C2FO accesses $30M investment with World Bank-backed IFC to expand KC firm’s working capital platform

April 14, 2025 | Startland News Staff

A just-announced capital infusion for Leawood-built C2FO reflects a shared commitment with global partners to boosting jobs and strengthening economic opportunities — notably for micro, small and medium enterprises in emerging markets worldwide.

The $30 million funding round features investment from the International Finance Corporation (IFC), a member of the World Bank Group, and existing shareholders.

“Having IFC as an investor is a great honor for us and a catalyst that will accelerate our shared mission to fully scale a global, durable, inclusive and sustainable platform for the world’s businesses,” said Sandy Kemper, founder and CEO of C2FO.

The company’s innovative platform leverages advanced technology to deliver dynamic funding, enabling suppliers — predominantly smaller businesses in such regions as India, Indonesia, Brazil and Africa — to access working capital faster and more efficiently than through traditional financing.

“C2FO believes when everyone has the capital they need to grow, everyone benefits. It fosters innovation, job growth and a more resilient economy,” explained Kemper. “That’s why we’ve created a platform where businesses can access low-cost, efficient working capital on demand without the burdens of traditional credit-based lending.”

The investment news comes about seven months after C2FO was named SME Financier of the Year-North America by the SME Finance Forum, which is managed by the IFC, and began working with the organization to enhance financing for local enterprises in Africa, starting with Nigeria. That initiative — with the potential to unlock tens of billions of dollars in annual financing for African MSMEs — is expected to launch later this year.

ICYMI: Worlds’ biggest financial leaders applaud C2FO for job-creating capital access

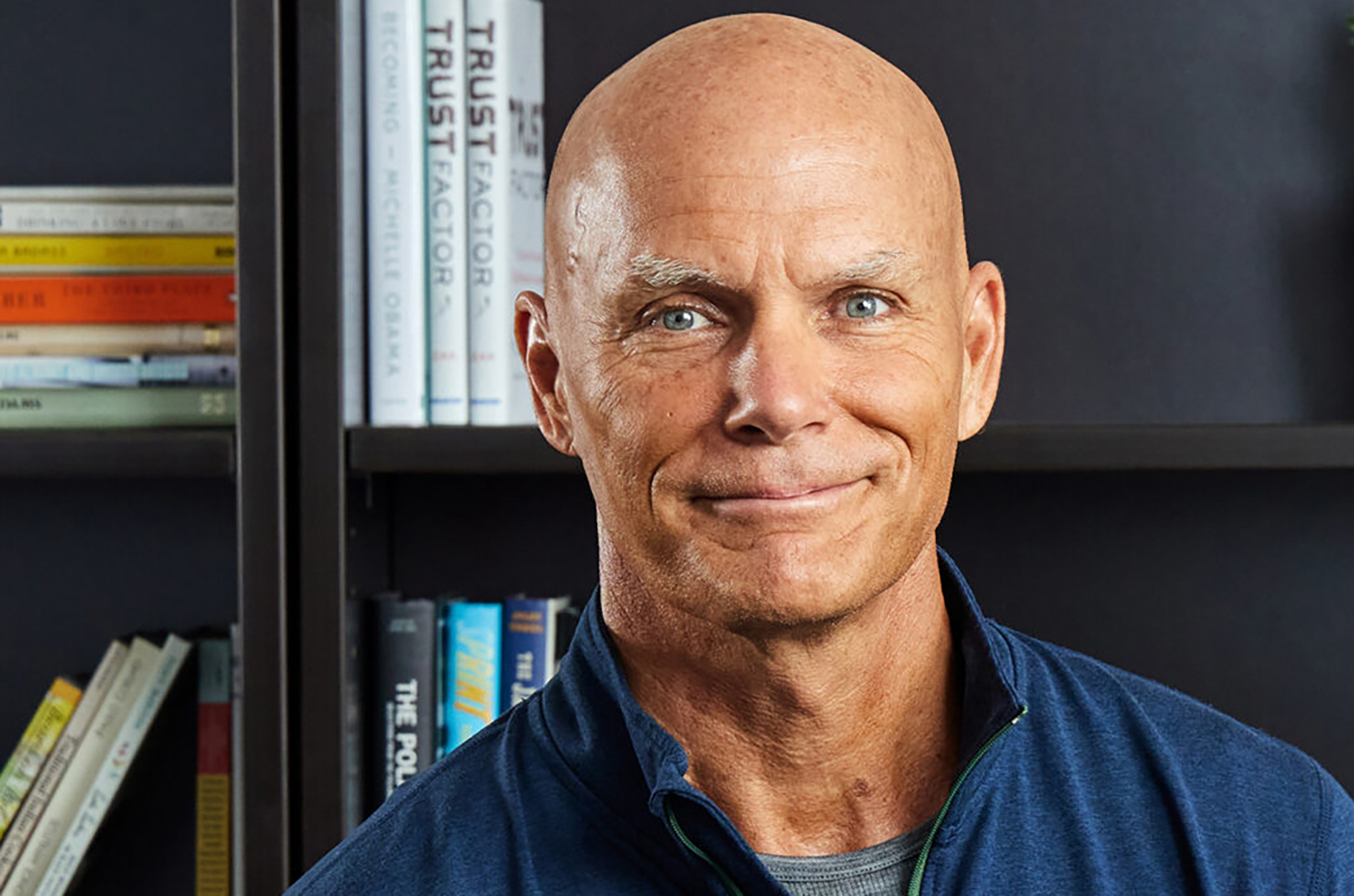

Sandy Kemper, C2FO, sits alongside Mohamed Gouled, vice president of industries for the International Finance Corporation, during a signing event in October 2024 for the organization’s strategic partnership with C2FO; photo courtesy of C2FO

“IFC provides more than capital — our expertise in supply chain finance and fintech is instrumental in scaling C2FO’s operations,” said Farid Fezoua, global director for disruptive technologies, services and funds at IFC. “This initiative will unlock the economic potential of smaller suppliers who cannot easily access needed working capital, driving growth and jobs.”

With operations around the globe, C2FO already facilitates a material amount of liquidity to emerging markets, the company said. In 2024, more than $13 billion in funding was provided to more than 20,000 businesses in developing nations across the globe through C2FO.

As C2FO continues to grow, it remains dedicated to its mission of providing accessible and efficient working capital solutions, empowering businesses to thrive in an increasingly competitive landscape, the company said, noting the strategic and financial support from IFC is a pivotal step in realizing this mission and expanding the impact of C2FO’s services on a global scale.

Featured Business

2025 Startups to Watch

stats here

Related Posts on Startland News

Meet the six competitors pitching for $50K in funding in HERImpact’s return to Kansas City

Editor’s note: 1863 Ventures is an advertiser with Startland News, though this report was produced independently by the nonprofit newsroom. The competition slate is set, as a half-dozen of Kansas City’s most promising emerging social entrepreneurs prepare to pitch for $50,000 in a public, shark-tank-style event for women founders. The live pitch event is set…

Web3 startup led by one of KC’s best-known exited founders redeems $2.5M pre-seed round

Redeem, a blockchain agnostic connectivity layer for Web3 that leverages phone numbers to send, receive and redeem utility NFTs, announced Wednesday its $2.5 million pre-seed funding round ahead of its launch, led by veteran blockchain investor Kenetic. The round also includes local venture firms Flyover Capital and KCRise Fund. Funding is expected to be used…

Only one side of the tracks: Omni Circle opens entrepreneurs ‘space to become or build their personal freedom’

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. This series is possible thanks to Go Topeka, which seeks economic success for all companies and citizens across Shawnee County through implementation of an aggressive economic development strategy that capitalizes…

How Kansas City’s new airport terminal became a sprawling art gallery for 28 diverse creatives

Every major milestone in Kathy Minhsin Liao’s life has been marked by travel, she shared, making airports synonymous with transition. “My [art]work at the new terminal is called ‘Hello and Goodbye,’ and it touches on my personal experience of the fluidity of travel. When you’re at the airport, you’re in that limbo space of thinking…