Novel Capital teams with Crux KC to offer growth-focused marketing to early-stage tech companies

March 31, 2025 | Startland News Staff

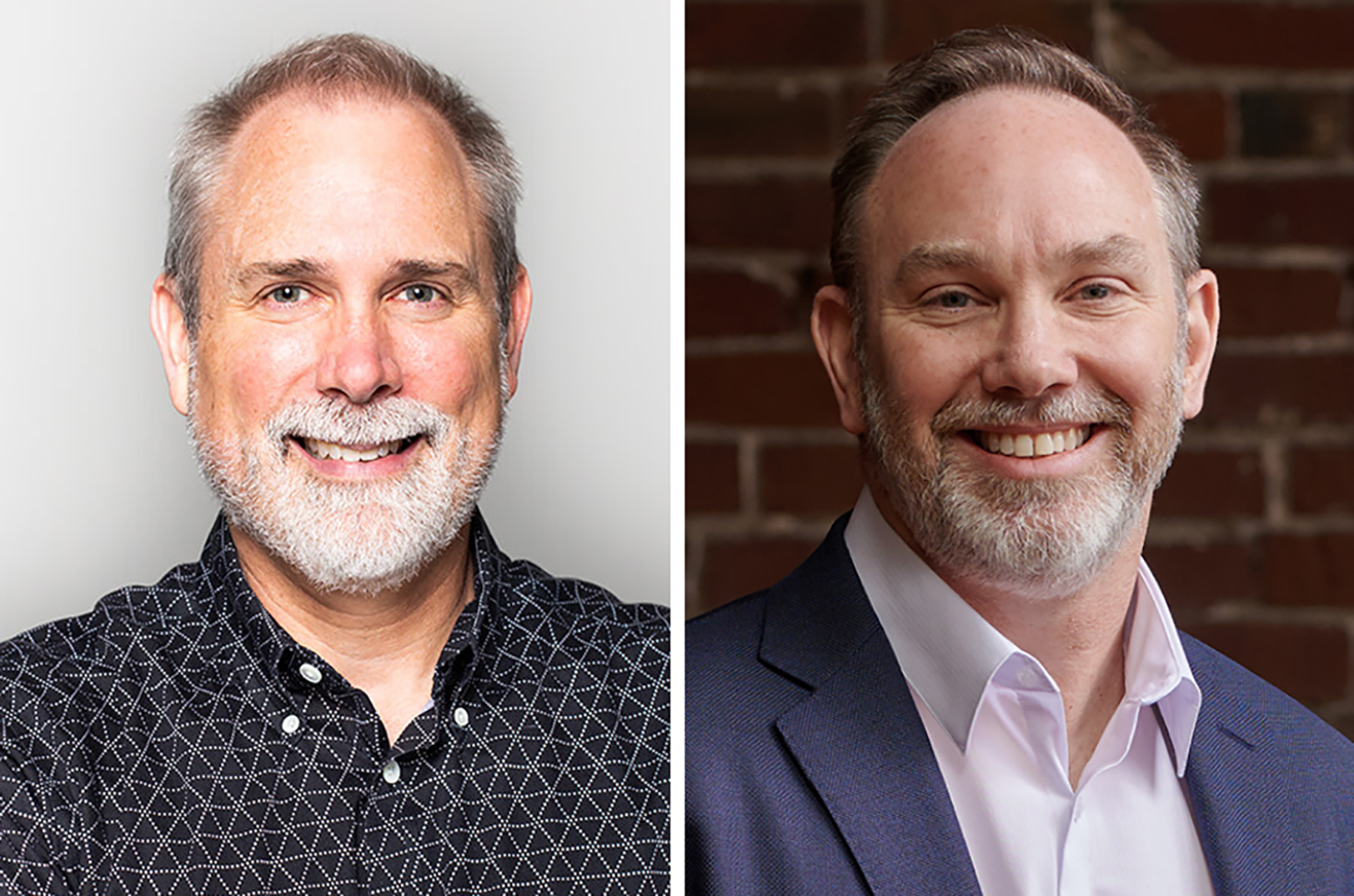

An exclusive partnership between two Kansas City-based innovators is expected to help remove a traditional financial hurdle to business growth, said Ethan Whitehill, president and chief strategy officer for the KC Chamber-lauded marketing firm Crux KC.

The collaboration between Crux and Overland Park-headquartered capital provider Novel Capital is expected to offer B2B SaaS and tech companies a path to non-dilutive flexible financing for essential marketing services.

“This partnership is a game changer, not only for Crux and Novel Capital, but to the entire market as a first-of-its-kind funding tool with flexible terms for marketing services and fractional chief marketer guidance,” said Whitehill. “We are excited to dive into these innovative, entrepreneurial startups and help them make smart marketing investments that establish their brand, scale marketing ops and rev up sales.”

Capital, sales development and marketing are three major challenges every tech venture faces to get their business off the ground, he continued. With Novel Capital’s simple, flexible model providing finding to early-stage SaaS companies ready to grow, and Crux’s expertise in marketing and sales, founders get the startup fuel they need to accelerate growth.

Click here to learn more about Crux’s partnership with Novel Capital, which leverages real-time data and AI to provide analytics, fundraising strategy, and non-dilutive capital to B2B SaaS and tech companies.

A three-time finalist for the Greater Kansas City Chamber of Commerce’s Small Business of the Year or “Mr. K” award, Crux’s experience in the technology-as-a-service category — offering fractional CMO services backed by a team of specialists — includes client relationships with TreviPay, Super Dispatch and RX Savings Solutions.

“Crux’s growth-focused business approach aligns perfectly with our vision for the founders we work with every day,” said Keith Harrington, co-founder and chief operating officer of Novel Capital alongside fellow serial entrepreneur Carlos Antequera. “At Novel, we’ve funded more than 150 entrepreneurs with more than $100 million, fueling their growth and helping them deliver on their ambitions. By removing the barrier to entry for reliable financing and strategic marketing through this partnership, we are giving founders an alternative to banks and VCs as well as the chance to build something bigger than they ever imagined.”

Crux’s exclusive marketing services partnership with Novel Capital has already begun with both companies working together to identify high-growth enterprise SaaS and tech clients who would benefit from financed marketing services.

Featured Business

2025 Startups to Watch

stats here

Related Posts on Startland News

7 endearing facts about the founder of H&R Block

Update: Henry Bloch passed away April 23, 2019. Click here to read business leaders’ salutes to the Kansas City icon. Henry Bloch, the co-founder and former CEO of tax prep giant H&R Block, recently spoke with a small group of Kansas City entrepreneurs during Startup Grind. The 93-year-old Kansas City legend shared an array of…

Events Preview: SEMPO Cities, IoT Launch

There are a boatload of entrepreneurial events hosted in Kansas City on a weekly basis. Whether you’re an entrepreneur, investor, supporter or curious Kansas Citian, we’d recommend these upcoming events for you. WEEKLY EVENT PREVIEW SEMPO Cities Kansas City When: October 29 @ 12:00 pm – 7:00 pm Where: Sprint Accelerator We’re excited to announce that…

High-profile judges for Kauffman contest includes Marcelo Claure, VCs

A star-studded lineup of businesspeople from around the nation will be judging 15 startups in the Kauffman Foundation’s One in a Million pitch contest. The competition, which will take place on Nov. 17 and 18 during Global Entrepreneurship Week, will award $10,000 to one startup that previously participated in the foundation’s 1 Million Cups program. Those evaluating…

5 takeaways from Midwest tech investment report

Lead Bank and investment research firm CB Insights recently analyzed the Midwest tech investing scene and distilled their findings into a report. The nearly 40-page report looks at investment trends, performance, major players and more. Here are five takeaways from the report. 1) The Midwest accounted for a small piece of the national tech investment…