Missouri lawmaker urges SBA change to ease access to federal funds for digital tools

December 4, 2024 | Startland Staff

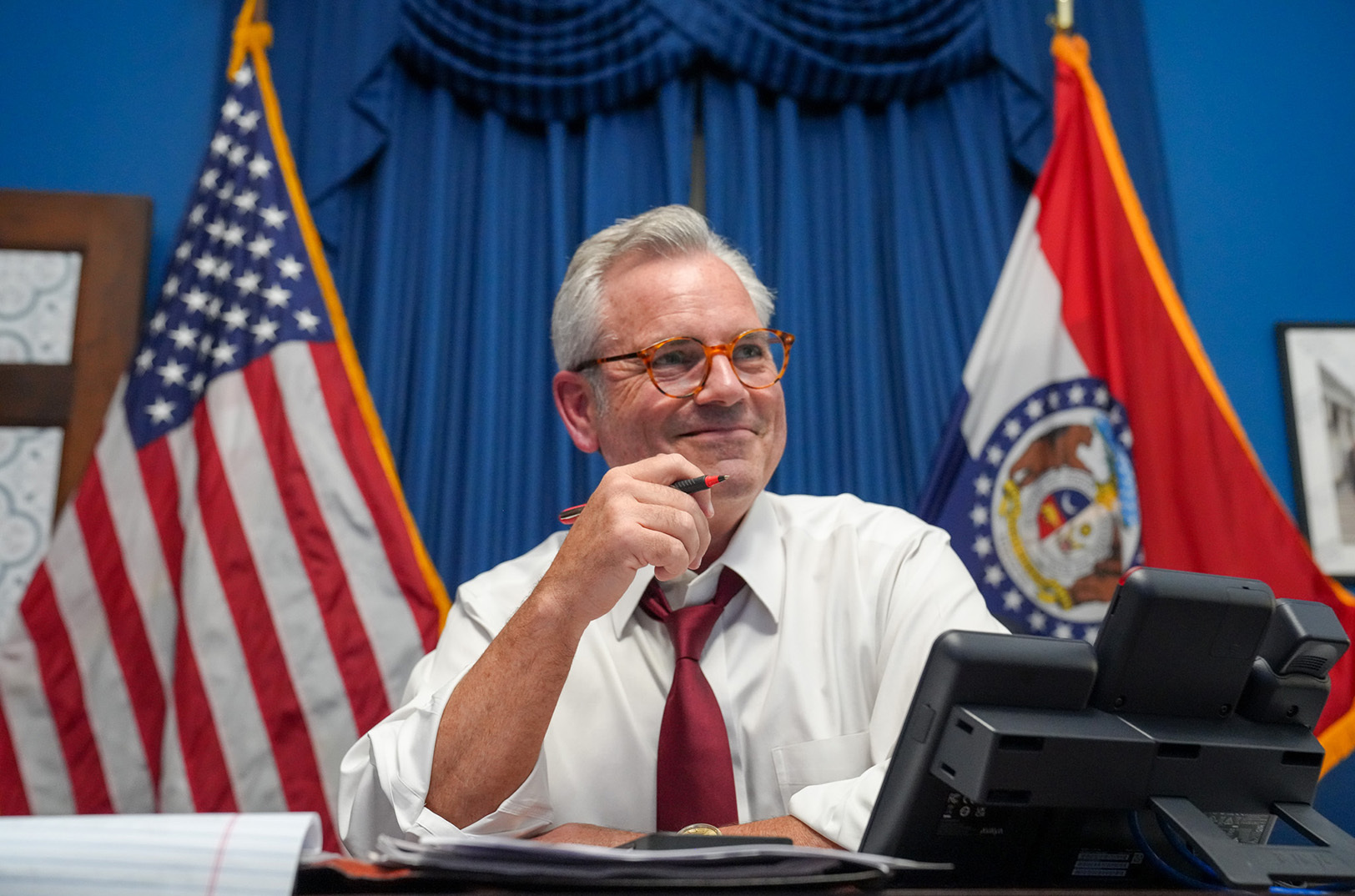

Government red tape is getting in the way of entrepreneurs’ ability to compete, said Mark Alford, detailing his efforts in Washington, D.C. to ensure affordable, equitable access to and use of “digital technologies” — especially when the federal government is involved, he added.

“Small businesses are the fabric of America, driving innovation and growth,” said U.S. Rep. Alford, R- Missouri, introducing a bill this week that would clarify Small Business Administration rules to allow SBA 7(a) loan funds to be used for digital tools and services.

“This legislation provides clarity and support for small businesses to embrace digital tools, enhancing their competitiveness in a rapidly evolving global market,” he continued, noting that small businesses that incorporate more technology platforms into their operations are more likely to have seen growth in their sales, profits, and employment since 2020.

Their success could hinge on eliminating barriers to digital adoption by updating federal relief programs, grant programs, and lending programs to include digital tools as an allowable use of funds, providing parity with the Economic Aid Act, his office said.

Click here to read the text of Alfords’ Small Business Technological Advancement Act.

Alford, who represents Missouri’s Fourth Congressional District in the U.S. House, serves on the Agriculture Committee, the Armed Services Committee, and the Small Business Committee.

“Fintech is the financial tool of choice for millions of American small businesses and startups, helping them access capital, streamline accounting, and manage complex expenses, inventory, and payroll,” said Penny Lee, president and CEO of the Financial Technology Association, a trade group representing fintech industry leaders. “We applaud Congressman Mark Alford for introducing commonsense legislation that would make it easier for small businesses to benefit from these innovative technological tools.”

2024 Startups to Watch

stats here

Related Posts on Startland News

KC’s Smart City ‘Living Lab’ to tackle domestic terrorism threats

Since 2013, more than 160 active shooter situations have taken place in the United States. Imagine for a moment if those events could be prevented or mitigated through the use of technology, such as drones, social media analysis and other sensors. That future is closer than ever according to leaders of Kansas City’s Smart City…

A vibrant arts culture leads to innovation and why hometown investors are vital

Here’s this week’s dish on why the arts community shouldn’t be a benched player on the sidelines of a city’s economy game; the importance of hometown investors to thriving startup communities; and what universities are doing to keep the talent pipeline strong for an entrepreneurial future. Check out more in this series here. The Atlantic…

ClaimKit snags $1.8M from local VC Flyover Capital

Insurance tech startup ClaimKit is tapping an area venture capital fund to help launch its second software offering that quickly analyzes policies. The company raised $1.8 million to launch RiskGenius, which helps to identify and categorize insurance clauses in commercial policies. Leawood-based venture capital firm Flyover Capital led the round, which included participation from the…

Arredondo: The Economist documentary, recent press great for Kansas City

It’s no secret that I’m a total homer for Kansas City. I truly believe that we have the opportunity and ability to become a world-class, 21st-century city. With that being said, I’ve been known to hyperbolize when it comes to the promise I see in Kansas City. But recently, our city has sold itself with…