Grit Road plants $11M venture fund to cultivate homegrown ag tech solutions across Midwest

September 19, 2023 | Nikki Overfelt Chifalu

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro.

OMAHA — The precision guide for Grit Road Partners — a Nebraska-based venture fund — is investing in ag tech companies that are solving Midwest producer problems, said Mike Jung, noting no shortage of ideas ready to be developed.

“But yet when it gets to the farm gate, it fails. It doesn’t truly understand what the producer needs or the processor wants,” continued Jung, managing partner for Grit Road. “And so as my partner would always say, ‘There’s a graveyard of ag tech companies out there that just fell short from getting to the root of the problem.’”

Grit Road — which launched in August 2021 under the Burlington Capital umbrella but spun off as a partnership between Jung and Invest Nebraska at the end of 2022 — closed an $11 million funding round this summer, according to Jung, who worked within the ag initiatives and investments verticals for Burlington for 18 years.

“We’re excited and relieved,” he continued. “Whenever you look back on when we initially set out to achieve this and set the goal of raising $11 million and then ultimately hitting that goal — and then over subscribing — it’s exciting to be able to kind of sit back and say, ‘Man, this was great. We actually did what we said we were going to do.’”

Grit Road has already made 12 investments, he shared, including five startups in Nebraska, three in Iowa, and one in Minnesota, Wyoming, and Texas (Corral Technologies, Grain Weevil, Birds Eye Robotics, LandTrust, Sentinel Fertigation, Marble Technologies, Distynct, Clayton Farms, EIO Diagnostics, HerdDogg, Continuum Ag, and Vane).

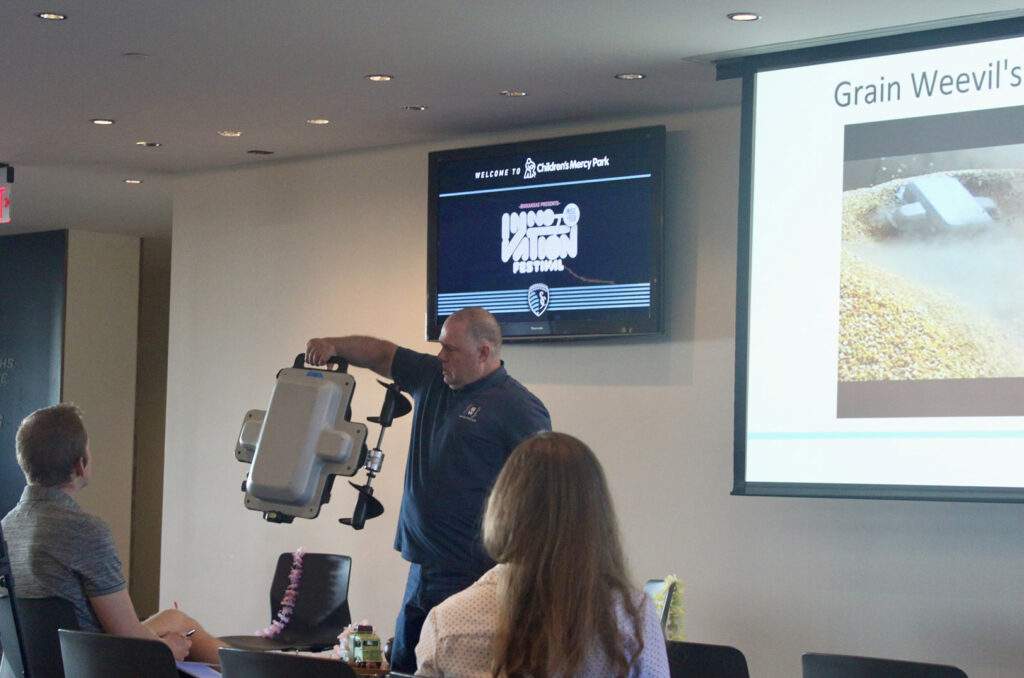

Chad Johnson, co-founder of Aurora, Nebraska-based Grain Weevil — a portfolio company of Grit Road Partners — presents his startup during the 2022 Innovation Festival at Children’s Mercy Park in Kansas City, Kansas; photo courtesy of Grit Road Partners

When looking for investors for the fund, Jung noted, his team wanted it to be an ag-heavy focus as Nebraska and the Midwest are filled with outstanding industrial ag players.

“We felt it was important for us to have that heavy ag-centric investor base because, as we’re looking at deploying capital and looking at investing opportunities, we want to make sure we create this bench of resources that we can tap to help us,” he said. “If we’re looking at technology that’s in the animal space, we want to make sure we’re talking with our feedlot partners. If we’re looking at something in the grain production space, we can talk to producers and co-ops in that area to help us in making sure that the investments we’re doing are the right ones.”

This strategy also involves bringing in institutional ag partners, he added.

“We wanted to make sure we were bringing in these people that are on the front line of ag — who are truly moving the needle when it comes to kind of ag production, ag processing — as partners, as well others who have kind of been there and done whether it’s in ag or other sorts of tech or startup initiatives,” he explained.

This partner network, Jung noted, is what sets Grit Road apart.

“(My partners and I) live here in Nebraska; we’re from this area,” he continued, “But we’re never going to mislead anybody to think that we know all the ins and outs of what is going on in the ag value chain. And we lean heavily on our partners to help us and guide us in doing our due diligence and betting opportunities for the fund.”

In January 2022, Jung shared, they also started an Ag Tech Deal Flow Network, which is a community of like-minded investors in the ag tech space that meets once a month to share deal flow opportunities and investments that are looking for additional capital, additional partners, and additional resources.

“We really want to make sure our initiative or this platform can help strengthen and build and serve as a catalyst to further develop the ag tech ecosystem here in the Midwest,” he said. “There’s a lot of great entrepreneurs that are around these areas and we just want to make sure that — not only through us but if they’re investors or if they’re partners — that these ag tech entrepreneurs have the resources and the support here in the middle of the country to achieve their goals and objectives.”

Featured Business

2023 Startups to Watch

stats here

Related Posts on Startland News

ShotTracker scores partnership with sports equipment giant Spalding

Overland Park, Kan.-based startup ShotTracker will partner with Spalding, the largest basketball equipment supplier in the world, to debut the first multi-player basketball tracking technology. ShotTracker’s technology tracks real-time basketball performance statistics using data from chips embedded in a basketball, players’ shoes, and portable sensors placed around the court. Davyeon Ross, COO of ShotTracker, commented that their…

Rightfully Sewn founder stitches a vision for Kansas City’s fashion future

Poised, posh and purposeful, Jennifer Lapka Pfeifer sits straight as a board at Kaldi’s coffee shop with unwavering eye contact. Donning a contoured-floral blue and white dress, Lapka smiles as she poetically recalls painting in high school and learning to sew with her grandmother in rural Kansas. Those experiences fostered a love for fashion, art…