M25 rankings: Startup hubs are slowing; why KC could be losing ground to Midwest neighbors

August 13, 2024 | Tommy Felts

Kansas City’s startup scene is walking a fine line between flat and stagnant, said Victor Gutwein, teasing caution and other insights into KC’s No. 11 ranking — a position it’s held since 2022 — on M25’s latest Midwest startup cities list.

“We’re seeing fewer startups (registered in our datasource Pitchbook) than we used to in Kansas City — and that’s worrying,” said Gutwein, founder and managing partner at M25, an influential early-stage venture firm based in Chicago.

Missing from the news: Headlines from Kansas City with hefty multi-million-dollar funding rounds, he noted, with only Sailes’ $5.1 million round (with regional investors KCRise Fund and Tenzing Capital) making a dent.

“Anecdotally at M25, we’ve seen a decrease in startup deal flow from the KC metro region,” he added. “That’s not something to be crazy concerned about — things can come and go in waves and we are also a small/biased sample — but if it continues for multiple years it will be a concerning trend.”

Click here to view the complete rankings from M25.

M25 boasts Kansas City startups SuperDispatch, Zohr, Backstitch and Whipz among its portfolio companies.

“We love investing in Kansas City,” Gutwein said. “And we want to do more.”

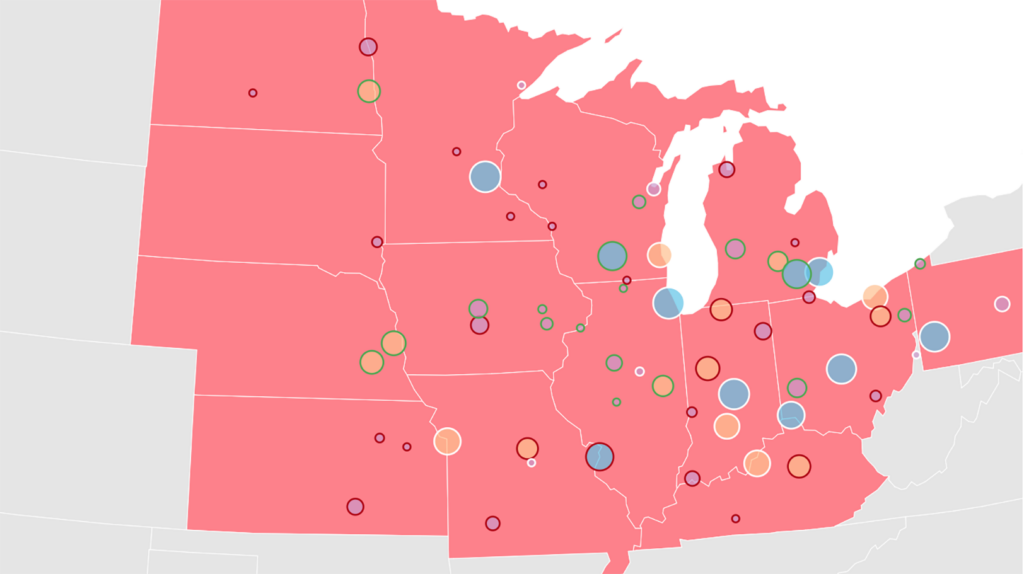

The deep-dive Best of The Midwest: Startup City Rankings report — compiled annually by the team at M25 — explores how micro-environments across the Midwest are performing relative to each other based on startup activity, access to resources, and business climate.

“In a year that saw relatively little, the Midwest still had a lot to brag about,” Gutwein said in a blog that discussed overall takeaways from the report (which shows Chicago, Minneapolis and Indianapolis continue to dominate the rankings).

“The past year has seen some lows in venture and startup funding that we haven’t seen for a while. Venture firms are on track to raise the lowest amount of capital since 2013, 38 percent of the venture funds that were actively deploying in 2022 did not make any new investments in 2023, and major startup funding announcements have slowed to a fraction of what they were in the ZIRP (zero interest-rate policy) economy,” he said. “Despite the tough macroeconomic environment of the last 12 months, we have continued to see deals get done in the Midwest that validate investor interest in what the region does best — capital efficient growth in industries that aren’t going anywhere.”

Click here to read more of Gutwein’s insights from the report.

Funding tank running low

A lack of high-dollar funding announcements or new venture funds launched the past 12 months contributed to malaise over Kansas City’s prospects in the rankings, Gutwein said.

He was, however, encouraged that Kansas City’s overall score in the report edged up slightly from 2023 (a score of 25.3 out 64.0, compared to a previous 25.0), and noted the significance of ongoing state support for startups and tech entrepreneurs from such organizations as the Missouri Technology Corporation.

Click here for a closer look at how M25’s rankings and scores are determined.

“But while we are seeing increased activity from MTC, it still pales in comparison to the volume, speed and efficiency that other direct investment programs have like Elevate Ventures in Indiana (which can be 50 percent of a round and invests on a regular cadence in several dozen Indiana startups every year and at every stage) or InvestNebraska, among others,” Gutwein said. “Not to mention Missouri doesn’t have an active angel tax credit or fund-of-funds, which other states have been actively deploying in the past few years.”

St. Louis saw more investment than Kansas City, with a handful of $10 million to $20 million rounds and one $45 million round, Gutwein said, noting its score increased from 28.4 to 28.

But that wasn’t enough to stop St. Louis’ slide in the rankings — dropping to No. 9 in 2024, down from a high of No. 5 in 2019.

“St. Louis just hasn’t kept up with the speed of other cities’ growth,” Gutwein said. “Columbus, Ann Arbor and Madison are all putting up a lot of growth in startup activity, have more VC funds raised locally and have produced more large rounds.”

Kansas City’s neighbors on the Kansas side also weren’t without criticism. Wichita, Manhattan and Topeka all saw drops in the rankings thanks to inactivity and a lack of big outcomes.

Help on the horizon?

For inspiration, Kansas City can look north to Nebraska — where No. 18 Omaha and No. 20 Lincoln both jumped two positions in the 2024 rankings.

“Both generally boast a higher-than-typical educated workforce, great startup density and Omaha has an unrivaled score for ‘big companies’ compared to any city of its size,” Gutwein said.

But tactically, what can the KC region do to make headway over the next 12 months? The M25 leader shared factors that could become gamechangers:

- Startup count — Launch more startups that get at least the first round of funding (even as little as $250,000 to $500,000; “Give them a fighting chance and get on the map.”

- Investor infusions — Attract both local and external investors to lead 10-plus rounds of $5 million or more each year; putting them on par with the cities with rankings Nos. 6-10

- Big outcomes — Raise at least one $50 million-plus round each year

“And if there’s any government/lobbying work to be done to push both states (Kansas and Missouri) to be more aggressive/competitive with other Midwest states, that would directly push up the government rankings score,” Gutwein said. “But it also indirectly increases the availability of capital and ability of KC startups to raise every round of capital (especially that first pre-seed round).”

Click here to read about Kansas City’s rankings on M25’s 2023 list.

2024 Startups to Watch

stats here

Related Posts on Startland News

MTC’s spring $1.4M investment cycle loops Facility Ally, DevStride into equity deals

Two Kansas City startups are among a handful of Missouri companies receiving a collective $1.4 million in investment allocations through a state-sponsored venture capital program. Facility Ally, led by serial entrepreneur Luke Wade; and DevStride, co-founded by Phil Reynolds, Chastin Reynolds, Aaron Saloff and Kujtim Hoxha; must now complete the Missouri Technology Corporation’s due diligence process…

Kauffman CEO: Foundation’s reset aligns Mr. K’s intent with KC’s needs of the moment

A recently announced strategy refresh for the Ewing Marion Kauffman Foundation will drive the organization’s collective impact in the community — honoring the vision of its namesake while recognizing the challenges Kansas City faces today, said Dr. DeAngela Burns-Wallace. “Mr. K had very distinct philosophies and ideas around how he wanted this work done,” explained…

Block by block: Prototype builds startup’s housing vision where everyone can afford their own castle

A mock home facade project on the grounds of Kansas City’s historic Workhouse Castle serves as a proof point for Godfrey Riddle’s rebooted Civic Saint — a social venture built on compressed earth blocks as its key to affordable, sustainable housing. “CEBs (compressed earth blocks) are great for Kansas City, because non-expansive sandy clay soil…

Resource revival: Digital Inclusion Fund relaunches with initial grants focused on devices

Kansas Citians can’t upgrade skills or devices they don’t already have, said organizers of a newly relaunched Digital Inclusion Fund — emphasizing a need to attack the metro’s digital divide at the infrastructure level. The fund is set to award up to $250,000 to 501(c)(3) public charities (including schools and churches) or governmental entities across…