Novel Capital teams with Crux KC to offer growth-focused marketing to early-stage tech companies

March 31, 2025 | Startland News Staff

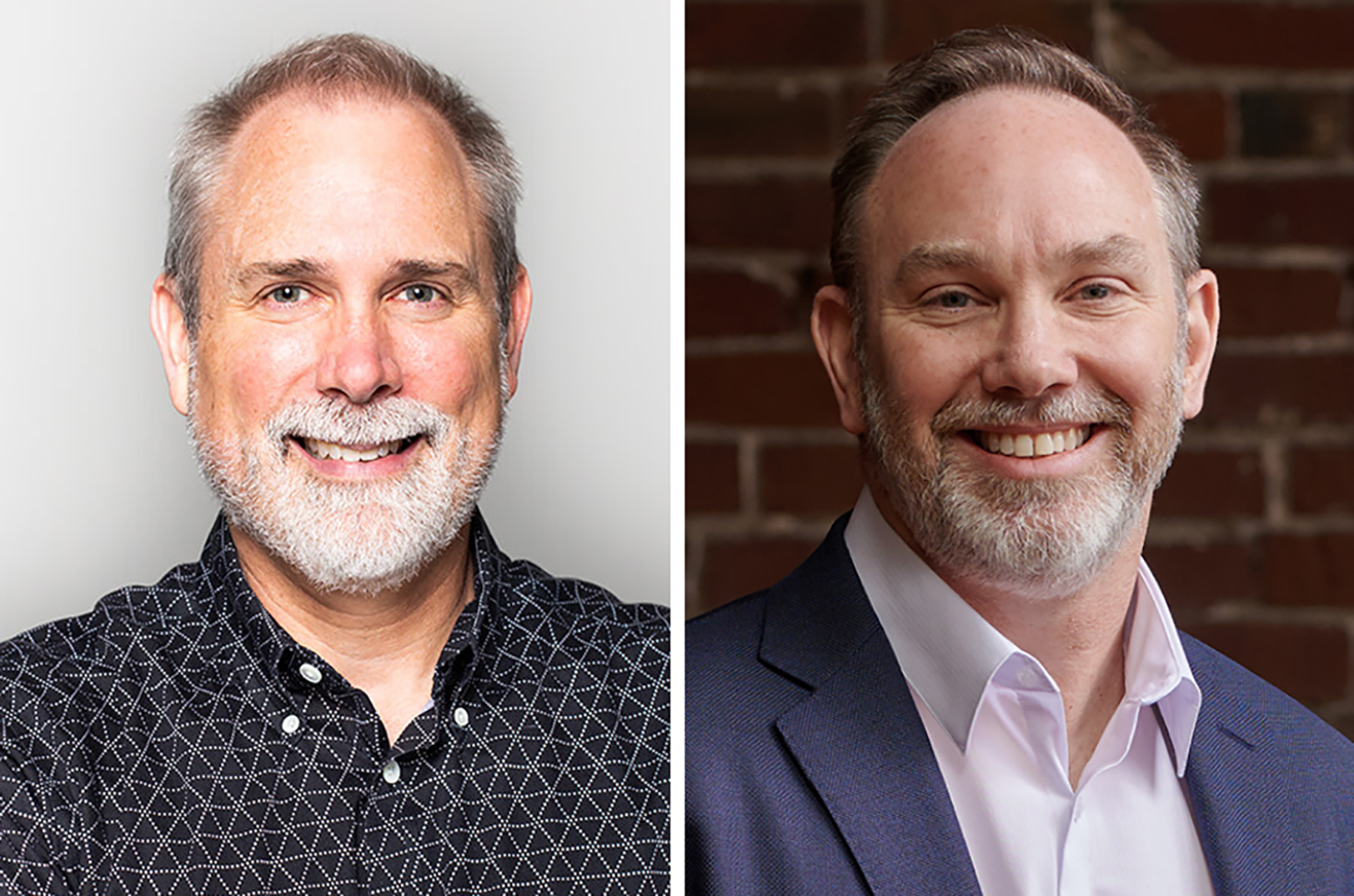

An exclusive partnership between two Kansas City-based innovators is expected to help remove a traditional financial hurdle to business growth, said Ethan Whitehill, president and chief strategy officer for the KC Chamber-lauded marketing firm Crux KC.

The collaboration between Crux and Overland Park-headquartered capital provider Novel Capital is expected to offer B2B SaaS and tech companies a path to non-dilutive flexible financing for essential marketing services.

“This partnership is a game changer, not only for Crux and Novel Capital, but to the entire market as a first-of-its-kind funding tool with flexible terms for marketing services and fractional chief marketer guidance,” said Whitehill. “We are excited to dive into these innovative, entrepreneurial startups and help them make smart marketing investments that establish their brand, scale marketing ops and rev up sales.”

Capital, sales development and marketing are three major challenges every tech venture faces to get their business off the ground, he continued. With Novel Capital’s simple, flexible model providing finding to early-stage SaaS companies ready to grow, and Crux’s expertise in marketing and sales, founders get the startup fuel they need to accelerate growth.

Click here to learn more about Crux’s partnership with Novel Capital, which leverages real-time data and AI to provide analytics, fundraising strategy, and non-dilutive capital to B2B SaaS and tech companies.

A three-time finalist for the Greater Kansas City Chamber of Commerce’s Small Business of the Year or “Mr. K” award, Crux’s experience in the technology-as-a-service category — offering fractional CMO services backed by a team of specialists — includes client relationships with TreviPay, Super Dispatch and RX Savings Solutions.

“Crux’s growth-focused business approach aligns perfectly with our vision for the founders we work with every day,” said Keith Harrington, co-founder and chief operating officer of Novel Capital alongside fellow serial entrepreneur Carlos Antequera. “At Novel, we’ve funded more than 150 entrepreneurs with more than $100 million, fueling their growth and helping them deliver on their ambitions. By removing the barrier to entry for reliable financing and strategic marketing through this partnership, we are giving founders an alternative to banks and VCs as well as the chance to build something bigger than they ever imagined.”

Crux’s exclusive marketing services partnership with Novel Capital has already begun with both companies working together to identify high-growth enterprise SaaS and tech clients who would benefit from financed marketing services.

Featured Business

2025 Startups to Watch

stats here

Related Posts on Startland News

Unearthing Kansas City’s startup gems (with your help)

Last week, Startland News published its Top 10 startups and four honorable mentions to watch in 2016. By and large, the piece has been well received with thousands of readers issuing kudos to startups that made the list. But as with any subjective “Top 10-whatever” list, we expected grumbles about the worthiness of the startups…

‘I’ve been breaking bureaucracies for 24 years’ Kansas City’s new CIO opens up

There’s a new hand at the helm of Kansas City innovation, and it belongs to that of Bob Bennett. A 24-year veteran of the U.S. Army, Bennett kicked off his tenure as the second-ever chief innovation officer of the City of Kansas City, Mo. on Jan. 1, taking the lead on an array of civic…

Advisors, role models and the importance of ‘champions’

“What types of support relationships do you find beneficial as a startup founder?” I asked a group of six women founders this question as part of a whiteboard conversation conducted last year by WhiteSpace Consulting and Startland News. Their answers reveal a broad range of support relationships, including one that is a must-have for every…

Crowdfunding law has changed, here’s what you need to know

Editors note: This piece was originally published Jan. 7, 2016. The Securities and Exchange Commission’s expanded rules for equity crowdfunding went into effect May 16. This past October, the SEC unveiled its final equity crowdfunding regulations set to take effect May 16. For the first time in the U.S., entrepreneurs will be able to…