Staying transaction-ready in uncertain market conditions

August 20, 2024 | Chris Malmgren

Editor’s note: The perspectives expressed in this commentary are the author’s alone. The following is a paid thought leadership piece from The Ferguson Smith Cohen Group at Morgan Stanley.

In the face of market uncertainty, one thing private companies can control is their “transaction-readiness” for an IPO or secondary offering. Discover three things a company may do to become “transaction-ready” in today’s market.

Amid global market volatility, some companies may be reconsidering planned liquidity events such as IPOs or private tender offers. In 2022, for instance, global IPO volume fell 45% from the prior year.

In the face of uncertainty, what companies can control is the degree to which they are “transaction-ready” for an IPO or secondary offering. Being proactive about transaction readiness can give a company more agency over future timing of a liquidity event, as well as minimize any delays leading up to the transaction.

If a company is thinking of going public or conducting a shareholder liquidity event in the future, here are three things it may consider to become transaction-ready:

1. Have the Right Systems in Place

Planning a large-scale liquidity event or IPO can require a lot more than preparing an up-to-date cap table, the right financial statements and information disclosures. It can also mean putting all the various compliance, corporate governance and accounting policies into place and developing a process for managing the various transacting parties.

Companies can get transaction-ready by putting the right backend systems and processes into place for an IPO or secondary offer. Particularly for an IPO, a lot of accounting, payroll and HR systems may need to work together harmoniously so that the company can capture and record public market transactions. How those systems all integrate and what the experience is like for stock plan administrators and shareholders can significantly impact the transaction timeline.

Even companies that invest in an enterprise resource planning (ERP) system or equity database may need to stress-test those systems to make sure they have everything needed for when the company ultimately goes public. The value of testing and quality assurance (QA) cannot be overestimated.

2. Focus on Data Integrity

There can be a lot of data involved in a liquidity transaction. Not only are shares are being issued or exchanged between buyers and sellers, but there may be detailed financial disclosures required for participants. Often, companies that are going public may need to provide audited financial statements as far back as two years and have the infrastructure in place to produce those statements on a quarterly basis.

Gathering all that data in one place can be a big challenge in itself and the complexity only mounts if companies need to take steps to ensure their data is accurate and reconcilable. Performing a data health check can be an important step a company can take on the path towards transaction-readiness. This includes validating everything from individual equity award and grant information to demographic data. Because all of it feeds into the transaction process, it needs to be accurate.

Remember that a third-party ERP or equity system won’t necessarily catch an inaccurate grant issuance (although a good service provider should help you perform a data health check to help diagnose any issues). Ultimately, the integrity of the underlying data for a liquidity event is the responsibility of the transacting company.

3. Design the Participant Experience

As companies get closer to the transaction execution window, a lot of focus tends to shift towards the administrator and shareholder experience. There are a lot of moving parts in a liquidity transaction; the last thing a company wants is for transaction participants to be confused or frustrated and for that to cause a delay in the transaction. If the liquidity event involves employees, it can benefit a company to focus specifically on the participant experience to ensure their employees fully understand the implications of participating (both financially and from a tax perspective).

For companies that are months or even weeks away from conducting a liquidity event, partnering with their equity service provider to test and deliver the participant experience can help mitigate unforeseen issues.

The Takeaway:

As recent years have made abundantly clear, market conditions can change very quickly. By putting the right systems infrastructure, data integrity and participant experience into place, companies may enhance their transaction readiness. Doing so can potentially provide greater control over the outcomes of their liquidity event when timing is uncertain. Implementing processes in private companies that mirror operations of public company stock plan cycles can help cut down on friction and errors when a transaction is on the horizon.

Thinking of going public or conducting a shareholder liquidity event? Morgan Stanley at Work specializes in helping companies plan and executive liquidity events. Our dedicated team focuses on helping companies prepare for the rigorous process of going public.

Disclosures:

Article by Morgan Stanley and provided courtesy of Morgan Stanley Financial Advisor.

The Ferguson Smith Cohen Group at Morgan Stanley in Leawood, KS at Morgan Stanley Smith Barney LLC (“Morgan Stanley”). They can be reached by email at chris.malmgreen@morganstanley.com or by telephone at 913-402-5243. Their website is, The Ferguson Smith Cohen Group | Leawood, KS | Morgan Stanley Wealth Management

This material may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm has not reviewed the linked site. Equally, except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm takes no responsibility for, and makes no representations or warranties whatsoever as to, the data and information contained therein. Such address or hyperlink (including addresses or hyperlinks to website material of Morgan Stanley Wealth Management) is provided solely for your convenience and information and the content of the linked site does not in any way form part of this document. Accessing such website or following such link through the material or the website of the firm shall be at your own risk and we shall have no liability arising out of, or in connection with, any such referenced website. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

Morgan Stanley at Work, Morgan Stanley Smith Barney LLC, and its affiliates and employees do not provide legal or tax advice. You should always consult with and rely on your own legal and/or tax advisors.

The Plaza Group at Mor may only transact business, follow-up with individualized responses, or render personalized investment advice for compensation, in states where they are registered or excluded or exempted from registration, The Ferguson Smith Cohen Group | Leawood, KS | Morgan Stanley Wealth Management

Morgan Stanley at Work services are provided by Morgan Stanley Smith Barney LLC, member SIPC, and its affiliates, all wholly owned subsidiaries of Morgan Stanley.

© 2023 Morgan Stanley Smith Barney LLC. Member SIPC.

CRC 5669254 5/2023

2024 Startups to Watch

stats here

Related Posts on Startland News

Leanlab launches edtech certification with focus on accountability to classrooms

A new product certification from Leanlab Education means increased transparency for edtech companies — as well as added credibility for their work within schools. “We want to give teachers and school administrators a quick way to understand if an edtech product reflects the insights of educators, students, and parents — the true end users in education — and…

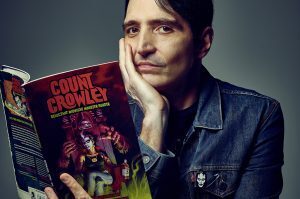

Actor David Dastmalchian fought his own demons; now the KC native is sending ’80s-inspired monsters to you

Growing up in Kansas City, David Dastmalchian was enamored with his hometown’s most shadowy corners: its fabled haunted houses, the shelves of Clint’s Comics, “Crematia Mortem’s Friday” on local TV, and even his Overland Park neighborhood’s mystical-seeming creeks and forests. Each of these childhood haunts planted a seed for the Hollywood actor’s latest project —…

MoodSpark buys defunct startup’s IP, minds focused on disrupting elderly veterans’ depression

A slew of new patents and tools are now in the hands of a KCK-rooted startup that aims to protect aging military veterans that suffer from loneliness, anxiety and depression. MoodSpark has acquired assets previously held by California-based Dthera Sciences — an early leader of the digital therapeutics space, known for its innovative quality of life…

Built to last, bought with intention: How JE Dunn set supplier diversity as a cornerstone

Editor’s note: The following story was sponsored by KC Rising, a regional initiative to help Kansas City grow faster and more intentionally, as part of a campaign to promote its CEO-to-CEO Challenge on supplier diversity. Approaching supplier diversity for the long haul means defining the work — without limiting it, said Jason Banks, describing how Kansas City-based construction icon JE…