‘Volatile times’: C2FO targets capital access to businesses rattled by global tariff disruptions

June 13, 2025 | Startland News Staff

Companies — especially small businesses with limited banking options — need liquidity during times of global economic uncertainty, said Sandy Kemper, detailing C2FO’s fruitful efforts to meet growing demand for fast capital amid unpredictable tariff-related disruptions.

Kansas City-based C2FO funded $18 billion through its global working capital platform to businesses worldwide during the first quarter of 2025, the company reported Thursday, including $3.2 billion to companies in developing nations.

“While we are always happy to grow with our customers,” said Kemper, founder and CEO of C2FO. “I’m most proud of our success when it comes at a time when they need us the most — and we rise to meet those demands in a challenging economic environment.”

On average, C2FO customers accessed capital 32 days earlier than standard payment terms, at a lower cost than most traditional funding options, the company reported, noting customer satisfaction was affirmed by a record-high Net Promoter Score (NPS) of 78 in the first quarter, up from 75 the previous quarter.

C2FO continues to lead customer-centric brands like Costco (NPS of 53), Apple (61) and Google (58), as reported by Comparably, a division of ZoomInfo.

“This momentum is more than a reflection of platform growth — it’s a validation of C2FO’s core philosophy: putting our customers’ needs at the center of working capital innovation,” said Kemper, noting recent C2FO customer surveys ranked the platform highly in flexibility, transparency and control — above other financing options.

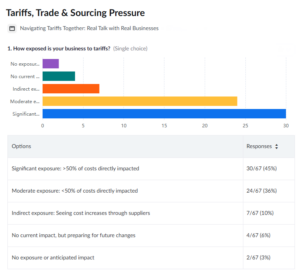

In a recent C2FO webinar with 100 U.S. business leaders, nearly half reported that tariffs affect more than 50 percent of their total costs.

“To navigate this uncertainty without hurting customer relationships or competitive standing, many leaders said they are reassessing purchasing timelines, evaluating cash positions and taking calculated risks in capital and inventory management to ensure consistent delivery,” the company said.

C2FO enables such businesses to maintain healthy cash flow without taking on additional debt or committing to rigid strategies ill-suited to a shifting economy, added Daniel Trost, product manager at C2FO.

The platform recently introduced enhanced features that go beyond the rigid, one-size-fits-all models common in early payment and supply chain finance programs, he added. Companies can now:

- Automate recurring early payment requests tailored to their invoicing cycles.

- Customize liquidity access based on unique cash flow needs and seasonal trends.

- Use improved price discovery tools to identify the most cost-effective capital options in real time.

“During volatile times, C2FO must be there for customers and continue to raise the bar to help them meet their cash flow needs as quickly and easily as possible,” Trost said. “That’s why we’ve dedicated development resources to improving the experience, transparency and usability of the platform.”

2025 Startups to Watch

stats here

Related Posts on Startland News

Fund Me, KC: Operation Breakthrough hopes to burn into STEM gap with laser cutter

Editor’s note: Startland News is continuing its ‘Fund Me, KC’ feature to highlight area entrepreneurial efforts to accelerate businesses or projects. If you or your startup is running a crowdfunding campaign, let us know by contacting news@startlandnews.com. Today’s featured campaign from Operation Breakthrough spotlights a campaign by the nonprofit childhood development center to boost its…

designWerx makes room for growing makers in North Kansas City

A home garage workspace can be a lonely, stifling place for a maker trying to grow his or her business, said Pam Newton, who is leading the artistic vision for designWerx, a new coworking space and incubator specifically for makers in North Kansas City. “You’re alone constantly. Sometimes it’s hard to get motivated,” she said.…

KCultivator Q&A: Tyler Enders talks his biggest failure, the ‘Made In’ concept and Obama

Seated amid vintage mosaic tile and striking black-and-white portraits by Kansas City photographer Cameron Gee, founder Tyler Enders seems at home within the walls of the Made in KC Cafe. He’s an art lover with a finance degree — not to mention one of the minds behind Made in KC, a retail showcase for local…

Kimberly Gandy: Proof a startup can emerge stronger from its founder’s cancer diagnosis

Cancer needn’t mean can’t, Kimberly Gandy said. When the Play-It Health founder and CEO was diagnosed with an aggressive, mid-stage cancer in May 2016, her startup found itself at a crossroads. Gandy had just joined the Kansas City-based Pipeline fellowship and her company was poised for growth through its web- and mobile-based health regimen tracking…