C2FO hits its first billion-dollar day; marks $400B in funding to customers as global finance shifts

January 14, 2025 | Startland News Staff

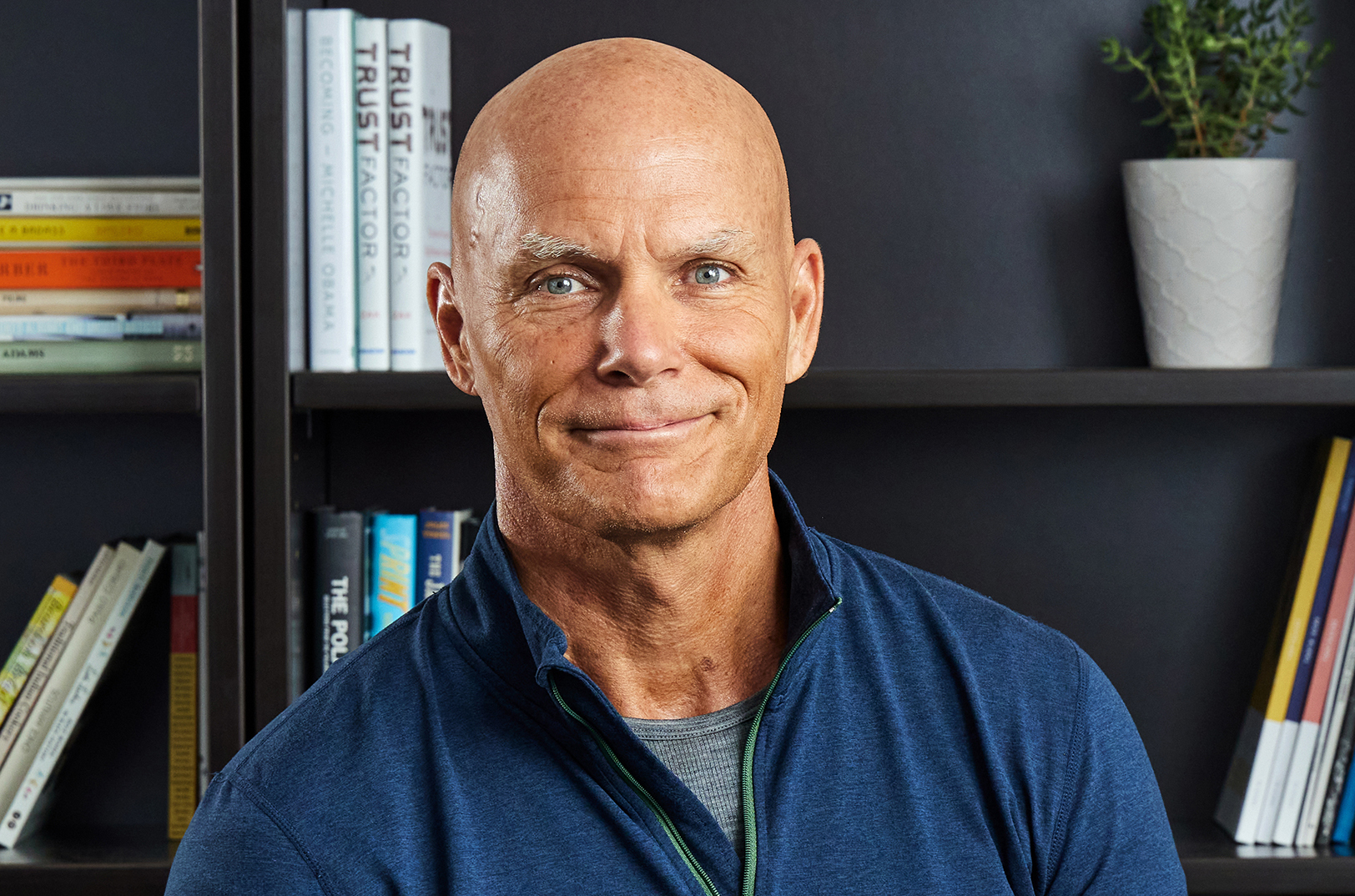

A record-breaking year for C2FO serves as a proof point itself, said Sandy Kemper, revealing the Kansas City-built fintech surpassed $400 billion in lifetime funding to its customers in 2024 and achieved $1 billion of daily funding for the first time.

“The success of the past year only demonstrates the tremendous need for more efficient and affordable capital and the need to unlock the trillions of dollars of trapped cash that still exists,” said Kemper, founder and CEO of C2FO, an on-demand working capital platform, providing fast, flexible and equitable access to low-cost capital to businesses worldwide.

“Now, we are even more determined to take this great momentum into the new year of 2025,” he added.

The just-announced milestones reflect a significant shift in the business financing landscape, with companies increasingly seeking more effective sources of financing as they move away from relying solely on banking and credit-based lending for working capital, he said.

In 2024, C2FO facilitated the early payment of more than 42 million invoices, which were paid an average of 32 days early to the companies comprising the supply chains of more than 200 of C2FO’s global enterprise clients, including six of the Fortune 10 companies, according to the company.

The demand for alternative sources of working capital shows no signs of slowing after years of exponential growth for C2FO, which was founded in 2008 to help companies of all sizes, from early-stage, fast-growth companies to established mainstream businesses, quickly access low-cost capital by offering their own discount rates for early payment and reduce the barriers of traditional lending, including risk-based underwriting, personal guarantees and high interest rates.

The fintech reached $400 billion in accelerated funding just over a year after surpassing $300 billion in funding in July 2023.

Reliable sources of working capital continue to be an issue for small businesses, the company said, citing loan approval rates for small businesses from large banks falling below 50 percent for the fourth consecutive quarter and saw a continued decline throughout 2024, according to results from the Small Business Lending Survey released by the Federal Reserve Bank of Kansas City in December.

At the same time, businesses have to contend with longer payment terms. In an analysis of nearly $2 trillion in accounts payable reviewed by C2FO, the average time it takes to be paid increased from 34 days in 2019 to 41 days today.

As a result, government agencies and international forums, like the G20, B20, United Nations and the International Finance Corporation (IFC), a member of the World Bank Group, are increasingly recognizing the need for more sustainable and innovative ways to facilitate working capital through platforms such as C2FO in recent policy papers and forums.

In May 2024, the company announced its first nationwide platform with the launch of C2treds, becoming the first U.S.-based fintech to be approved by the Reserve Bank of India (RBI) to facilitate payments through the Trade Receivables Discounting System (TReDS) for the financing and discounting of trade receivables of midsize and small enterprises (MSMEs).

“India, in particular, is an extraordinary country; it’s a global leader and is only going to increase its global leadership,” Kemper told Startland News previously. “They have a wonderful population and rising birth rate; that means a lot of young people who need jobs. In fact, they need 100 million new jobs created between now and 2030. The only way you’re going to do that is by creating more capital flow for small businesses.”

Sandy Kemper, C2FO, stands alongside IFC officials during a signing event for the organization’s new strategic partnership; photo courtesy of C2FO

In October, IFC announced plans to partner with C2FO to launch the first nationwide working capital platform for MSMEs in Africa later in 2025. The program’s impact is estimated to unlock as much as $25 billion in annual financing for MSMEs. IFC has estimated that for every $1 million of working capital made available in developing countries,16 new jobs are created over two years.

“It has been a great four months for the team and for the hundreds of thousands of customers we serve,” said Kemper. “We produced record profitability in September, signed our global partnership with IFC in October, celebrated our first day above $900 million in funding in November — then to end the year by crossing over $1 billion in daily funding in December and to see a strong increase in profitability over September was an amazing capstone to a fantastic year.”

2025 Startups to Watch

stats here

Related Posts on Startland News

Pure Pitch Rally passes $1 million in prizes; FastDemocracy and TheraWe lead winners

A quick-paced pitch competition Wednesday saw big wins for political tracking startup FastDemocracy and child therapy resource TheraWe Connect, with more than $1 million in prizes awarded between 10 young companies. “Our sponsors felt a funding head-rush like a speeding train — throwing money everywhere,” said Michael Williamson, an IP attorney for Polsinelli, one of…

Be fearlessly honest about diversity gap, Atlanta expert tells KC Techweek panelists (Photos)

Building an inclusive startup community begins with being unafraid to directly state the problem — a diversity gap — free of coded language related to race and gender, said Rodney Sampson. “I am unapologetically about being ‘color-brave’ and ‘race-brave’ — rather than being ‘color blind’ — because when you say ‘color blind,’ you’re saying you…

Hunting access to capital? Do your homework first, Techweek panel says

Imagining overnight startup success is as unrealistic as wanting to become a winning athlete or megastar musician overnight — it all takes time and practice, said Juan Campos. “If you actually have the ambition to create a multimillion dollar company, then the people that are the most successful at that didn’t just wake up one…

Real estate tech firm RealQuantum moving from bootcamp to LaunchKC stage

Lacking the sex appeal of tech and other high-growth, super-charged industries, the world of commercial real estate is ripe for change, said Jeff Weiner. LaunchKC competitor RealQuantum is ready to modernize that landscape, he said. “Serving a critical need that doesn’t really get a lot of attention is a really smart place to be and…