KC ranks No. 11 among Midwest startup cities, holding its spot thanks to funding wins amid VC slowdown

August 10, 2023 | Matthew Gwin

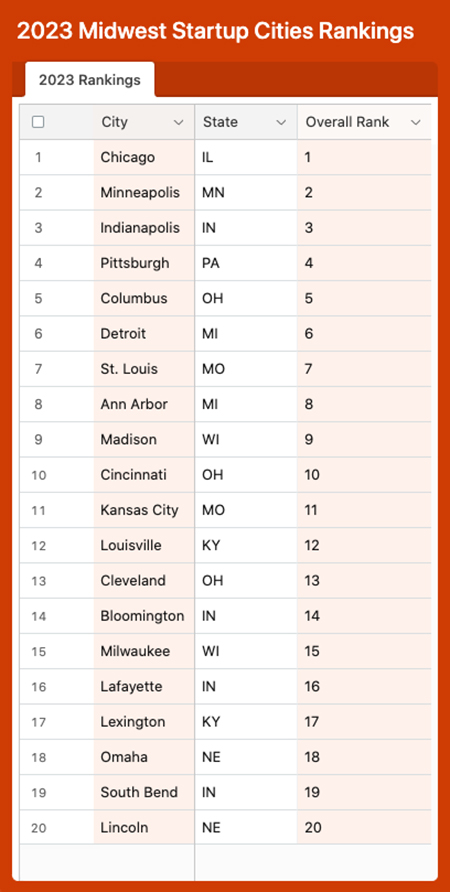

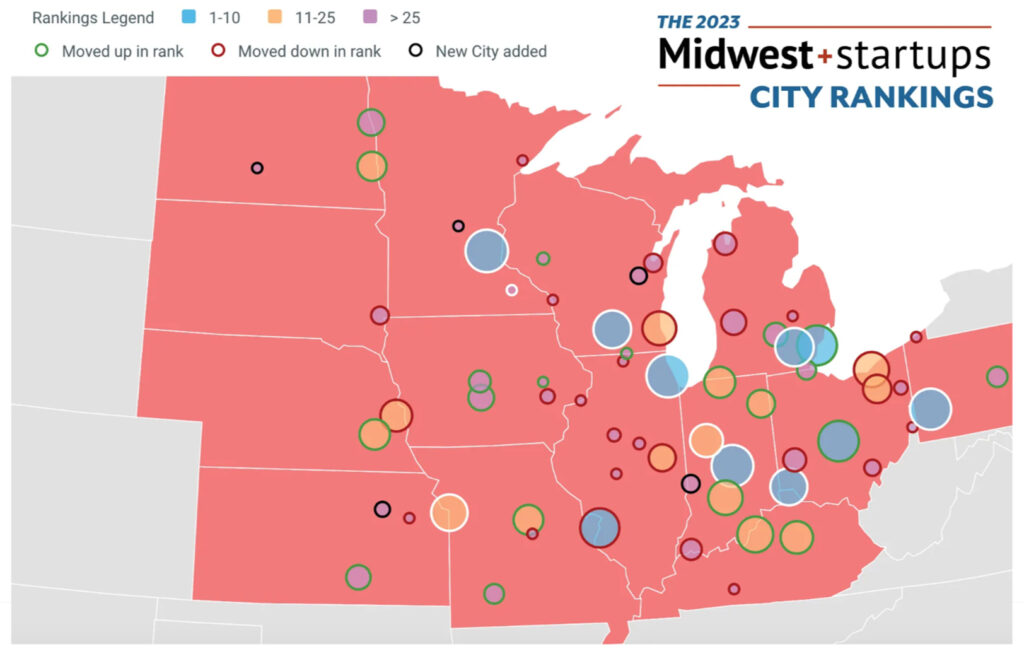

A healthy dose of recent funding events kept Kansas City in the No. 11 spot in the 2023 edition of M25’s annual ranking of Midwest startup cities, said Victor Gutwein, founder and managing partner at M25.

The comprehensive report explores how metropolitan areas across the Midwest are performing relative to each other based on startup activity, access to resources, and business climate.

Click here to view the complete rankings from M25.

Gutwein pointed to raises from PayIt, Sailes, Free From Market, Orange EV, and Redeem as positive activity within the local startup ecosystem, adding that Kansas City outperformed higher-ranked cities like Saint Louis and Indianapolis in that area.

“Kansas City has had a lot of relatively big recent wins,” Gutwein said. “That’s what is keeping the city strong.”

Click here to check out M25’s Kansas City breakdown.

Having regionally-focused venture capital firms — like the KCRise Fund, which closed its $34 million Fund III earlier this year — separates Kansas City from many other Midwestern cities, Gutwein added.

“They raised that even when the economy is down,” Gutwein said. “That is making it clear people are seeing good results, and they’re seeing a reason to invest in Kansas City. … It’s actually very, very rare to find such a relatively small, geographic-focused venture fund that’s having so much success.”

Another big win in Kansas City’s column: Homegrown Rx Savings Solutions’ exit to McKesson Corporation in a deal reportedly valued at $875 million. The acquisition was finalized in November.

Beyond the news event of Rx Savings’ sale, the move could have a meaningful ripple effect, Gutwein said.

“It was acquired by McKesson, which also had the major acquisition of CoverMyMeds back in 2017 in Columbus, Ohio, and that was a huge catalyst for that ecosystem,” he said. “KC might continue to see boosts from this for years to come.”

As the broader economy slows down, venture capital invested in Midwest startups has returned to pre-pandemic levels, though Gutwein cautioned against extreme concern.

“I’m not too worried about our companies,” he said of startups in the Heartland. “I think there was just a really exceptional amount of capital coming in during that two-year period from mid-2020 to mid-2022. That was an exceptional point in time, and now we’re back to a new normal. It may feel tight and constricted, but it’s not too bad in the scheme of things.”

Some of the funding activity during that time frame was unlikely to be sustainable, Gutwein added, noting that the prevailing sentiment in the VC industry is that funding will stay low temporarily but recover within a couple years.

While startups adjust to lower and less frequent cash flows, Midwestern companies have an advantage over coastal startups, Gutwein said.

“A lot of our companies have adjusted to be more profitable,” he said. “They didn’t have crazy high burn rates anyway. It’s pretty encouraging to see our companies still growing, still hiring, and still finding a lot of success. … That’s one area where I think the Midwest has an advantage. When the capital is free-flowing, it’s great; but when it’s not, our companies don’t rely on capital too much.”

Click here to read Gutwein’s M25 commentary on the rankings.

Funding from the State Small Business Credit Initiative Program (SSBCI) — an outgrowth of the Biden Administration’s American Rescue Plan — has been a key variable across startup ecosystems as states allocate the resources from the federal government differently, Gutwein noted.

He described Kansas as having an aggressive approach, which helped Wichita surge up the rankings to No. 29, up 13 spots from last year.

“That has also catalyzed a lot of angel [investment] activity in the city,” Gutwein said. “That’s going to result in more startups getting funded, more people moving there, or leaving a larger company there and starting a company.”

Seed rounds from WorkTorch and Plot could be a harbinger of more funding coming to the Wichita area, Gutwein added.

“That’s not something you used to see in Wichita, so I think that’s encouraging,” he said. “It’s a good sign, and that happened before even most of the SSBCI funding.”

On the Missouri side of the state line, Columbia climbed yet another spot, up to No. 21.

EquipmentShare — on the heels of a $290 million Series E round — continues to power the mid-Missouri college town’s growth, causing folks from across the country to take notice, Gutwein said.

“That’s been one of the more interesting ecosystems to watch lately,” he said. “I hardly paid attention to [Columbia] when I started at M25 in 2015. Now, it’s somewhere you can’t ignore. … It’s one that people nationally have heard of and seen some of the activity.”

Fellow college town Manhattan made its first appearance in the rankings, debuting at No. 43, 14 spots ahead of nearby Topeka at No. 57.

Though the Manhattan startup ecosystem is relatively small, it benefits from having Kansas State University in the city, Gutwein said, adding that the Little Apple proved it belongs on the list.

“It definitely deserves to be compared and ranked and analyzed,” Gutwein said, “so that was very validating.”

Featured Business

2023 Startups to Watch

stats here

Related Posts on Startland News

1 Million Cups wraps month-long black entrepreneur showcase

Celebrating differences strengthens everyone, a white 1 Million Cups volunteer told a room full of black entrepreneurs and business owners Wednesday evening. “Diversity and inclusion are important to us year-round here at 1 Million Cups,” said Kyle Smith, communications coordinator at KCSourceLink and a 1MC Kansas City community organizer. “And I am very well aware…

C2FO raises massive $100M round for global expansion

In what is believed to be the largest venture-backed funding round in the Kansas City area’s history, C2FO is lighting the fuse on its global expansion with a $100 million capital raise. The Leawood-based financial tech firm’s round was led by Munich-based Allianz X and Abu Dhabi-based Mubadala Investment Company, and included participation from Temasek,…

Techweek KC returning with big LaunchKC, Techstars, BetaBlox demo days

One of Kansas City’s biggest conference series for entrepreneurs is returning in October alongside some of KC’s most premier accelerator programs, said Amanda Signorelli, CEO of Techweek KC. Demo days for Techstars KC and BetaBlox will join LaunchKC as signature events during the Oct. 8-12 conference, she said. “Combined with the nationally recognized LaunchKC competition…

Techstars KC alum Grit Virtual posts $840K oversubscribed seed round

Reality is starting to sink in for Grit Virtual, said co-founder Chris Callen. “It’s exciting to finally be able to talk about our funding rounds and the successes we have had,” Callen said. “It’s been an exciting ride so far, and we’re kind of gearing up to make it a real company, not just an R&D…