Travois receives $35M in tax credits to boost economic development in Native communities

October 23, 2024 | Startland News Staff

A fresh tranche of new markets tax credits is expected to help Crossroads-based Travois support the funding of projects in Native spaces, like school facilities and health clinics, said Phil Glynn.

“New markets tax credits are an essential tool for filling funding gaps for projects in places with the greatest need,” said Glynn, president of Travois, which received $35 million in tax credits to assist with funding such development projects efforts.

For the second consecutive year, the U.S. Department of the Treasury allocated tax credits for Travois New Markets, a nationally certified Community Development Entity (CDE) in Kansas City, Missouri. Tribal governments and organizations that partner with Travois can use new markets tax credits (NMTCs) to help finance various projects, including school facilities, for-profit businesses, public infrastructure, health clinics, and more.

“We applaud Tribal leaders around the country who have advocated for greater access to NMTCs in Native communities,” Glynn added. “We look forward to financing projects that create jobs, treat patients, educate students, provide groceries, and many other important services.”

Travois is a Certified B Corporation focused exclusively on promoting housing and economic development for American Indian, Alaska Native, and Native Hawaiian communities.

Since 1995, Travois has brought investor equity to more than 260 developments in 23 states through the Low Income Housing Tax Credit (LIHTC) program and the NMTC program, making an impact of more than $2 billion across Indian Country.

NMTCs are allocated by the Community Development Financial Institutions (CDFI) Fund, a division of the U.S. Department of Treasury, to qualified CDEs. CDEs are private companies that finance economic development projects in low-income communities.

Travois New Markets was the only CDE focused exclusively on supporting Native communities to receive an allocation during the latest funding round. It is currently seeking Tribal economic development projects eligible to use NMTCs.

Last year, three Native-focused CDEs, including Travois New Markets, Chickasaw Nation Community Development Endeavor, and Native American Bank, received a combined $150 million in NMTCs.

Already, last year’s allocations are creating a meaningful impact, Travois said in a press release.

The Confederated Tribes of the Colville Reservation recently used NMTCs from Native American Bank, Chickasaw Nation Community Development Endeavor, and Clearinghouse CDFI to assist in financing a $36 million health clinic in Omak, Washington. Travois New Markets helped to facilitate this closing, and US Bank Impact Finance provided the NMTC equity investment.

“Tribal organizations have a proven track record of using New Markets Tax Credits to help fund community-focused projects,” said Michael Bland, director of community investments at Travois. “From health clinics to schools to infrastructure, these projects will make a huge difference in the lives of the people they serve for years to come.”

2024 Startups to Watch

stats here

Related Posts on Startland News

Pint-sized perspective: KC’s Little Hoots takes nostalgia-capturing tech to MIT

From the cute and comedic to the whimsical and wise, every parent can pinpoint a Little Hoots moment that relates to their personal adventure in child-rearing, said Lacey Ellis, founder and CEO of the Kansas City-birthed mobile app that recently turned heads at MIT. “If a picture is worth a thousand words, a hoot is…

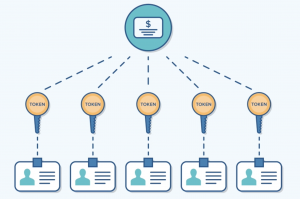

LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement. “The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for…

Sickweather forecasts flu trouble ahead, urges handwashing and vaccinations

Sickweather’s illness forecasting technology points to a seasonal uptick in influenza rates for Kansas City, said Laurel Edelman, noting a particularly rough patch expected at the end of year. “We actually see more of a dome here in Kansas City,” said Edelman, the chief revenue officer for Sickweather, referring to a chart that plots expected…

Techstars hacks into expert minds for visions of a future dominated by robotics

A Fourth Industrial Revolution is unfolding as consumers and the tech industry alike watch with bated breath, Karen Kerr told a crowd of Techstars Kansas City attendees. “Two things are happening,” Kerr, senior managing director with GE Ventures explained during a panel Thursday that explored the future of the robotics and manufacturing industries. “We’re able…