Bardavon’s latest funding round gets a KC boost, supports Recovery+ new product rollout

April 30, 2024 | Startland News Staff

A transformative product release from one of Kansas City’s leading healthtech companies coincides with a meaningful funding round — marking a new chapter in workers’ compensation, as well as for Bardavon’s recently announced new CEO, the company said.

Financial details of the round — led by WestCap and NewRoad Capital Partners, with participation from KCRise Fund and others — were undisclosed, but Alex Benson, CEO of the leading workers’ compensation and musculoskeletal (MSK) health company, emphasized continued participation by investors in Bardavon‘s previous Series A, B, and C raises.

The capital cements Bardavon’s commitment to the workers’ compensation industry and positions the company to best support the needs of claims managers, adjusters, nurse case managers, and most importantly injured or rehabilitating workers, Benson added.

“The funding will sustain growth the company realized in 2023, while allowing us to focus on new product enhancements like Recovery+, additional referral management enhancements and our injury prevention product suite, which uses wearable safety sensors to predict and prevent injuries,” he said. “Additionally, we’ll expand our U.S.-based sales and marketing efforts.”

RELATED: Bardavon founder moves to board as company promotes new CEO from its C-suite

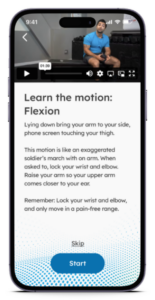

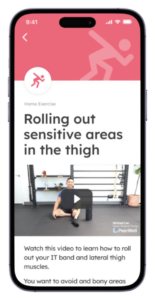

Recovery+ — an industry-leading health coaching platform designed to expedite recovery and enhance the return-to-work process for injured workers — is expected to empower injured workers by giving them a one-to-one platform to engage directly with certified clinicians, ensuring a more personalized and supportive recovery experience, according to Bardavon. It is also designed to lighten the load for client partners, payors and case administrators by efficiently triaging issues and streamlining the care management process.

The new product is now part of Bardavon’s PT/OT network offering, actively being adopted by existing clients and available for new clients.

“Recovery+ marks a new chapter in workers’ compensation that puts the focus on people by providing personalized, on-demand support for injured workers as well as streamlining the recovery process for our stakeholder partners,” Benson said. “Recovery+ was designed to make the healing process and return-to-work journey smoother for everyone. Early case progress results show that by prioritizing our injured workers’ health and care plans, both our clients and those on the road to recovery benefit.”

Ongoing investor support for Bardavon — especially from a Kansas City-based fund like KCRise — as it rolls out new products like Recovery+ is heartening, said Benson, noting the long-term relationship built between Bardavon founder Matt Condon and KCRise Fund founder Darcy Howe.

“It means the world,” Benson added. “Darcy and the KCRise team have supported Bardavon from its earliest days. Having their (growing) team alongside the company through this next chapter is a blessing, and is something that was extremely important to Matt and I.”

“From the beginning, Bardavon was established as a Kansas City company, founded with intention and belief that healthcare could be changed for the better with learnings and contributions from great Kansas City institutions and entrepreneurs like Neal Patterson, Cliff Illig, David Lockton and Terry Dunn,” he continued. “KCRise is a key part of that fabric — guiding and helping so many early stage companies with a profile similar to Bardavon’s.”

2024 Startups to Watch

stats here

Related Posts on Startland News

KCultivator Q&A: Katie Kimbrell pushes reimagined education, equality for women

Editor’s note: KCultivators is a lighthearted profile series to highlight people who are meaningfully enriching Kansas City’s entrepreneurial ecosystem. The KCultivator Series is sponsored by WeWork Corrigan Station, a modern twist on Kansas City office space. MECA Challenge and Startland News are both programs of the Kansas City Startup Foundation, though the content below was produced…

Wild Way mobile coffee shop makes camp for winter in Crossroads warehouse

Winter weather has proven a little too wild for Christine Clutton’s coffee camper, the Wild Way founder said, revealing an indoor, seasonal home for the mobile coffee shop. “We are in a warehouse, but operate in a camper still,” she said of the Wild Way Winter Warehouse space at 708 E. 19th St. “We just…

Get in front of investors: Deadline nearing for InvestMidwest premier venture showcase

InvestMidwest presents more than just an opportunity for startups to pitch to a crowd from outside Kansas City, said Kyle FitzGerald. The event — which spotlights high-growth companies seeking at least $1 million — fosters real investor connections, he added. “It’s the region’s best chance to get in front of a high volume of very qualified…