Crowdfunding platform for small businesses launches local hub for KC entrepreneurs

February 8, 2024 | Startland News Staff

Editor’s note: KC BizCare is a partner of Startland News.

A newly announced partnership with the international non-profit Kiva is expected to boost Kansas City entrepreneurs who have had difficulties securing traditional bank loans — offering access to social underwriting and affordable starting capital.

Kiva Kansas City (Kiva KC), a crowdfunded microloan program for small businesses, gives entrepreneurs access to zero-percent interest loans ranging from $1,000 to $15,000.

Established in partnership with the City of Kansas City, Missouri’s KC BizCare Office, the program operates under the Economic Development Corporation of Kansas City (EDCKC).

Corianne Rice, Center for City Solutions at the National League of Cities, speaks with Nia Richardson, KC BizCare, during the November 2022 grand opening of KC BizCare’s new offices at City Hall; photo by Nikki Overfelt Chifalu, Startland News

“Our intent with the new crowdfunded loan program is to create more opportunities for our KC entrepreneurs to get access to affordable starting capital for their businesses,” said Nia Richardson, managing director of the KC BizCare Office, as well as the office of digital equity with the City of Kansas City. “The National League of Cities really helped to make this possible through their CIE program and grants for microlending. Their program gave us the tools and resources we needed to bring the first hub to Kansas City.”

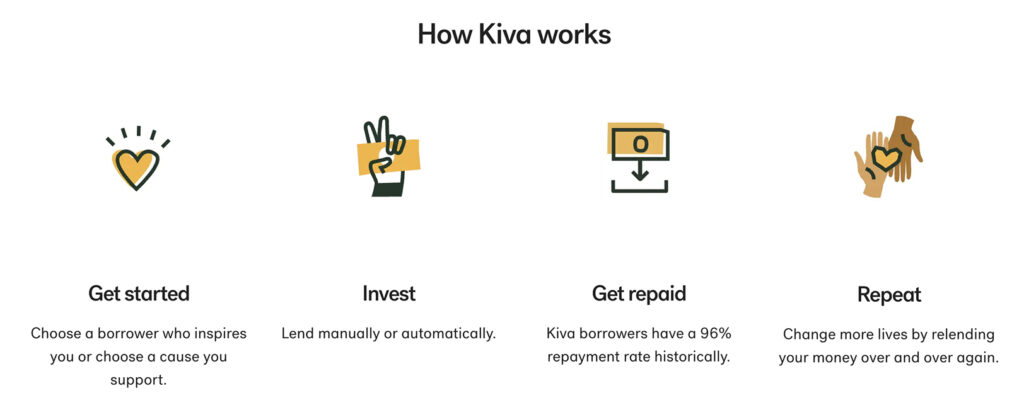

Kiva KC works closely with local entrepreneurs, guiding them through the loan application, fundraising, and repayment processes. The program enables lenders to contribute as little as $25 to provide affordable capital to small businesses, supporting job creation and positive community impact.

Through the newly formed Kiva KC site, members of the Kansas City community can sign up to lend money to either local business owners or international entrepreneurs who are accessing the global Kiva network.

Click here to explore Kiva KC. Applications are now open.

Kiva’s access to affordable capital for marginalized entrepreneurs, coupled with EDCKC’s deep knowledge of the local entrepreneurial ecosystem in Kansas City, is sure to have a profound impact for the small business community, the non-profit said.

“KivaUS is excited about entering the Kansas City market to provide affordable capital,” said Warren S. Galloway, senior partnerships manager of KivaUS. “We’ve found that identifying capital is one of the biggest challenges our business owners cite. As a result, you will see entrepreneurs become economic engines in their communities after not only receiving capital, but also receiving technical support from EDCKC and community partners.”

Borrowers who apply and get approved for a Kiva loan must have between 5 to 40 of their friends, family, or personal network lend as little as $25 to their loan. This proves a borrower’s creditworthiness and is part of Kiva’s social underwriting process. Once a borrower has reached their lender goal, they are listed on Kiva’s online platform, where they raise the remaining balance of their approved loan amount.

To qualify for Kiva Kansas City:

- Borrower and business must be U.S.-based

- Borrower must be 18 years of age or older

- Loan must be used for business purposes

- Business must not be engaged in multi-level marketing, direct sales, pure financial investing, etc.

- Borrower or business must not be under foreclosure, bankruptcy, or under any liens

- Home-based businesses are eligible for a Kiva loan

Businesses must have a business bank account connected to PayPal. Kiva loans are disbursed and repaid through PayPal.

Kiva KC was established through the City of KCMO’s participation in the 2022-2023 City Inclusive Entrepreneurship (CIE) program with the National League of Cities (NLC) for microlending. The city committed to building a platform for microlending to serve entrepreneurs without access to traditional finance.

The Kiva KC hub was funded in part by the Ewing Kauffman Foundation $250,000 Access to Capital Grant, National League of Cities $15,000 CIE grant and the US Conference of Mayors $10,000 Dollarwise Grant.

Tracey Lewis, president and CEO of the Economic Development Corporation of Kansas City (EDCKC), speaks in October 2023 at the Downtown KC Office Summit; photo by Taylor Wilmore, Startland News

“We’re happy to partner with the City of Kansas City to establish a Kiva hub in our region,” said Tracey Lewis, president and CEO of EDCKC. “This relationship will allow us to guide and support crucial small businesses that help our economic ecosystem expand, while also bringing in disadvantaged participants that are typically excluded.”

RELATED: EDCKC boasts right team at the right time, CEO says as agency rebuilds its reputation

With a focus on helping minority and female entrepreneurs regain control of their finances, the EDCKC established the role of capital access manager for Kiva KC.

“I’ll be able to walk interested borrowers through the Kiva application, fundraising, and repayment process, locally in Kansas City, making the program even more accessible,” said Regina Sosa, capital access manager with EDCKC.

The Kiva KC initiative is a component of the EDCKC’s and KC BizCare Office’s new small business “starting” capital programs launching in 2024. A micro-business grants program within that campaign already launched.

RELATED: New capital programs for KC small businesses unveiled, starting with micro-biz grants

Featured Business

2024 Startups to Watch

stats here

Related Posts on Startland News

KC capital implants cattle tech startup with fuel to scale, expanding IVF labs, headcount

Livestock production has seen a remarkable transformation since Kerryann Kocher was growing up on her family’s sixth-generation farm in northeast Iowa, the Vytelle CEO said. Instead of just selecting the cow that looks best and bringing in the neighbor’s bull for breeding, as she remembers it, Kocher and Vytelle — a Kansas City-based precision livestock…

Venture experts: Getting your first check in KC is too difficult, but a record influx of coastal investors isn’t a bad substitute

A new report on Kansas City’s venture-backed companies showed year-over-year growth in multiple areas — impressing industry experts who identified key investment trends in the data. More companies with venture capital backing; higher employee counts; a 58 percent boost in fundraising. Yet growth was not universal. Despite gains in top-line figures, the number of Kansas City-based…

RX Savings Solutions sale would see the startup acquired for up to $875M in KC’s biggest-ever exit

The McKesson Corporation has agreed to purchase Overland Park-prescribed Rx Savings Solutions in a deal worth nearly $1 billion. McKesson announced Monday that it had entered into an agreement with the prescription pricing startup valued at up to $875 million — more than double the $425 million price tag for which Kansas City-built Backlot Cars…

KC team developing tool to get low-income entrepreneurs online (and it just got a $240K boost)

A collaborative project to “bridge the gap” in Kansas City’s digital divide secured one of the 2022 Heartland Challenge grants from the Ewing Marion Kauffman Foundation. PCs for People Kansas City (formerly Connecting for Good), in partnership with The Usher Garage and No-Where Consultants, will receive $240,000 in funding to be used over two years…