PMI Rate Pro exits: KC fintech calls acquisition the ‘natural next step’ for its mortgage tech solution

May 8, 2025 | Startland News Staff

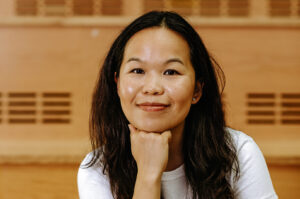

MIAMI — A strategic acquisition between a software leader and a Kansas City fintech startup brings together two innovators in mortgage tech to deliver the industry’s most comprehensive platform, said Nomi Smith, co-founder of PMI Rate Pro.

LoanPASS on Thursday announced its purchase of PMI Rate Pro, an Overland Park-based fintech specializing in API-driven private mortgage insurance (PMI) pricing technology. Financial terms of the deal were not disclosed.

PMI Rate Pro — one of Startland News’ past Kansas City Startups to Watch — will retain its brand identity and continue operating independently, with Smith at the helm and full support from LoanPASS for its current lender clients and software integrations, she said.

“We built our PMI technology to be modern, flexible, and easy to integrate with LOS, PPE, and POS systems,” the Techstars Kansas City alum and member of the Pipeline Entrepreneurs network added. “Joining LoanPASS is a natural next step. Together, we’re building the kind of connected infrastructure the mortgage industry has needed for years.”

Integrating Smith’s company and its technology is expected to boost LoanPass’s product configuration, pricing, eligibility, and mortgage insurance quoting, giving lenders access to all six national PMI providers through a single API.

The result of the LoanPASS deal: faster, more accurate quotes, reduced manual effort, and better pricing options for borrowers, Smith said.

Both teams are committed to uninterrupted service and will collaborate to further expand platform capabilities and tech partnerships, said Bill Roy, founder and CEO of LoanPASS.

“Together, LoanPASS and PMI Rate Pro deliver a unified system for pricing and mortgage insurance, elevating the lending experience for our customers,” he added. “This integration brings speed, accuracy, and control to the forefront — allowing lenders to manage product pricing and PMI through one modern interface.”

First launched in 2019, PMI Rate Pro’s platform was designed to simplify one of the most fragmented parts of the mortgage process. Instead of building and maintaining six individual PMI integrations, lenders and tech platforms can now connect once to PMI Rate Pro’s single, unified API — saving time and development resources.

Featured Business

2025 Startups to Watch

stats here

Related Posts on Startland News

New city flag designed for KC’s now (and tomorrow): Here’s where you’ll see it flying first

Kansas City is ushering in an era of growth and development, Jared Horman said, and the unveiling of a new municipal flag is just the way to recognize this new chapter. “The timing feels particularly exciting with the Chiefs headed to the Super Bowl, the opening of the new terminal at the airport and the…

Pushing without force: Founder credits accelerator’s collaborative ‘in the trenches’ guidance for overseas scaling success

Editor’s note: This article is sponsored by the NMotion startup accelerator, but was independently produced by Startland News. The powerhouse mix of global and localized support David Biga received from the NMotion Growth Accelerator was well worth the program’s required exchange of equity, the proptech startup founder detailed. Particle Space — one of Startland News’…

Coming to the Plaza: Food hall to put ‘chefs out front’ from breakfast to late-night crowd

Just months after expanding to Downtown Kansas City, the Strang Chef Collectives’ next location for a chef-driven food hall will be tailored to fit its new home on the Country Club Plaza, said Shawn Craft. The hall’s four new food and beverage concepts — slated to open in late May or early June — will…

PMI Rate Pro pivots to tech solutions firm as pricing tool integrates with mortgage software solution

The mortgage industry is lagging behind in the current world of technology, Nomi Smith said; but PMI Rate Pro is innovating to become a one-stop shop for private mortgage insurance (PMI). “We began as a quoting service, so we developed an API (application programming interface) supporting another API. But we quickly realized that there needed…