MTC’s spring $1.4M investment cycle loops Facility Ally, DevStride into equity deals

May 8, 2024 | Startland News Staff

Two Kansas City startups are among a handful of Missouri companies receiving a collective $1.4 million in investment allocations through a state-sponsored venture capital program.

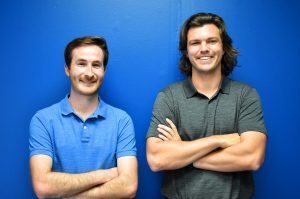

Facility Ally, led by serial entrepreneur Luke Wade; and DevStride, co-founded by Phil Reynolds, Chastin Reynolds, Aaron Saloff and Kujtim Hoxha; must now complete the Missouri Technology Corporation’s due diligence process for the IDEA Fund, which includes raising required matching funds.

RELATED: MTC hits $50M investment milestone through its state-sponsored venture capital program

Support from MTC further proves Facility Ally is on the right track, said Wade, adding it’s validating for others to see what his team is building and believe in the vision.

Sports tech startup Facility Ally helps manage court/field bookings, leagues, event sign-ups, lessons, classes, memberships, and more, all in one system.

“We plan to use the funding to hire more local sales and development team members right here in Kansas City,” said Wade, noting Facility Ally is still raising its next round. “I believe we stood out in the application process due to the traction we gained in 2023 and so far this year plus our desire to continue to hire locally and grow our team in Kansas City, Missouri.”

Fellow awardee DevStride is an integrated project and portfolio management solution designed for complex organizations that want to bridge the gap between internal agile practices and rigid external commitments. DevStride eases friction between agile workflows and regulatory, statutory and contractual requirements by meeting stakeholders where they are in their agile transformation journeys.

Co-founders Phil and Chastin Reynolds relocated to Kansas City in 2021 from Springfield, Missouri.

“I have found that there is this genuine culture of founders cheering each other on and trying to offer meaningful, helpful support,” Phil Reynolds told Startland News previously. “There’s just a lot going on, and everybody is very friendly and collaborative. I couldn’t appreciate it more.”

Additional equity investments were announced for three St. Louis companies:

- Maximum Fidelity Surgical Simulations — creates hyper-realistic surgical simulations using EnvivoPC, which is a patented and proprietary cadaver perfusion system. Customizing every surgical simulation experience to match the unique needs of their customers, whether it is for military training, research and product development, or medical education.

- Pairidex — a clinical diagnostics company that offers laboratory-based testing for cancer detection. Pairidex uses patent-pending technology to accurately detect gene fusion-driven cancer at lower levels than any other tests, allowing for earlier detection of disease or relapse. Initially we are focused on blood cancers—specifically leukemia.

- Trelus — a subscription-based, SaaS platform and digital roadmap giving founders and owners step-by-step guidance, AI-powered workflow and resources to maximize value and ensure exit readiness long before they exit.

Since January 2023, MTC has awarded over $11 million in investment allocations through the IDEA Fund to nearly 40 Missouri-based high-growth potential startups.

Kansas City companies receiving allocations in recent months include Sailes, SaRA Health, Serviam Care Network, backstitch, Foresight and Likarda. Not all companies who receive allocations ultimately join MTC’s IDEA Fund portfolio.

MTC accepts IDEA Fund applications continuously and reviews applications on a quarterly cycle to determine award allocation. Awarded companies have up to one year to secure the matching co-investment, close their funding round, and receive MTC’s investment.

Deadlines for full consideration for each quarterly application review cycle:

- 11:59 p.m., Wednesday, May 8 — July 2024 Award Cycle

- 11:59 p.m., Wednesday, Aug. 7 — October 2024 Award Cycle

2024 Startups to Watch

stats here

Related Posts on Startland News

Site confirmed for ASTRA innovation district; Why the project ‘sends a signal to startups’ and beyond

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. This series is possible thanks to the Ewing Marion Kauffman Foundation, which leads a collaborative, nationwide effort to identify and remove large and small barriers to new business creation. One…

Techstars arrival: Find that ‘ride or die’ investor who answers your 3 am calls, founder says

Even in a startup’s early stages, founders need both a roadmap and destination, said Zerryn Gines. “You don’t need to know exactly what you’re doing every step of the way, but if you know where you want to go — then you can connect to the right people and ask the right questions,” explained Gines,…

New in KC: How two OU alumni secured over $1M from NASA, US Air Force for 3D printing startup

Editor’s note: New in KC is an ongoing profile series that highlights newly relocated members of the Kansas City startup community, their reasons for a change of scenery, and what they’ve found so far in KC. This series is sponsored by C2FO, a Leawood-based, global financial services company. Click here to read more New in KC profiles. Replicating the founding…

Flyover Capital closes its Tech Fund II over $60M, targeting new seed, post-seed startups

Tech startups raising seed and post-seed funding will benefit most from the close of Flyover Capital Fund II, the venture capital firm said, announcing Thursday its oversubscribed close. “The oversubscribed fund brings Flyover Capital’s total assets under management to approximately $110 million,” the Overland Park-based venture capital firm said in a release, outlining plans for…