Missouri lawmaker urges SBA change to ease access to federal funds for digital tools

December 4, 2024 | Startland Staff

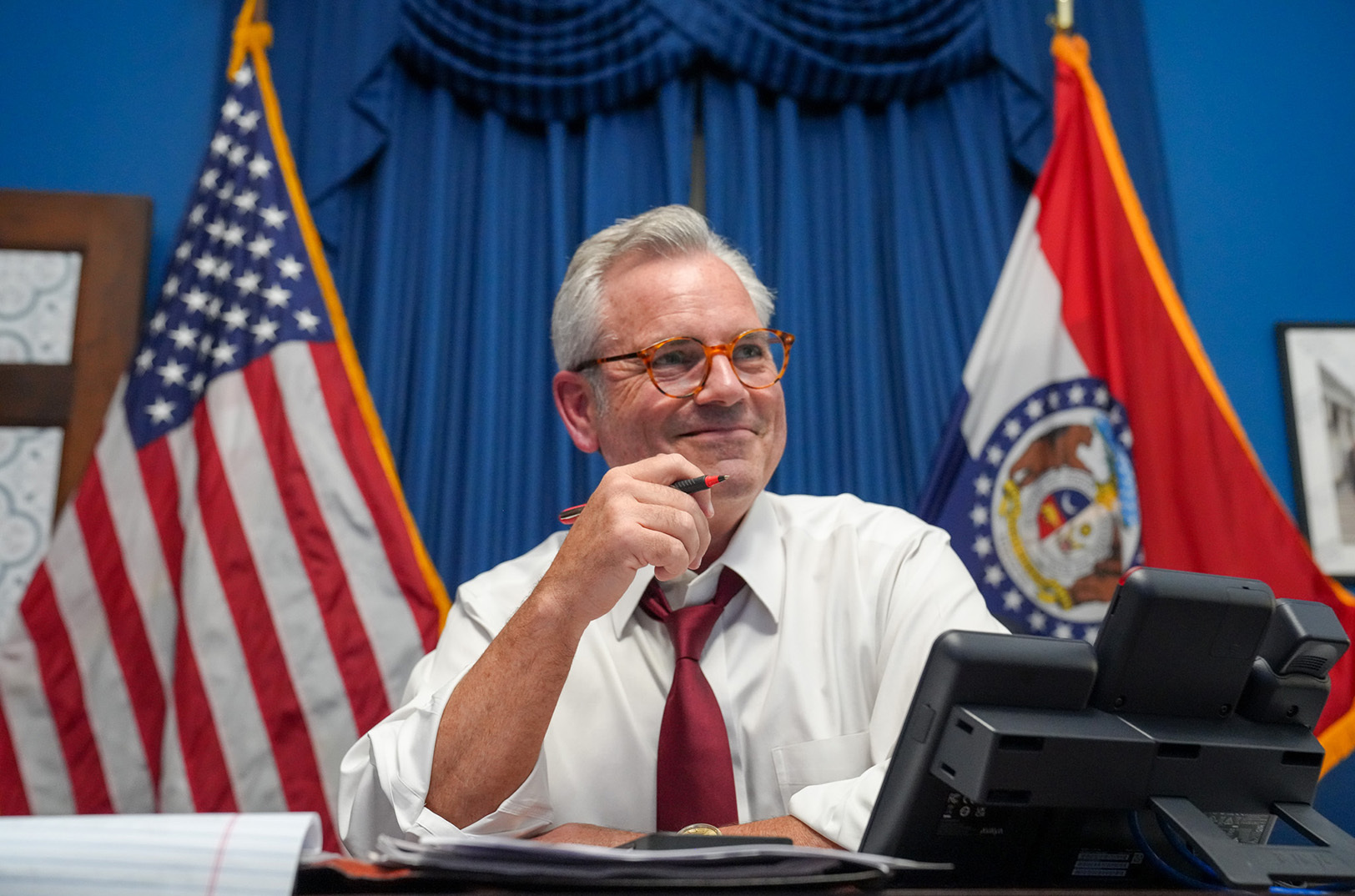

Government red tape is getting in the way of entrepreneurs’ ability to compete, said Mark Alford, detailing his efforts in Washington, D.C. to ensure affordable, equitable access to and use of “digital technologies” — especially when the federal government is involved, he added.

“Small businesses are the fabric of America, driving innovation and growth,” said U.S. Rep. Alford, R- Missouri, introducing a bill this week that would clarify Small Business Administration rules to allow SBA 7(a) loan funds to be used for digital tools and services.

“This legislation provides clarity and support for small businesses to embrace digital tools, enhancing their competitiveness in a rapidly evolving global market,” he continued, noting that small businesses that incorporate more technology platforms into their operations are more likely to have seen growth in their sales, profits, and employment since 2020.

Their success could hinge on eliminating barriers to digital adoption by updating federal relief programs, grant programs, and lending programs to include digital tools as an allowable use of funds, providing parity with the Economic Aid Act, his office said.

Click here to read the text of Alfords’ Small Business Technological Advancement Act.

Alford, who represents Missouri’s Fourth Congressional District in the U.S. House, serves on the Agriculture Committee, the Armed Services Committee, and the Small Business Committee.

“Fintech is the financial tool of choice for millions of American small businesses and startups, helping them access capital, streamline accounting, and manage complex expenses, inventory, and payroll,” said Penny Lee, president and CEO of the Financial Technology Association, a trade group representing fintech industry leaders. “We applaud Congressman Mark Alford for introducing commonsense legislation that would make it easier for small businesses to benefit from these innovative technological tools.”

2024 Startups to Watch

stats here

Related Posts on Startland News

No time for risks or red flags: Why this fund backs ‘unbankable’ businesses in WYCO’s investment desert

This story is possible thanks to Entrepreneurial Growth Ventures (EGV), a business unit of NetWork Kansas supporting innovative, high-growth entrepreneurs in the State of Kansas. A partnership between NetWork Kansas and the Wyandotte Economic Development Council is providing minority entrepreneurs in Wyandotte County with loans and technical assistance to get their business ideas off the ground.…

Company boosted by Topeka becomes capital city’s latest Plug and Play corporate partner

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. TOPEKA — Plug and Play Topeka announced this week the addition of Bimini Pet Health as a new corporate partner of the Topeka-based animal health accelerator — a move expected…

NFL Draft arrives in Kansas City: Here’s what you need to know

Editor’s note: This story was originally published by The Kansas City Beacon, a member of the KC Media Collective, which also includes Startland News, KCUR 89.3, American Public Square, Kansas City PBS/Flatland, and Missouri Business Alert. Click here to read the original story from The Kansas City Beacon, an online news outlet focused on local, in-depth journalism…

Kin crafts flavor into hard seltzer market, targeting overlooked Black consumers looking for authentic social experiences

The founding trio of a new hard seltzer crafted in Kansas City hopes the drink will add much-needed inclusivity to the craft seltzer space. Kin Seltzer is a collaboration between Joshua Lewis and Kearra Johnson of UpDown Nightlife, and Eric Martens of Border Brewing Company. Currently, leading seltzer brands target their marketing predominantly to white…