with as thrilling ups and downs as Big 12 basketball, she said. “It’s a pretty special and unique…

Cloud platform Packet opens KC office after $25M funding round in New York

New York-based Packet’s newly established Kansas City office is expected to take full advantage of the area’s wealth of tech talent, said Ihab Tarazi. “There is actually a very good technical base in Kansas City — so here’s validation of that,” said Tarazi, chief technology officer at the cloud infrastructure firm committed to “building a…