C2FO accesses $30M investment with World Bank-backed IFC to expand KC firm’s working capital platform

April 14, 2025 | Startland News Staff

A just-announced capital infusion for Leawood-built C2FO reflects a shared commitment with global partners to boosting jobs and strengthening economic opportunities — notably for micro, small and medium enterprises in emerging markets worldwide.

The $30 million funding round features investment from the International Finance Corporation (IFC), a member of the World Bank Group, and existing shareholders.

“Having IFC as an investor is a great honor for us and a catalyst that will accelerate our shared mission to fully scale a global, durable, inclusive and sustainable platform for the world’s businesses,” said Sandy Kemper, founder and CEO of C2FO.

The company’s innovative platform leverages advanced technology to deliver dynamic funding, enabling suppliers — predominantly smaller businesses in such regions as India, Indonesia, Brazil and Africa — to access working capital faster and more efficiently than through traditional financing.

“C2FO believes when everyone has the capital they need to grow, everyone benefits. It fosters innovation, job growth and a more resilient economy,” explained Kemper. “That’s why we’ve created a platform where businesses can access low-cost, efficient working capital on demand without the burdens of traditional credit-based lending.”

The investment news comes about seven months after C2FO was named SME Financier of the Year-North America by the SME Finance Forum, which is managed by the IFC, and began working with the organization to enhance financing for local enterprises in Africa, starting with Nigeria. That initiative — with the potential to unlock tens of billions of dollars in annual financing for African MSMEs — is expected to launch later this year.

ICYMI: Worlds’ biggest financial leaders applaud C2FO for job-creating capital access

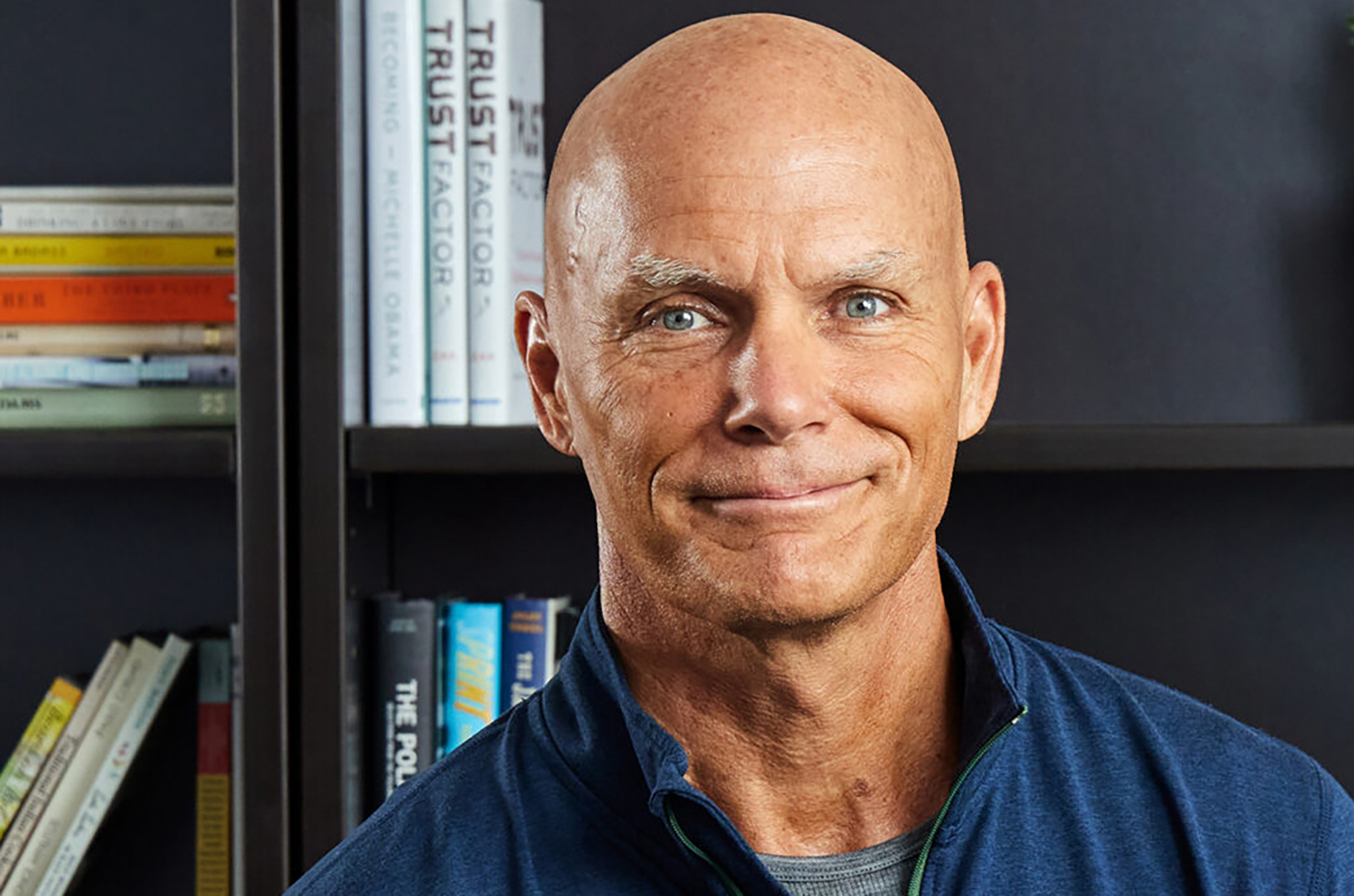

Sandy Kemper, C2FO, sits alongside Mohamed Gouled, vice president of industries for the International Finance Corporation, during a signing event in October 2024 for the organization’s strategic partnership with C2FO; photo courtesy of C2FO

“IFC provides more than capital — our expertise in supply chain finance and fintech is instrumental in scaling C2FO’s operations,” said Farid Fezoua, global director for disruptive technologies, services and funds at IFC. “This initiative will unlock the economic potential of smaller suppliers who cannot easily access needed working capital, driving growth and jobs.”

With operations around the globe, C2FO already facilitates a material amount of liquidity to emerging markets, the company said. In 2024, more than $13 billion in funding was provided to more than 20,000 businesses in developing nations across the globe through C2FO.

As C2FO continues to grow, it remains dedicated to its mission of providing accessible and efficient working capital solutions, empowering businesses to thrive in an increasingly competitive landscape, the company said, noting the strategic and financial support from IFC is a pivotal step in realizing this mission and expanding the impact of C2FO’s services on a global scale.

Featured Business

2025 Startups to Watch

stats here

Related Posts on Startland News

KC innovator’s anti-itch spray so natural it was discovered on a front porch lab

Homindy founder Ronan Molloy discovered the benefits of his company’s itch relief spray somewhat by accident. During the summer of 2020, Molloy volunteered to participate in a clinical study for a tea with all-natural ingredients that was supposed to reduce inflammation in his right knee. At that time, he was president of the Innovation Stockyard,…

KC capital implants cattle tech startup with fuel to scale, expanding IVF labs, headcount

Livestock production has seen a remarkable transformation since Kerryann Kocher was growing up on her family’s sixth-generation farm in northeast Iowa, the Vytelle CEO said. Instead of just selecting the cow that looks best and bringing in the neighbor’s bull for breeding, as she remembers it, Kocher and Vytelle — a Kansas City-based precision livestock…

Venture experts: Getting your first check in KC is too difficult, but a record influx of coastal investors isn’t a bad substitute

A new report on Kansas City’s venture-backed companies showed year-over-year growth in multiple areas — impressing industry experts who identified key investment trends in the data. More companies with venture capital backing; higher employee counts; a 58 percent boost in fundraising. Yet growth was not universal. Despite gains in top-line figures, the number of Kansas City-based…

RX Savings Solutions sale would see the startup acquired for up to $875M in KC’s biggest-ever exit

The McKesson Corporation has agreed to purchase Overland Park-prescribed Rx Savings Solutions in a deal worth nearly $1 billion. McKesson announced Monday that it had entered into an agreement with the prescription pricing startup valued at up to $875 million — more than double the $425 million price tag for which Kansas City-built Backlot Cars…