Startup gives fans real ownership in emerging athletes; investing in talent before they make it big

May 3, 2024 | Nikki Overfelt Chifalu

Just as investors can put their money in Google or Apple, Parker Graham wants sports enthusiasts to invest in the next Patrick Mahomes or Travis Kelce, he shared.

Along with co-founder and fellow Oklahoma State football alum Yves Batoba, the Kansas City-based serial entrepreneur, Pipeline fellow, and founder of Finotta has now launched Vestible — an investment platform that allows fans to buy stock in players and share in their success via a federally regulated marketplace.

“It’s a big swing for the industry of sports fandom,” Graham said. “We’re trying to focus on the next Patrick Mahomes — that athlete who hasn’t made it yet — but has the ability to earn a lot of money for their investors, and at the same time, a lot of money for themselves.”

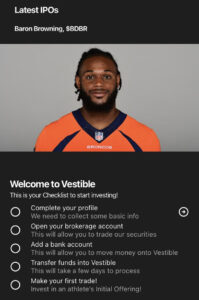

In January, Vestible received approval from the federal government — the first startup of its kind to do so — and the duo launched the app in March, he noted. With one athlete on the platform now — Denver Broncos outside linebacker Baron Browning — the Vestible team is bringing in investors and hoping to close its first offering in the next couple of months.

The platform expects to release opportunities with college and professional football and basketball players in the next year, Graham said, noting Vestible is starting with athletes in the highest revenue-generating sports.

“The difficult part is finding diamonds in the rough — people who are high performers but haven’t really made their money yet — and really have the investors come in at the most opportune time and the athlete the most risky time and really create that opportunity for that entity to exist and for it to make sense,” he said.

Vestible partners with these up-and-coming athletes to create a company via regulatory qualification, Graham detailed, then that company is split into equity shares.

“We’re raising capital for them just like we would a corporation,” he explained. “They’re making 80 percent of the proceeds that we raise. So if we raise a million bucks, they are at least taking home $800,000.”

For the investors, he continued, they can buy shares and build up their athlete portfolio during the initial offering. After 30 days, they can trade shares in the app.

“They’re buying shares in these athlete careers,” Graham said. “Through those shares that they purchase, they own a certain percentage of that athlete’s income. So they’re getting paid distributions every time the athlete gets paid.”

For example, Graham explained, investors would be able to profit from an athlete’s bonus incentives like the $1.25 million bonus Kansas Chiefs Chiefs player Chris Jones received for garnering 10 sacks last season.

“Everybody was watching that game to see if would he get it,” Graham said. “Well, now, fans are gonna be able to participate in that bonus, as well, because they would have invested in Chris 10 years ago. So that’s the kind of future state that we want to create.”

Inspired by crypto boom

Graham and Batoba came up with the idea for Vestible in 2021 when they saw what was happening with NFTs, cryptocurrency, and sports, Graham shared.

“We saw the pump and dumps that were occurring and we had this idea as sports fans and as athletes ourselves,” he recalled. “Athletes have always been called businesses. We’ve been told since high school to treat yourself as a business. And then this crypto thing happened.”

“We were just like, ‘Man, there was these different examples of creators using their businesses and basically creating equity in those businesses and selling them to their fans in just a bunch of different ways.’”

The duo wanted to create something similar, he continued, but in a regulated space to provide the safety and security of investment protections with which investors are accustomed.

“And we wanted to do something really cool and innovative with athletes and basically create businesses with them,” he added.

Vestible, Graham noted, is the perfect hybrid for both his and Batoba’s backgrounds. He has experience as a professional athlete (signed as an undrafted free agent by the Baltimore Ravens in 2014 before being cut), investment advisor, and software founder, while Batoba has experience in player engagement and development within the Miama Dolphins organization, giving him a unique perspective on the early careers of athletes.

“It’s a really a cool, unique combination of both of our superpowers and really coming together and creating a product that’s never existed and creating something really unique and really innovative,” he added.

New season of opportunity

While the duo is hyperfocused on closing the offering for their first athlete, Graham said, their goal is to bring on 10 athletes this year.

“We feel pretty confident with the team that we have built and with the strategies that we have in place to really go and eclipse that this year,” he added.

Now marks the perfect opportunity for Vestible, Graham noted, in today’s time of athletes as brands and fans who wager on games and athletics.

“The athlete/business CEO mindset is definitely different and it’s expecting a whole lot more,” he explained. And it should because the value they’re generating is just astronomical compared to what they’re paid. So we really view Vestible as a natural addition to the revenue they’re generating on the field or on the court.”

“On the fan side, though, it’s probably even more dramatic,” Graham continued. “Fans are so much smarter than they’ve ever been.”

If you think of brands that are prevalent in everyone’s lives — like Nike, Apple, and Ford — they pale in comparison to the brand fandom that encompasses, not just athletes, but social influencers, Graham said.

It’s a new world, he emphasized.

“A typical startup company — raise capital, make a bigger company, and rinse and repeat until you’re an IPO — has worked for 100 years, maybe more,” Graham said. “The next 100 years, I would love for us to be the New York Stock Exchange that is doing that for people.”

“So if you are a brand, if you are a brand builder, if you are a social media influencer or an athlete or whatever vertical you pick, we’re the place where they go to create that company and to create that brand value in a way that they just can’t do it anywhere else,” he added.

2024 Startups to Watch

stats here

Related Posts on Startland News

This 11-year-old’s lemonade sells out in hours at Hy-Vee; Here’s how he hopes to extend the shelf life of his young family business

The all-natural, fresh-squeezed lemonade made by 11-year-old Tre Glasper and his family in a Manhattan commercial kitchen is making its way to Kansas City thanks to a tart partnership with one of the Midwest’s leading grocery chains. Tre typically sells about 100 bottles of Tre’s Squeeze — an amount that takes two to three hours…

Grief happens on (and off) company time: Why a startup founded from loss is building holistic bereavement plans for corporate America

When grieving employees return to work, managers and colleagues often aren’t equipped to properly support them, said Lisa Cooper. “While I was working in corporate America for quite some time, I had witnessed a lot of dysfunction surrounding grief,” said Cooper, co-founder of Workplace Healing alongside Mindy Corporon. For example, I can remember specifically when someone…

Cherry enters the endorsement game, scoring NIL deals that also boost female college athletes

Partnering with college athletes is a natural elevation of sports apparel company Cherry Co., said Thalia Cherry. The KC-based brand signed agreements with 18 athletes for NIL (name, image, likeness) endorsement deals, shared Cherry, founder and CEO. “It’s a perfect alignment,” she continued. “We were already working with professional athletes in some capacity. So when…