LendingStandard closes $6.7M round with Flyover Capital among key longterm investors

June 6, 2023 | Startland News Staff

A Kansas City startup’s efforts to streamline the commercial real estate industry are not only reducing wasted time and frustration for lenders and borrowers, said Keith Molzer, it’s making good on investors’ expectations of the tech-driven Saas marketplace.

“LendingStandard has listened and responded to what the market needs,” said Molzer, founding managing partner at Flyover Capital and board chairman at LendingStandard. “As one of their earliest investors, we’ve seen them grow and are eager to watch their next steps.”

The startup on Tuesday announced a $6.7 million round of equity funding, led by Naples Technology Ventures (NTV) with participation from Kansas City-based Flyover Capital and existing investors.

Founded in Kansas City, Kansas in 2015, LendingStandard offers commercial real estate (CRE) lenders a single platform to manage the loan process across all their products. The company’s comprehensive commercial real estate finance platform increases efficiencies by up to 45 percent for clients working with some of the most complex loans.

Its platform is used by three of the top 10 U.S. lenders, and the company looks to rapidly expand its market share with this new round of capital, said Andy Kallenbach, CEO of LendingStandard.

“We’ve had amazing feedback from our prospects and clients over the last few years, and that input has driven us to reimagine how we can expand to serve the commercial real estate industry more robustly,” said Kallenbach. “This round of funding will help us push the platform — and our experienced enterprise team — forward faster.”

In recent years, LendingStandard has meticulously rebuilt its platform to support not just underwriting, but managing and optimizing the entire commercial real estate process from quote to close, according to Kallenbach. The company’s next-generation platform has also expanded to cover a larger spectrum of loan types, from Fannie Mae and Freddie Mac loans to balance sheet lending.

“At a tough time for the industry, commercial real estate lenders need to make the most of every single deal,” said Mike Abbaei, managing partner at NTV. “Our team is proud to support LendingStandard in simplifying and modernizing commercial real estate lending.”

As part of the funding deal, Frank Strauss, advisor at NTV, will join the LendingStandard board alongside Molzer.

Featured Business

2023 Startups to Watch

stats here

Related Posts on Startland News

For one night only, KCI’s new terminal became the city’s premier event venue; Here’s how they pulled it off

Transforming an airport terminal into a high-profile, elegant celebration and then back to an airport terminal within 48 hours is no easy feat, Whitney Butler said, but the women-led PlatinumXP team was up for the challenge. “We were creating within a venue that will never be able to be used as an event venue again.…

WeCode KC founder earns women’s achievement honor; adds national STEM figure to her org’s leadership

Only a few days into March, 2023 is already proving to be a big year for WeCode KC, noted co-founder and CEO Tammy Buckner. The organization — which operates with a mission is to give youth, especially those in the urban core, the opportunity to learn technology concepts and leadership skills and create a pipeline…

‘Shark Tank’ sets stage for Bryght Labs’ new smart play product rollout amid MO funding uptick

Fresh off a successful appearance on “Shark Tank,” Olathe-based connected gaming startup Bryght Labs hopes to capitalize on that exposure to build momentum, said founder and CEO Jeff Wigh. Wigh and co-founder Adam Roush were featured on an episode that aired in December, pitching their product ChessUp, a patented chess board that uses AI technology…

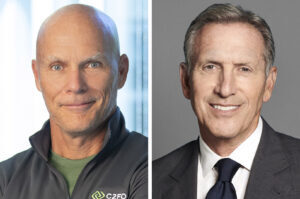

C2FO: $10M investment from Starbucks CEO will unlock $100M in loans to small, diverse businesses

One of Kansas City’s most successful scaling startups announced Tuesday a new initiative — funded by Sheri Schultz and Starbucks CEO Howard Schultz — to provide access to $100 million in working capital for small and diverse businesses. The partnership — designed to use Leawood-based C2FO’s innovative lending approach to deliver flexible, equitable access to…