KC ranks No. 11 among Midwest startup cities, holding its spot thanks to funding wins amid VC slowdown

August 10, 2023 | Matthew Gwin

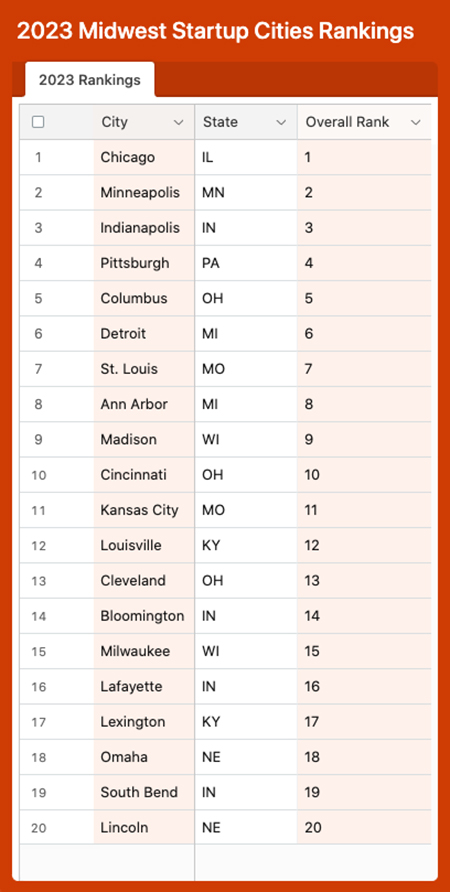

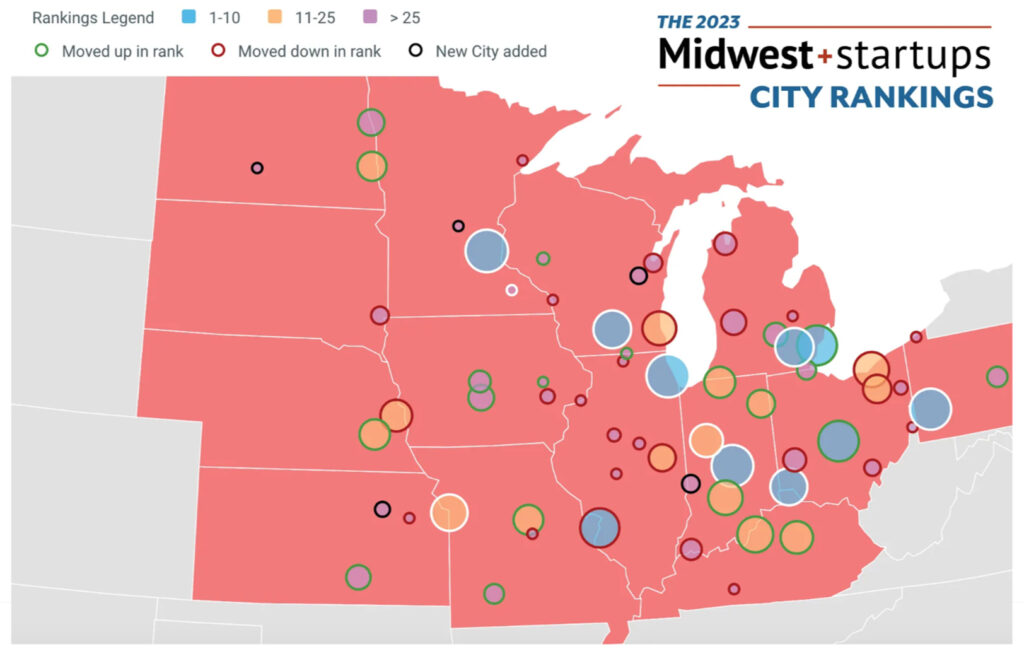

A healthy dose of recent funding events kept Kansas City in the No. 11 spot in the 2023 edition of M25’s annual ranking of Midwest startup cities, said Victor Gutwein, founder and managing partner at M25.

The comprehensive report explores how metropolitan areas across the Midwest are performing relative to each other based on startup activity, access to resources, and business climate.

Click here to view the complete rankings from M25.

Gutwein pointed to raises from PayIt, Sailes, Free From Market, Orange EV, and Redeem as positive activity within the local startup ecosystem, adding that Kansas City outperformed higher-ranked cities like Saint Louis and Indianapolis in that area.

“Kansas City has had a lot of relatively big recent wins,” Gutwein said. “That’s what is keeping the city strong.”

Click here to check out M25’s Kansas City breakdown.

Having regionally-focused venture capital firms — like the KCRise Fund, which closed its $34 million Fund III earlier this year — separates Kansas City from many other Midwestern cities, Gutwein added.

“They raised that even when the economy is down,” Gutwein said. “That is making it clear people are seeing good results, and they’re seeing a reason to invest in Kansas City. … It’s actually very, very rare to find such a relatively small, geographic-focused venture fund that’s having so much success.”

Another big win in Kansas City’s column: Homegrown Rx Savings Solutions’ exit to McKesson Corporation in a deal reportedly valued at $875 million. The acquisition was finalized in November.

Beyond the news event of Rx Savings’ sale, the move could have a meaningful ripple effect, Gutwein said.

“It was acquired by McKesson, which also had the major acquisition of CoverMyMeds back in 2017 in Columbus, Ohio, and that was a huge catalyst for that ecosystem,” he said. “KC might continue to see boosts from this for years to come.”

As the broader economy slows down, venture capital invested in Midwest startups has returned to pre-pandemic levels, though Gutwein cautioned against extreme concern.

“I’m not too worried about our companies,” he said of startups in the Heartland. “I think there was just a really exceptional amount of capital coming in during that two-year period from mid-2020 to mid-2022. That was an exceptional point in time, and now we’re back to a new normal. It may feel tight and constricted, but it’s not too bad in the scheme of things.”

Some of the funding activity during that time frame was unlikely to be sustainable, Gutwein added, noting that the prevailing sentiment in the VC industry is that funding will stay low temporarily but recover within a couple years.

While startups adjust to lower and less frequent cash flows, Midwestern companies have an advantage over coastal startups, Gutwein said.

“A lot of our companies have adjusted to be more profitable,” he said. “They didn’t have crazy high burn rates anyway. It’s pretty encouraging to see our companies still growing, still hiring, and still finding a lot of success. … That’s one area where I think the Midwest has an advantage. When the capital is free-flowing, it’s great; but when it’s not, our companies don’t rely on capital too much.”

Click here to read Gutwein’s M25 commentary on the rankings.

Funding from the State Small Business Credit Initiative Program (SSBCI) — an outgrowth of the Biden Administration’s American Rescue Plan — has been a key variable across startup ecosystems as states allocate the resources from the federal government differently, Gutwein noted.

He described Kansas as having an aggressive approach, which helped Wichita surge up the rankings to No. 29, up 13 spots from last year.

“That has also catalyzed a lot of angel [investment] activity in the city,” Gutwein said. “That’s going to result in more startups getting funded, more people moving there, or leaving a larger company there and starting a company.”

Seed rounds from WorkTorch and Plot could be a harbinger of more funding coming to the Wichita area, Gutwein added.

“That’s not something you used to see in Wichita, so I think that’s encouraging,” he said. “It’s a good sign, and that happened before even most of the SSBCI funding.”

On the Missouri side of the state line, Columbia climbed yet another spot, up to No. 21.

EquipmentShare — on the heels of a $290 million Series E round — continues to power the mid-Missouri college town’s growth, causing folks from across the country to take notice, Gutwein said.

“That’s been one of the more interesting ecosystems to watch lately,” he said. “I hardly paid attention to [Columbia] when I started at M25 in 2015. Now, it’s somewhere you can’t ignore. … It’s one that people nationally have heard of and seen some of the activity.”

Fellow college town Manhattan made its first appearance in the rankings, debuting at No. 43, 14 spots ahead of nearby Topeka at No. 57.

Though the Manhattan startup ecosystem is relatively small, it benefits from having Kansas State University in the city, Gutwein said, adding that the Little Apple proved it belongs on the list.

“It definitely deserves to be compared and ranked and analyzed,” Gutwein said, “so that was very validating.”

Featured Business

2023 Startups to Watch

stats here

Related Posts on Startland News

The Sprint Accelerator returns in 2017 with new approach

In less that 24 hours, Kansas City has learned that it will have a new pair of major accelerator programs in 2017. The Sprint Accelerator announced Thursday morning that, while it’s retained its name, the program has undergone a significant evolution that hopes to foster meaningful partnerships between startups and Kansas City corporations. Among a…

Techstars to launch new accelerator program in Kansas City

Accelerator guru group Techstars announced Wednesday that it’s launching a new program in Kansas City after leading the Sprint Accelerator for three years with Sprint. Lesa Mitchell, a former vice president of innovation and networks for the Ewing Marion Kauffman Foundation, will serve as the managing director of the Kansas City accelerator. “We’re excited to…

Kauffman Fellows hosting hundreds of global VCs in Kansas City homecoming

More than 200 investors and entrepreneurs from around the globe will soon converge in Kansas City as part of one of the most highly-esteemed venture capital organizations in the world. Now in its 21st year, the Kauffman Fellows program will reunite top-tier investors that hail from five continents for a reunion summit on Oct. 24…

KCRise Fund makes first area investments in SpiderOak, Innara Health

Only a few weeks after closing on its first $10 million, the KCRise Fund announced Wednesday that it has invested in its first Kansas City-area companies. Launched in February in conjunction with the KC Rising economic initiative, the KCRise Fund is joining ongoing investment rounds in SpiderOak and Innara Health. The fund, led by Darcy…