LendingStandard closes $6.7M round with Flyover Capital among key longterm investors

June 6, 2023 | Startland News Staff

A Kansas City startup’s efforts to streamline the commercial real estate industry are not only reducing wasted time and frustration for lenders and borrowers, said Keith Molzer, it’s making good on investors’ expectations of the tech-driven Saas marketplace.

“LendingStandard has listened and responded to what the market needs,” said Molzer, founding managing partner at Flyover Capital and board chairman at LendingStandard. “As one of their earliest investors, we’ve seen them grow and are eager to watch their next steps.”

The startup on Tuesday announced a $6.7 million round of equity funding, led by Naples Technology Ventures (NTV) with participation from Kansas City-based Flyover Capital and existing investors.

Founded in Kansas City, Kansas in 2015, LendingStandard offers commercial real estate (CRE) lenders a single platform to manage the loan process across all their products. The company’s comprehensive commercial real estate finance platform increases efficiencies by up to 45 percent for clients working with some of the most complex loans.

Its platform is used by three of the top 10 U.S. lenders, and the company looks to rapidly expand its market share with this new round of capital, said Andy Kallenbach, CEO of LendingStandard.

“We’ve had amazing feedback from our prospects and clients over the last few years, and that input has driven us to reimagine how we can expand to serve the commercial real estate industry more robustly,” said Kallenbach. “This round of funding will help us push the platform — and our experienced enterprise team — forward faster.”

In recent years, LendingStandard has meticulously rebuilt its platform to support not just underwriting, but managing and optimizing the entire commercial real estate process from quote to close, according to Kallenbach. The company’s next-generation platform has also expanded to cover a larger spectrum of loan types, from Fannie Mae and Freddie Mac loans to balance sheet lending.

“At a tough time for the industry, commercial real estate lenders need to make the most of every single deal,” said Mike Abbaei, managing partner at NTV. “Our team is proud to support LendingStandard in simplifying and modernizing commercial real estate lending.”

As part of the funding deal, Frank Strauss, advisor at NTV, will join the LendingStandard board alongside Molzer.

Featured Business

2023 Startups to Watch

stats here

Related Posts on Startland News

Leanlab launches edtech certification with focus on accountability to classrooms

A new product certification from Leanlab Education means increased transparency for edtech companies — as well as added credibility for their work within schools. “We want to give teachers and school administrators a quick way to understand if an edtech product reflects the insights of educators, students, and parents — the true end users in education — and…

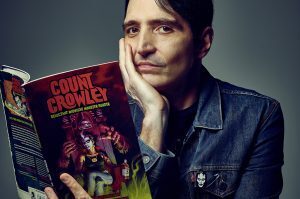

Actor David Dastmalchian fought his own demons; now the KC native is sending ’80s-inspired monsters to you

Growing up in Kansas City, David Dastmalchian was enamored with his hometown’s most shadowy corners: its fabled haunted houses, the shelves of Clint’s Comics, “Crematia Mortem’s Friday” on local TV, and even his Overland Park neighborhood’s mystical-seeming creeks and forests. Each of these childhood haunts planted a seed for the Hollywood actor’s latest project —…

MoodSpark buys defunct startup’s IP, minds focused on disrupting elderly veterans’ depression

A slew of new patents and tools are now in the hands of a KCK-rooted startup that aims to protect aging military veterans that suffer from loneliness, anxiety and depression. MoodSpark has acquired assets previously held by California-based Dthera Sciences — an early leader of the digital therapeutics space, known for its innovative quality of life…

Built to last, bought with intention: How JE Dunn set supplier diversity as a cornerstone

Editor’s note: The following story was sponsored by KC Rising, a regional initiative to help Kansas City grow faster and more intentionally, as part of a campaign to promote its CEO-to-CEO Challenge on supplier diversity. Approaching supplier diversity for the long haul means defining the work — without limiting it, said Jason Banks, describing how Kansas City-based construction icon JE…