Startup gives fans real ownership in emerging athletes; investing in talent before they make it big

May 3, 2024 | Nikki Overfelt Chifalu

Just as investors can put their money in Google or Apple, Parker Graham wants sports enthusiasts to invest in the next Patrick Mahomes or Travis Kelce, he shared.

Along with co-founder and fellow Oklahoma State football alum Yves Batoba, the Kansas City-based serial entrepreneur, Pipeline fellow, and founder of Finotta has now launched Vestible — an investment platform that allows fans to buy stock in players and share in their success via a federally regulated marketplace.

“It’s a big swing for the industry of sports fandom,” Graham said. “We’re trying to focus on the next Patrick Mahomes — that athlete who hasn’t made it yet — but has the ability to earn a lot of money for their investors, and at the same time, a lot of money for themselves.”

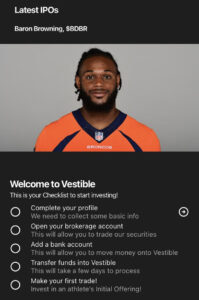

In January, Vestible received approval from the federal government — the first startup of its kind to do so — and the duo launched the app in March, he noted. With one athlete on the platform now — Denver Broncos outside linebacker Baron Browning — the Vestible team is bringing in investors and hoping to close its first offering in the next couple of months.

The platform expects to release opportunities with college and professional football and basketball players in the next year, Graham said, noting Vestible is starting with athletes in the highest revenue-generating sports.

“The difficult part is finding diamonds in the rough — people who are high performers but haven’t really made their money yet — and really have the investors come in at the most opportune time and the athlete the most risky time and really create that opportunity for that entity to exist and for it to make sense,” he said.

Vestible partners with these up-and-coming athletes to create a company via regulatory qualification, Graham detailed, then that company is split into equity shares.

“We’re raising capital for them just like we would a corporation,” he explained. “They’re making 80 percent of the proceeds that we raise. So if we raise a million bucks, they are at least taking home $800,000.”

For the investors, he continued, they can buy shares and build up their athlete portfolio during the initial offering. After 30 days, they can trade shares in the app.

“They’re buying shares in these athlete careers,” Graham said. “Through those shares that they purchase, they own a certain percentage of that athlete’s income. So they’re getting paid distributions every time the athlete gets paid.”

For example, Graham explained, investors would be able to profit from an athlete’s bonus incentives like the $1.25 million bonus Kansas Chiefs Chiefs player Chris Jones received for garnering 10 sacks last season.

“Everybody was watching that game to see if would he get it,” Graham said. “Well, now, fans are gonna be able to participate in that bonus, as well, because they would have invested in Chris 10 years ago. So that’s the kind of future state that we want to create.”

Inspired by crypto boom

Graham and Batoba came up with the idea for Vestible in 2021 when they saw what was happening with NFTs, cryptocurrency, and sports, Graham shared.

“We saw the pump and dumps that were occurring and we had this idea as sports fans and as athletes ourselves,” he recalled. “Athletes have always been called businesses. We’ve been told since high school to treat yourself as a business. And then this crypto thing happened.”

“We were just like, ‘Man, there was these different examples of creators using their businesses and basically creating equity in those businesses and selling them to their fans in just a bunch of different ways.’”

The duo wanted to create something similar, he continued, but in a regulated space to provide the safety and security of investment protections with which investors are accustomed.

“And we wanted to do something really cool and innovative with athletes and basically create businesses with them,” he added.

Vestible, Graham noted, is the perfect hybrid for both his and Batoba’s backgrounds. He has experience as a professional athlete (signed as an undrafted free agent by the Baltimore Ravens in 2014 before being cut), investment advisor, and software founder, while Batoba has experience in player engagement and development within the Miama Dolphins organization, giving him a unique perspective on the early careers of athletes.

“It’s a really a cool, unique combination of both of our superpowers and really coming together and creating a product that’s never existed and creating something really unique and really innovative,” he added.

New season of opportunity

While the duo is hyperfocused on closing the offering for their first athlete, Graham said, their goal is to bring on 10 athletes this year.

“We feel pretty confident with the team that we have built and with the strategies that we have in place to really go and eclipse that this year,” he added.

Now marks the perfect opportunity for Vestible, Graham noted, in today’s time of athletes as brands and fans who wager on games and athletics.

“The athlete/business CEO mindset is definitely different and it’s expecting a whole lot more,” he explained. And it should because the value they’re generating is just astronomical compared to what they’re paid. So we really view Vestible as a natural addition to the revenue they’re generating on the field or on the court.”

“On the fan side, though, it’s probably even more dramatic,” Graham continued. “Fans are so much smarter than they’ve ever been.”

If you think of brands that are prevalent in everyone’s lives — like Nike, Apple, and Ford — they pale in comparison to the brand fandom that encompasses, not just athletes, but social influencers, Graham said.

It’s a new world, he emphasized.

“A typical startup company — raise capital, make a bigger company, and rinse and repeat until you’re an IPO — has worked for 100 years, maybe more,” Graham said. “The next 100 years, I would love for us to be the New York Stock Exchange that is doing that for people.”

“So if you are a brand, if you are a brand builder, if you are a social media influencer or an athlete or whatever vertical you pick, we’re the place where they go to create that company and to create that brand value in a way that they just can’t do it anywhere else,” he added.

2024 Startups to Watch

stats here

Related Posts on Startland News

This keychain could stop an opioid overdose; carry the antidote — not the burden of guilt

ST. LOUIS — Easy access to life-saving naloxone (better known by the brand name Narcan) could’ve prevented the fatal overdose of Danielle Wilder’s close friend in college, the tragedy-prompted entrepreneur said. Her friend was in possession of naloxone — a fast-acting medicine that can reverse the deadly impacts of an opioid overdose when delivered near-immediately…

Brookside restaurant spot shifts from Irish to Mexican flavors as two families expand their dream

Two longtime friends and their daughters — all seasoned restaurant workers — are joining together in a new East Brookside restaurant they can call their own. Muy Caliente Grill & Cantina is scheduled to open later this month at 751 E. 63rd St., Suite 110, in the former Brady & Fox restaurant. Owners Fredy Rivera…

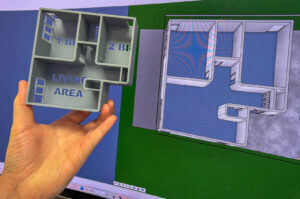

Landlord’s solution to Kansas housing crisis: 3D print his own home inventory

TOPEKA — Regularly confronted with a lack of supply in the housing market — and the subsequent higher prices — landlord and general capital investor Chris Stemler faced a multi-dimensional challenge. “I thought to myself, ‘How do I help solve an inventory problem?’ the Topeka-based Trident Homes founder said. “I know I’ve got renters who…

Just-launched retail hub gets first tenant, battling ‘blight of the heart’ on Troost corner

‘We are each other’s bootstraps’ Transforming a long-vacant building along Troost into a space for neighborhood small businesses is about empowering the entrepreneurs already living and working in the east side community, said Father Justin Mathews. The newly unveiled RS Impact Exchange — built within the renovated, 1920-built Baker Shoe Building at 3108-3116 Troost Ave.…