Missouri lawmaker urges SBA change to ease access to federal funds for digital tools

December 4, 2024 | Startland Staff

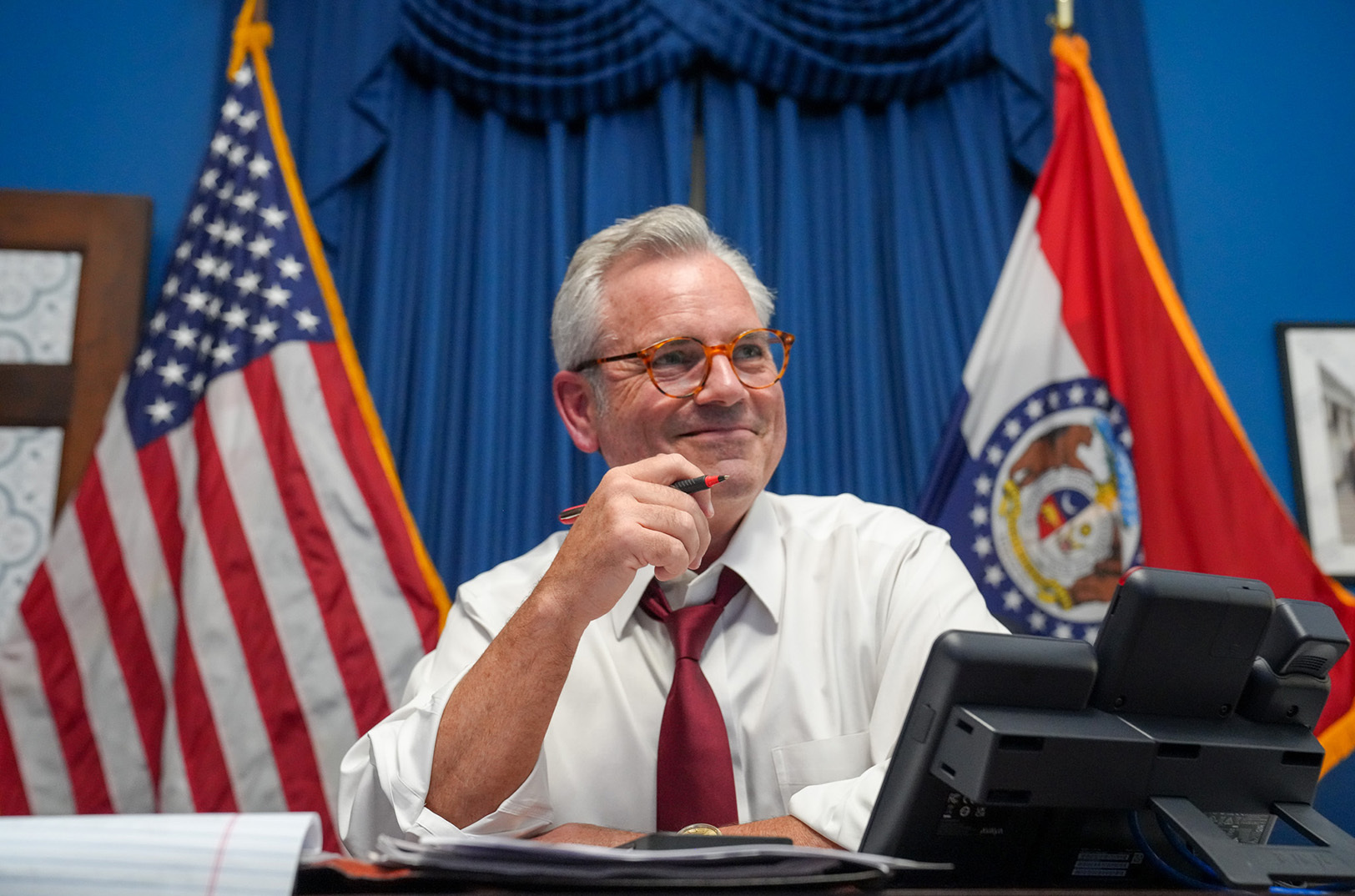

Government red tape is getting in the way of entrepreneurs’ ability to compete, said Mark Alford, detailing his efforts in Washington, D.C. to ensure affordable, equitable access to and use of “digital technologies” — especially when the federal government is involved, he added.

“Small businesses are the fabric of America, driving innovation and growth,” said U.S. Rep. Alford, R- Missouri, introducing a bill this week that would clarify Small Business Administration rules to allow SBA 7(a) loan funds to be used for digital tools and services.

“This legislation provides clarity and support for small businesses to embrace digital tools, enhancing their competitiveness in a rapidly evolving global market,” he continued, noting that small businesses that incorporate more technology platforms into their operations are more likely to have seen growth in their sales, profits, and employment since 2020.

Their success could hinge on eliminating barriers to digital adoption by updating federal relief programs, grant programs, and lending programs to include digital tools as an allowable use of funds, providing parity with the Economic Aid Act, his office said.

Click here to read the text of Alfords’ Small Business Technological Advancement Act.

Alford, who represents Missouri’s Fourth Congressional District in the U.S. House, serves on the Agriculture Committee, the Armed Services Committee, and the Small Business Committee.

“Fintech is the financial tool of choice for millions of American small businesses and startups, helping them access capital, streamline accounting, and manage complex expenses, inventory, and payroll,” said Penny Lee, president and CEO of the Financial Technology Association, a trade group representing fintech industry leaders. “We applaud Congressman Mark Alford for introducing commonsense legislation that would make it easier for small businesses to benefit from these innovative technological tools.”

2024 Startups to Watch

stats here

Related Posts on Startland News

PMI Rate Pro pivots to tech solutions firm as pricing tool integrates with mortgage software solution

The mortgage industry is lagging behind in the current world of technology, Nomi Smith said; but PMI Rate Pro is innovating to become a one-stop shop for private mortgage insurance (PMI). “We began as a quoting service, so we developed an API (application programming interface) supporting another API. But we quickly realized that there needed…

Popular airport vending machines stocked with local maker goods won’t make the move to new terminal

When Kansas City’s new terminal opens Feb. 28 — booked full of local brands — a retail startup that weathered nearly a decade (and a pandemic that grounded much of the nation’s air travel) at the airport won’t be among those selling KC goods at the new shopping destination, its founders announced this week. SouveNEAR…

Cost of victory: Potential Super Bowl parade would bring hefty price tag to KCMO

Editor’s note: The following story was originally published by CityScene KC, an online news source focused on Greater Downtown Kansas City. Click here to read the original story or here to sign up for the weekly CityScene KC email review. Being a successful NFL city doesn’t come cheap. The estimated cost to city taxpayers for a hoped-for Feb. 15…