C2FO accesses $30M investment with World Bank-backed IFC to expand KC firm’s working capital platform

April 14, 2025 | Startland News Staff

A just-announced capital infusion for Leawood-built C2FO reflects a shared commitment with global partners to boosting jobs and strengthening economic opportunities — notably for micro, small and medium enterprises in emerging markets worldwide.

The $30 million funding round features investment from the International Finance Corporation (IFC), a member of the World Bank Group, and existing shareholders.

“Having IFC as an investor is a great honor for us and a catalyst that will accelerate our shared mission to fully scale a global, durable, inclusive and sustainable platform for the world’s businesses,” said Sandy Kemper, founder and CEO of C2FO.

The company’s innovative platform leverages advanced technology to deliver dynamic funding, enabling suppliers — predominantly smaller businesses in such regions as India, Indonesia, Brazil and Africa — to access working capital faster and more efficiently than through traditional financing.

“C2FO believes when everyone has the capital they need to grow, everyone benefits. It fosters innovation, job growth and a more resilient economy,” explained Kemper. “That’s why we’ve created a platform where businesses can access low-cost, efficient working capital on demand without the burdens of traditional credit-based lending.”

The investment news comes about seven months after C2FO was named SME Financier of the Year-North America by the SME Finance Forum, which is managed by the IFC, and began working with the organization to enhance financing for local enterprises in Africa, starting with Nigeria. That initiative — with the potential to unlock tens of billions of dollars in annual financing for African MSMEs — is expected to launch later this year.

ICYMI: Worlds’ biggest financial leaders applaud C2FO for job-creating capital access

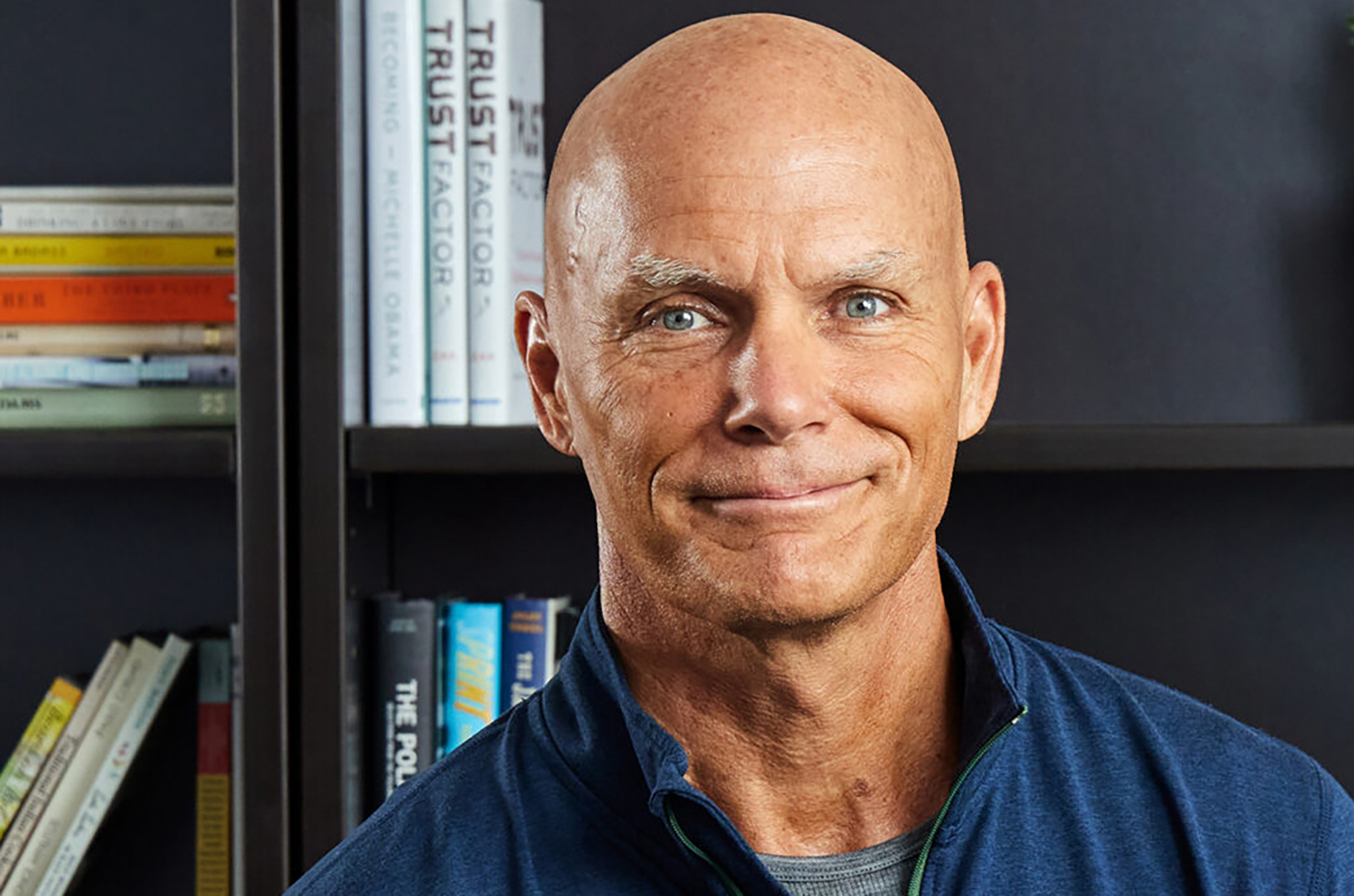

Sandy Kemper, C2FO, sits alongside Mohamed Gouled, vice president of industries for the International Finance Corporation, during a signing event in October 2024 for the organization’s strategic partnership with C2FO; photo courtesy of C2FO

“IFC provides more than capital — our expertise in supply chain finance and fintech is instrumental in scaling C2FO’s operations,” said Farid Fezoua, global director for disruptive technologies, services and funds at IFC. “This initiative will unlock the economic potential of smaller suppliers who cannot easily access needed working capital, driving growth and jobs.”

With operations around the globe, C2FO already facilitates a material amount of liquidity to emerging markets, the company said. In 2024, more than $13 billion in funding was provided to more than 20,000 businesses in developing nations across the globe through C2FO.

As C2FO continues to grow, it remains dedicated to its mission of providing accessible and efficient working capital solutions, empowering businesses to thrive in an increasingly competitive landscape, the company said, noting the strategic and financial support from IFC is a pivotal step in realizing this mission and expanding the impact of C2FO’s services on a global scale.

Featured Business

2025 Startups to Watch

stats here

Related Posts on Startland News

Tariffs are driving up costs for American coffee roasters: ‘We’ve never seen anything like this’

Editor’s note: The following story was published by Harvest Public Media and KCUR, Kansas City’s NPR member station, and a fellow member of the KC Media Collective. Click here to read the original story or here to sign up for KCUR’s email newsletter. Coffee has gotten a lot more expensive in the U.S. as tariffs seep into the price tag;…

‘I absolutely refuse to fail’: Sweet Peaches founder battles for national spot in frozen dessert aisles

Editor’s note: This story was originally published by Kansas City PBS/Flatland, a member of the Kansas City Media Collective, which also includes Startland News, KCUR 89.3, American Public Square, The Kansas City Beacon, and Missouri Business Alert. Click here to read the original story. Denisha Jones is poised to turn America’s devotion to apple pie on its…

Kiva KC brings zero-interest microloans to founders shut out of traditional capital

Editor’s note: The Economic Development Corporation of Kansas City (EDCKC) and KC BizCare are partners of Startland News. Kansas City is betting that a global microlending model — one built on $25 contributions and community belief in everyday entrepreneurs — can help close one of the city’s most stubborn gaps: early-stage capital for founders who…

How this startup (and a KC sports icon) turned young players into card-carrying legends overnight

An Overland Park-based custom trading card company and a Kansas City soccer star are teaming up on the pitch with a goal to make youth sports fun again. Stat Legend — launched by Chris Cheatham and Nick Weaver in 2023 — created custom cards for all 250 players who suit up for the Captains Soccer…