‘Volatile times’: C2FO targets capital access to businesses rattled by global tariff disruptions

June 13, 2025 | Startland News Staff

Companies — especially small businesses with limited banking options — need liquidity during times of global economic uncertainty, said Sandy Kemper, detailing C2FO’s fruitful efforts to meet growing demand for fast capital amid unpredictable tariff-related disruptions.

Kansas City-based C2FO funded $18 billion through its global working capital platform to businesses worldwide during the first quarter of 2025, the company reported Thursday, including $3.2 billion to companies in developing nations.

“While we are always happy to grow with our customers,” said Kemper, founder and CEO of C2FO. “I’m most proud of our success when it comes at a time when they need us the most — and we rise to meet those demands in a challenging economic environment.”

On average, C2FO customers accessed capital 32 days earlier than standard payment terms, at a lower cost than most traditional funding options, the company reported, noting customer satisfaction was affirmed by a record-high Net Promoter Score (NPS) of 78 in the first quarter, up from 75 the previous quarter.

C2FO continues to lead customer-centric brands like Costco (NPS of 53), Apple (61) and Google (58), as reported by Comparably, a division of ZoomInfo.

“This momentum is more than a reflection of platform growth — it’s a validation of C2FO’s core philosophy: putting our customers’ needs at the center of working capital innovation,” said Kemper, noting recent C2FO customer surveys ranked the platform highly in flexibility, transparency and control — above other financing options.

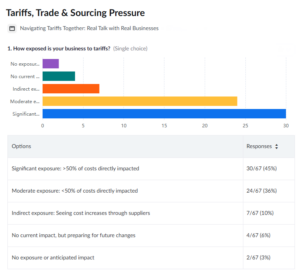

In a recent C2FO webinar with 100 U.S. business leaders, nearly half reported that tariffs affect more than 50 percent of their total costs.

“To navigate this uncertainty without hurting customer relationships or competitive standing, many leaders said they are reassessing purchasing timelines, evaluating cash positions and taking calculated risks in capital and inventory management to ensure consistent delivery,” the company said.

C2FO enables such businesses to maintain healthy cash flow without taking on additional debt or committing to rigid strategies ill-suited to a shifting economy, added Daniel Trost, product manager at C2FO.

The platform recently introduced enhanced features that go beyond the rigid, one-size-fits-all models common in early payment and supply chain finance programs, he added. Companies can now:

- Automate recurring early payment requests tailored to their invoicing cycles.

- Customize liquidity access based on unique cash flow needs and seasonal trends.

- Use improved price discovery tools to identify the most cost-effective capital options in real time.

“During volatile times, C2FO must be there for customers and continue to raise the bar to help them meet their cash flow needs as quickly and easily as possible,” Trost said. “That’s why we’ve dedicated development resources to improving the experience, transparency and usability of the platform.”

2025 Startups to Watch

stats here

Related Posts on Startland News

Embracing the chaos, LaborChart soothes the calamity of construction

Editor’s note: This content is sponsored by LaunchKC but independently produced by Startland News. Entrepreneurship is often attractive to personalities that don’t mind dealing with uncertainty. And though Ben Schultz never envisioned himself an entrepreneur, his experience as an electrical contractor forced him to embrace a myriad of unknowns in the construction industry. “Construction is…

Events Preview: Sports Hack for Social Change Competition

There are a boatload of entrepreneurial events hosted in Kansas City on a weekly basis. Whether you’re an entrepreneur, investor, supporter, or curious Kansas Citian, we recommend these upcoming events for you. WEEKLY EVENT PREVIEW Second Fridays at Village Square When: October 14 @ 4:30 pm – 7:30 pm Where: Village Square Coworking Studio Second…

Kansas Citians preparing for plethora of pitch competitions

A staple of early-stage business — the elevator pitch — will be on full display for the Kansas City community in coming weeks. Entrepreneurs from around the metro area have several upcoming opportunities to pitch their businesses or to hear other innovators deliver spiels on their firms. Here are few of those events. The University of Kansas’…

Royals, entrepreneurial stars fielding pitches from Kansas City educators

Children today require more than just a pencil and paper to complete their lesson plan. Thanks to a booming education technology market, teachers’ out-of-pocket spending goes far beyond the occasional pen, pencil or box of tissues nowadays. In 2013, teachers spent $1.6 billion annually to support their classroom. To alleviate the climbing prices of basic…