C2FO hits its first billion-dollar day; marks $400B in funding to customers as global finance shifts

January 14, 2025 | Startland News Staff

A record-breaking year for C2FO serves as a proof point itself, said Sandy Kemper, revealing the Kansas City-built fintech surpassed $400 billion in lifetime funding to its customers in 2024 and achieved $1 billion of daily funding for the first time.

“The success of the past year only demonstrates the tremendous need for more efficient and affordable capital and the need to unlock the trillions of dollars of trapped cash that still exists,” said Kemper, founder and CEO of C2FO, an on-demand working capital platform, providing fast, flexible and equitable access to low-cost capital to businesses worldwide.

“Now, we are even more determined to take this great momentum into the new year of 2025,” he added.

The just-announced milestones reflect a significant shift in the business financing landscape, with companies increasingly seeking more effective sources of financing as they move away from relying solely on banking and credit-based lending for working capital, he said.

In 2024, C2FO facilitated the early payment of more than 42 million invoices, which were paid an average of 32 days early to the companies comprising the supply chains of more than 200 of C2FO’s global enterprise clients, including six of the Fortune 10 companies, according to the company.

The demand for alternative sources of working capital shows no signs of slowing after years of exponential growth for C2FO, which was founded in 2008 to help companies of all sizes, from early-stage, fast-growth companies to established mainstream businesses, quickly access low-cost capital by offering their own discount rates for early payment and reduce the barriers of traditional lending, including risk-based underwriting, personal guarantees and high interest rates.

The fintech reached $400 billion in accelerated funding just over a year after surpassing $300 billion in funding in July 2023.

Reliable sources of working capital continue to be an issue for small businesses, the company said, citing loan approval rates for small businesses from large banks falling below 50 percent for the fourth consecutive quarter and saw a continued decline throughout 2024, according to results from the Small Business Lending Survey released by the Federal Reserve Bank of Kansas City in December.

At the same time, businesses have to contend with longer payment terms. In an analysis of nearly $2 trillion in accounts payable reviewed by C2FO, the average time it takes to be paid increased from 34 days in 2019 to 41 days today.

As a result, government agencies and international forums, like the G20, B20, United Nations and the International Finance Corporation (IFC), a member of the World Bank Group, are increasingly recognizing the need for more sustainable and innovative ways to facilitate working capital through platforms such as C2FO in recent policy papers and forums.

In May 2024, the company announced its first nationwide platform with the launch of C2treds, becoming the first U.S.-based fintech to be approved by the Reserve Bank of India (RBI) to facilitate payments through the Trade Receivables Discounting System (TReDS) for the financing and discounting of trade receivables of midsize and small enterprises (MSMEs).

“India, in particular, is an extraordinary country; it’s a global leader and is only going to increase its global leadership,” Kemper told Startland News previously. “They have a wonderful population and rising birth rate; that means a lot of young people who need jobs. In fact, they need 100 million new jobs created between now and 2030. The only way you’re going to do that is by creating more capital flow for small businesses.”

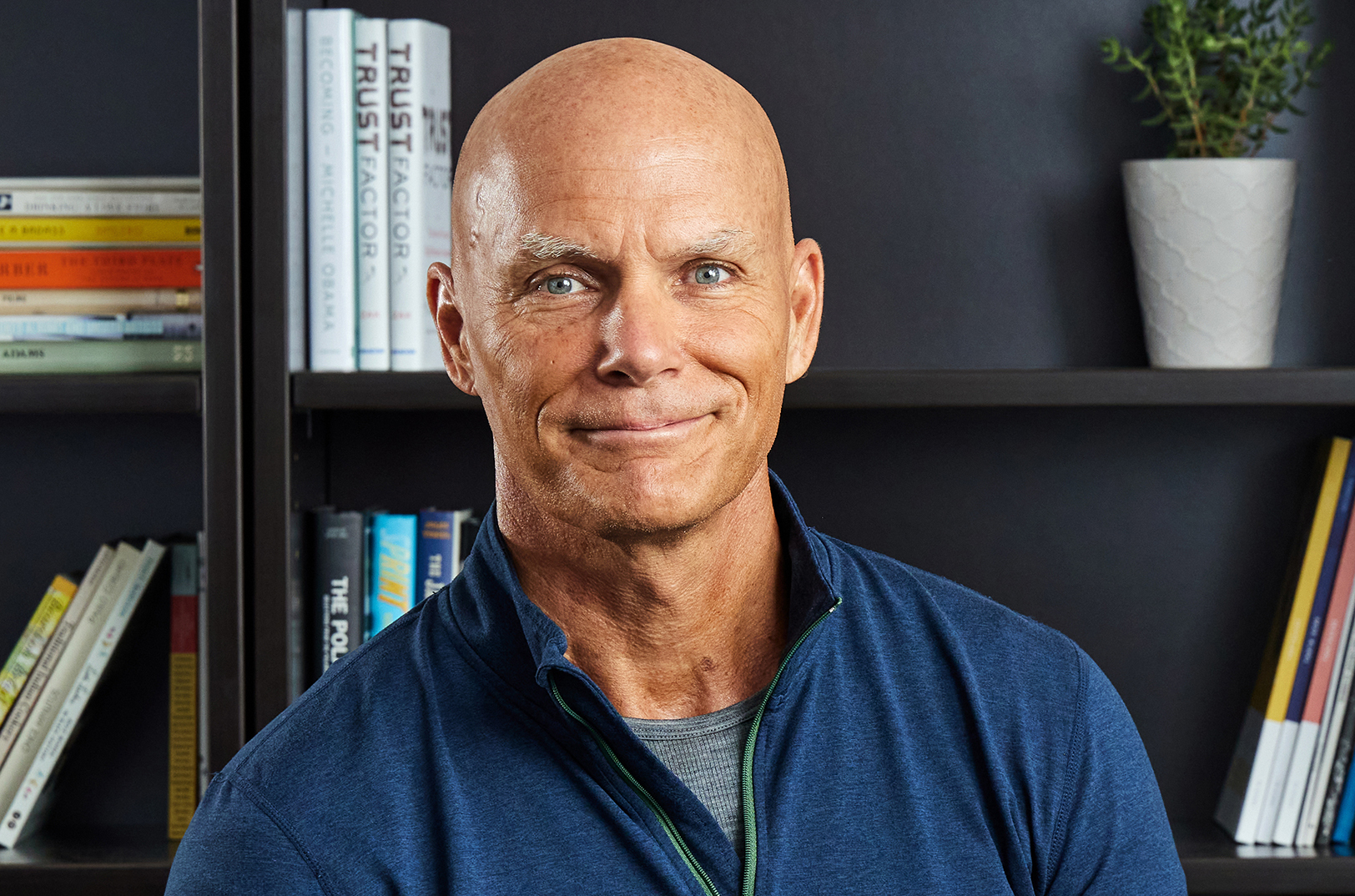

Sandy Kemper, C2FO, stands alongside IFC officials during a signing event for the organization’s new strategic partnership; photo courtesy of C2FO

In October, IFC announced plans to partner with C2FO to launch the first nationwide working capital platform for MSMEs in Africa later in 2025. The program’s impact is estimated to unlock as much as $25 billion in annual financing for MSMEs. IFC has estimated that for every $1 million of working capital made available in developing countries,16 new jobs are created over two years.

“It has been a great four months for the team and for the hundreds of thousands of customers we serve,” said Kemper. “We produced record profitability in September, signed our global partnership with IFC in October, celebrated our first day above $900 million in funding in November — then to end the year by crossing over $1 billion in daily funding in December and to see a strong increase in profitability over September was an amazing capstone to a fantastic year.”

2025 Startups to Watch

stats here

Related Posts on Startland News

Rx Savings secures $18.4M funding round, nears 2 million members

An $18.4 million funding round is the prescription Rx Savings Solutions needs to expand its fight against a crippling, yet common ailment, said Michael Rea. “Everyone in the nation has the same problem — high drug costs — and most people don’t know there are options to save money,” said Rea, founder and chief executive…

Before prime time: Did Amazon’s 1999 arrival in Kansas deliver on hype?

In 1999, Amazon — still in its infancy — meant only two things to most consumers: low-priced books and CDs. But for one small town in Kansas, residents believed the online retailer had the potential to be a game-changer for their economically depressed, rural community. “People in Coffeyville were practically doing cartwheels in the streets,” said…

FCC head: Repealing net neutrality will boost innovation, investment; startups disagree

The Federal Communications Commission is preparing to eliminate regulatory rules that prohibit internet service providers from interfering with consumers’ access to web content. FCC chairman Ajit Pai announced in a Wall Street Journal op-ed that the regulatory body will vote Dec. 14 to repeal 2015 Obama-era regulations. That regulatory model, referred to as Title II,…

Bitten by Disney sharks, Roy Scott beats the odds with Healthy Hip Hop

When a potentially life-altering business deal suddenly vanished, Roy Scott didn’t get mad — he got funded. “Disney thought they were going to snuff us out, but all they did was put gasoline on this fire,” said Scott, founder of Kansas City-based H3 Enterprises (Healthy Hip Hop). Rewind. Starting his company with a live performance-based…