C2FO accesses $30M investment with World Bank-backed IFC to expand KC firm’s working capital platform

April 14, 2025 | Startland News Staff

A just-announced capital infusion for Leawood-built C2FO reflects a shared commitment with global partners to boosting jobs and strengthening economic opportunities — notably for micro, small and medium enterprises in emerging markets worldwide.

The $30 million funding round features investment from the International Finance Corporation (IFC), a member of the World Bank Group, and existing shareholders.

“Having IFC as an investor is a great honor for us and a catalyst that will accelerate our shared mission to fully scale a global, durable, inclusive and sustainable platform for the world’s businesses,” said Sandy Kemper, founder and CEO of C2FO.

The company’s innovative platform leverages advanced technology to deliver dynamic funding, enabling suppliers — predominantly smaller businesses in such regions as India, Indonesia, Brazil and Africa — to access working capital faster and more efficiently than through traditional financing.

“C2FO believes when everyone has the capital they need to grow, everyone benefits. It fosters innovation, job growth and a more resilient economy,” explained Kemper. “That’s why we’ve created a platform where businesses can access low-cost, efficient working capital on demand without the burdens of traditional credit-based lending.”

The investment news comes about seven months after C2FO was named SME Financier of the Year-North America by the SME Finance Forum, which is managed by the IFC, and began working with the organization to enhance financing for local enterprises in Africa, starting with Nigeria. That initiative — with the potential to unlock tens of billions of dollars in annual financing for African MSMEs — is expected to launch later this year.

ICYMI: Worlds’ biggest financial leaders applaud C2FO for job-creating capital access

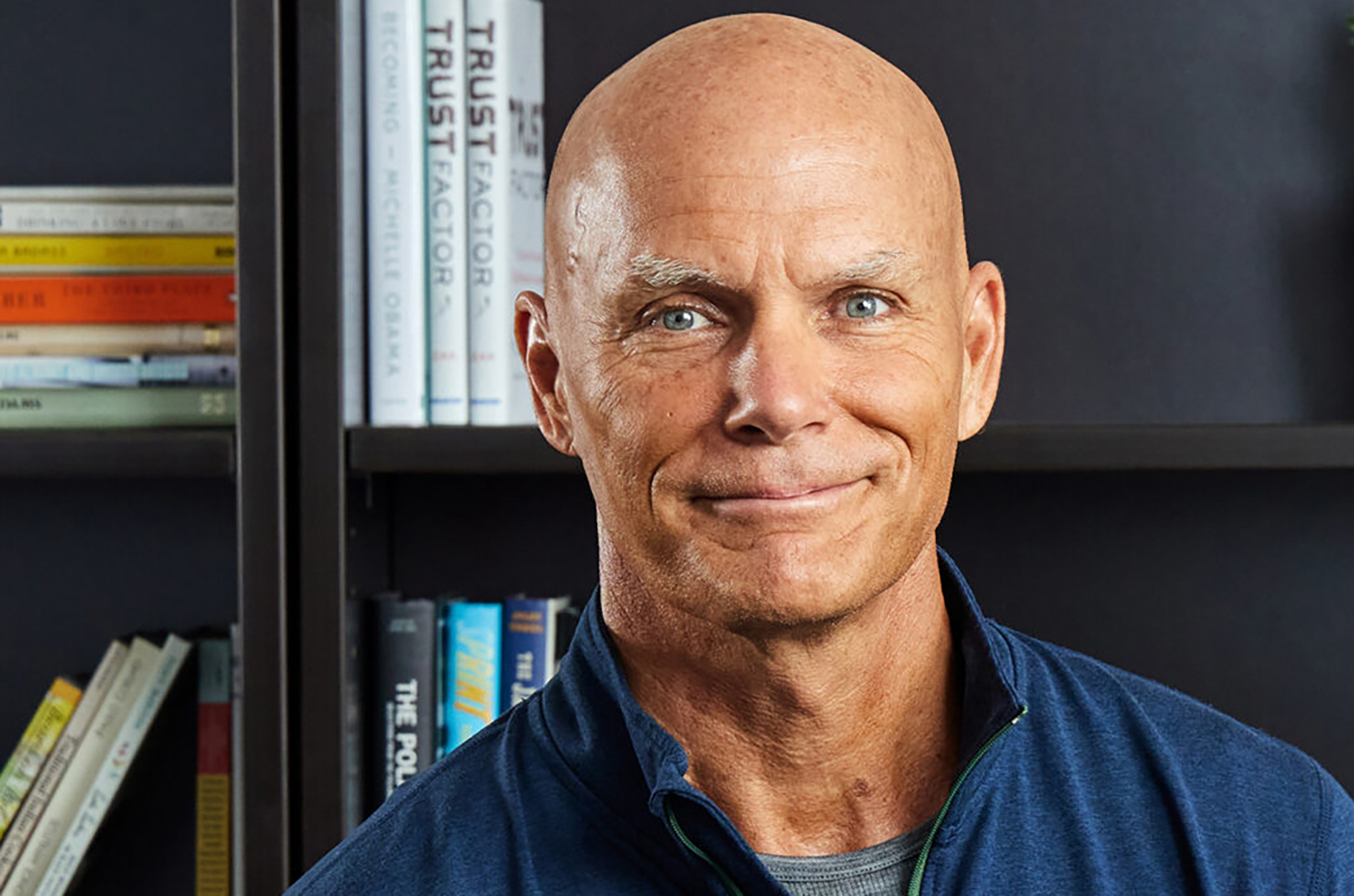

Sandy Kemper, C2FO, sits alongside Mohamed Gouled, vice president of industries for the International Finance Corporation, during a signing event in October 2024 for the organization’s strategic partnership with C2FO; photo courtesy of C2FO

“IFC provides more than capital — our expertise in supply chain finance and fintech is instrumental in scaling C2FO’s operations,” said Farid Fezoua, global director for disruptive technologies, services and funds at IFC. “This initiative will unlock the economic potential of smaller suppliers who cannot easily access needed working capital, driving growth and jobs.”

With operations around the globe, C2FO already facilitates a material amount of liquidity to emerging markets, the company said. In 2024, more than $13 billion in funding was provided to more than 20,000 businesses in developing nations across the globe through C2FO.

As C2FO continues to grow, it remains dedicated to its mission of providing accessible and efficient working capital solutions, empowering businesses to thrive in an increasingly competitive landscape, the company said, noting the strategic and financial support from IFC is a pivotal step in realizing this mission and expanding the impact of C2FO’s services on a global scale.

Featured Business

2025 Startups to Watch

stats here

Related Posts on Startland News

Flint Group’s new strategic partner invests in taking the home services platform national

SEATTLE — A newly announced strategic investment from the global firm General Atlantic is expected to help a home services platform with Kansas City leadership enhance its business offerings and accelerate its growth, ultimately toward scaling the company nationally. Founded in 2019 by industry veterans Collin Hathaway and Trevor Flannigan, Flint Group has quickly expanded…

Biotech startup’s $6.5M Series A expected to cultivate expanded workforce, research capabilities

Ronawk’s Bio-Block Universe has already revolutionized cell and tissue production, Tom Jantsch said, and the recent investment of $6.5 million is set to further research and development. “We have really changed the paradigm of how not only cell culture is done, but how researchers are able to scale. They can go from the bench, all…

J Rieger continues its international push, adding whiskey distribution to northern neighbors

Fresh off its win as the KC Chamber’s top international small business, J. Rieger & Co. announced its expansion into Nova Scotia — a milestone as the Kansas City-based distiller enters the Canadian market. “We are thrilled to bring our range of artisanal spirits to Canada for the first time,” said Ryan Maybee, co-founder of J.…

Mid x Midwest returning in November with renewed vision to connect KC founders, VCs

The pilot Mid x Midwest event in fall 2022 supported the idea that early-stage tech founders and investors are hungry for more conversations post pandemic, Dan Kerr and Maggie Kenefake shared, spurring the return of the invite-only meetup in November. “We both showed up that morning to Hotel Kansas City and we walked into the…