Novel Capital teams with Crux KC to offer growth-focused marketing to early-stage tech companies

March 31, 2025 | Startland News Staff

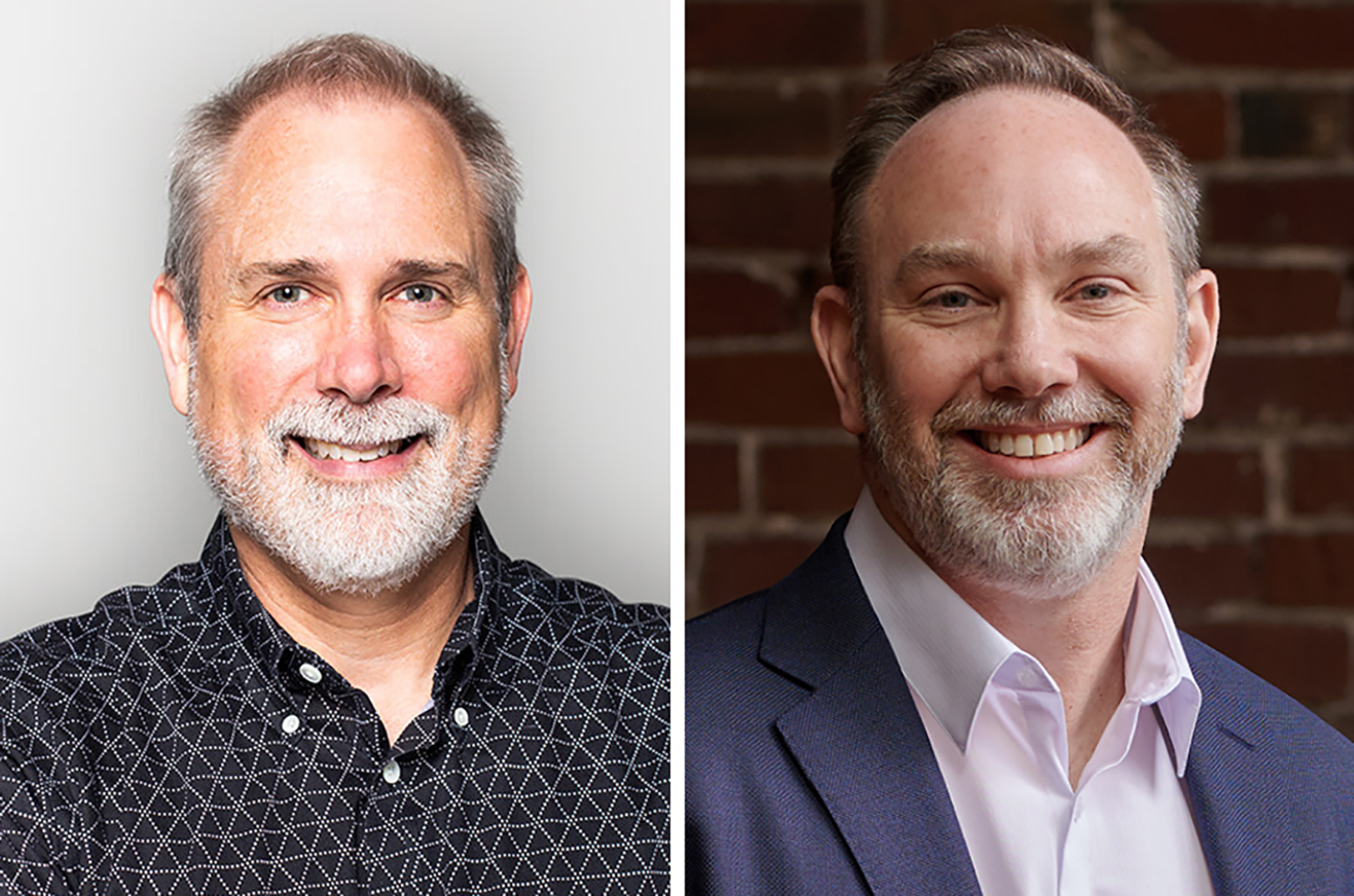

An exclusive partnership between two Kansas City-based innovators is expected to help remove a traditional financial hurdle to business growth, said Ethan Whitehill, president and chief strategy officer for the KC Chamber-lauded marketing firm Crux KC.

The collaboration between Crux and Overland Park-headquartered capital provider Novel Capital is expected to offer B2B SaaS and tech companies a path to non-dilutive flexible financing for essential marketing services.

“This partnership is a game changer, not only for Crux and Novel Capital, but to the entire market as a first-of-its-kind funding tool with flexible terms for marketing services and fractional chief marketer guidance,” said Whitehill. “We are excited to dive into these innovative, entrepreneurial startups and help them make smart marketing investments that establish their brand, scale marketing ops and rev up sales.”

Capital, sales development and marketing are three major challenges every tech venture faces to get their business off the ground, he continued. With Novel Capital’s simple, flexible model providing finding to early-stage SaaS companies ready to grow, and Crux’s expertise in marketing and sales, founders get the startup fuel they need to accelerate growth.

Click here to learn more about Crux’s partnership with Novel Capital, which leverages real-time data and AI to provide analytics, fundraising strategy, and non-dilutive capital to B2B SaaS and tech companies.

A three-time finalist for the Greater Kansas City Chamber of Commerce’s Small Business of the Year or “Mr. K” award, Crux’s experience in the technology-as-a-service category — offering fractional CMO services backed by a team of specialists — includes client relationships with TreviPay, Super Dispatch and RX Savings Solutions.

“Crux’s growth-focused business approach aligns perfectly with our vision for the founders we work with every day,” said Keith Harrington, co-founder and chief operating officer of Novel Capital alongside fellow serial entrepreneur Carlos Antequera. “At Novel, we’ve funded more than 150 entrepreneurs with more than $100 million, fueling their growth and helping them deliver on their ambitions. By removing the barrier to entry for reliable financing and strategic marketing through this partnership, we are giving founders an alternative to banks and VCs as well as the chance to build something bigger than they ever imagined.”

Crux’s exclusive marketing services partnership with Novel Capital has already begun with both companies working together to identify high-growth enterprise SaaS and tech clients who would benefit from financed marketing services.

Featured Business

2025 Startups to Watch

stats here

Related Posts on Startland News

Her new role is reenvisioning one of KC’s most iconic events for entrepreneurs; how Callie England is shaking up GEW

Callie England misses the life of an entrepreneur, she shared, but her new role with the UMKC Innovation Center — and GEWKC — allows her to stay in the game without being on the field. As of January, the veteran Kansas City startup founder is responsible for managing the branding and marketing initiatives of the…

Sand volleyball tourney for early-career professions works to ‘Spike the Stigma’ on mental health

Joining the workforce is no walk on the beach, said Mark Potts, but give him and his teammates a few hours in the sun and sand on a Saturday afternoon and it could be. “Nobody is on their journey alone,” said Potts, president of the Go Further Foundation, explaining the organization’s purpose and its goal…

Sailes closes $5.1M investment round led by STL firm, with KCRise Fund, Wichita VC

The foundation for Sailes has always been solving difficult problems for sales teams, said Nick Smith; the success of a Series A funding round for the startup will power new tools toward that goal. “Everyone is on this AI hype train, and we’ve been for AI for a while. But it’s not just about using…

EquipmentShare completes another $150M equity raise, building on its Series E funding

COLUMBIA, Missouri — The latest tranche of funding for EquipmentShare puts mid-Missouri’s most earth-moving scaleup close to a half-billion dollars in funding announced over the past six months. EquipmentShare, a Columbia-based equipment and digital solutions provider serving the construction industry, on Wednesday announced it completed an extension of its Series E equity raise, led by funds…