Invary’s $3.5M seed round gives startup homefield advantage to rewrite the rules of cybersecurity

February 3, 2025 | Nikki Overfelt Chifalu

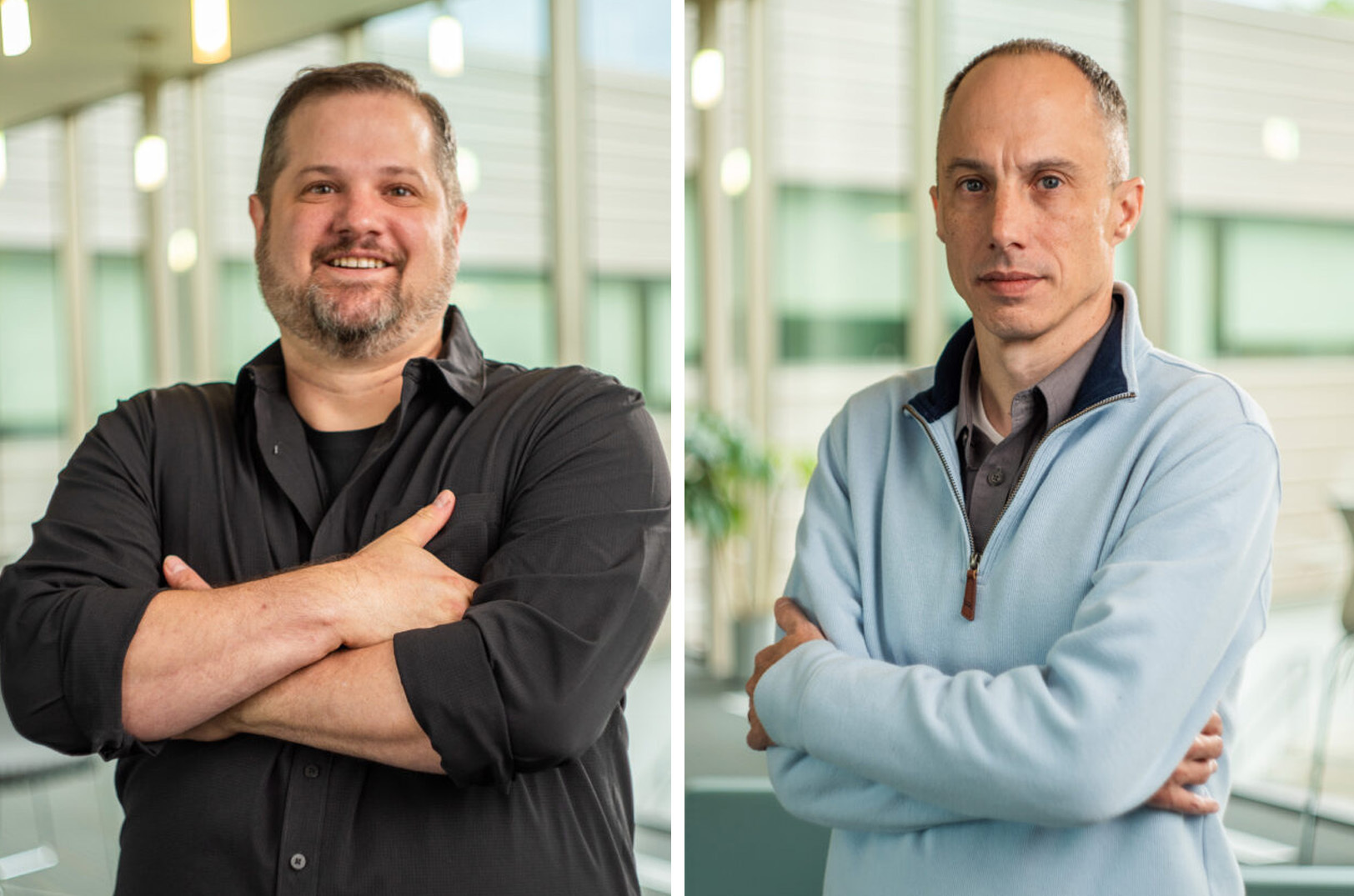

A $3.5 million seed round backed by two high-profile Kansas City funds is expected to help Invary redefine runtime security, said Jason Rogers, CEO of the Lawrence-based cybersecurity startup — making new funding headlines from within the KU Innovation Park.

Invary — a pioneer in Runtime Integrity solutions built on NSA-licensed technology — announced the round Monday, led by SineWave Ventures, Flyover Capital, Hyperlink Ventures, and KCRise Fund.

“This is great momentum for us,” Rogers said. “We are looking to continue to grow. We had a good year last year and see a lot of additional opportunities — both from the federal and the commercial space.”

One of Startland News’ Startups to Watch in 2024, Invary is leading a paradigm shift in confidential computing, the company said, bringing advanced runtime security already deployed in high-assurance federal entities to the commercial sector.

Its 2024 success included record revenue growth supporting mission critical partners, including a five-year contract to support the U.S. Navy through General Dynamics Mission Systems and work with Lockheed Martin.

RELATED: KC-based Jayhawk startups earn cut of $570K from Oread Angel Investors pitch event

The just-announced seed investments will accelerate the launch of the startup’s Windows Kernel Runtime Integrity solution and groundbreaking eBPF Runtime Integrity verification, complementing its established Linux Runtime Integrity solution, according to Invary. These offerings provide continuous state-based verification of vital layers core to security, enabling customers to detect sophisticated threats and zero-day malware that are invisible to other threat detection mechanisms.

“The funding helps accelerate that to the point we’re expecting to launch two of those new products in March,” Rogers added. “We’re seeing a lot of adoption in customers focused on their data privacy, high performance computing, AI projects into the most critical aspects of government and then the commercial space at the same time. We’re excited to be able to create a foundation of that confidential security for that broad spectrum of folks.”

“And we’re eager to push this technology out to government and commercial partners,” added Dr. Wesley Peck, CTO of Invary. “It’s a really critical technology, and will close a gap in cybersecurity that we see today. Forming this critical mass is going to be great — not just for us, but for the industry as a whole.”

By successfully validating critical government systems, Invary has demonstrated its capability to address some of the most demanding challenges in system security, noted Dan Kerr, partner at Flyover Capital, which led the startup’s $1.85 million pre-seed funding round in 2023.

“Invary is experiencing growing interest from the private sector, further fueled by its upcoming launch of Runtime Integrity for Windows,” he said in a news release. “The real-time system integrity approach pioneered by Invary has the potential to redefine how industries think about and implement security in the years ahead.”

The Flyover Capital team, Rogers shared, has been by Invary’s side even before the pre-seed round.

“They were really guiding us and giving us advice from our angel days forward,” he continued. “So we can’t say enough about the value of their support and how they’ve helped us grow over these last couple of years.”

“We’re also excited to have KCRise Fund in this round, as well,” he added. “Its team offers great coverage here in the Midwest.”

Funding from the round also is expected to help grow the Invary team, both on the technology and the go-to market side, Rogers said. The plan is to add a head of operations and fill three technology full-time positions.

“We are expanding our team and then using the expansion to both grow our customer base and our partner base, as well as our product base,” he added.

Dr. Patricia Muoio — general partner at SineWave Ventures and former chief of NSA’s Trusted Systems Group — is joining Invary’s board of directors as part of the deal.

“She just has a wealth of experience — not just in investing — but in the exact technology we’re trying to push into the commercial and government space,” Peck noted.

“It is time for enterprises to stop letting attackers dictate the rules of the game, instead capitalizing on having home-field advantage,” said Muoio in a news release. “Invary’s Runtime Integrity solution is an important technology for any enterprise looking to enhance their security posture.”

Featured Business

2025 Startups to Watch

stats here

Related Posts on Startland News

DevOpsDays brings two-day grassroots tech conference back to Kansas City

DevOpsDays KC is returning this week with an open spaces concept wherein audience members at the two-day conference vote on the topics to cover in real time, said Ryan McNair. Topics with the most votes create zones in the space in which the audience can flow freely from each area. “If you don’t like it,…

Privacy in practice: Responding to daily cyber threats sharpens Polsinelli tech team

Editor’s note: The following content is sponsored by Polsinelli PC but independently produced by Startland News. We see the fallout nearly every day. Another company, government or celebrity that’s been technologically compromised, prompting officials to scramble on how to best calm customers, citizens and stakeholders. And when you lead one of the nation’s top cybersecurity…

Pint-sized perspective: KC’s Little Hoots takes nostalgia-capturing tech to MIT

From the cute and comedic to the whimsical and wise, every parent can pinpoint a Little Hoots moment that relates to their personal adventure in child-rearing, said Lacey Ellis, founder and CEO of the Kansas City-birthed mobile app that recently turned heads at MIT. “If a picture is worth a thousand words, a hoot is…

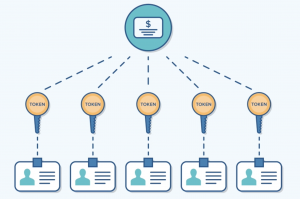

LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement. “The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for…