Smart regulation required as digital assets, blockchain push innovation faster than ever, entrepreneur says

June 26, 2023 | Jy Maze

Editor’s note: The opinions expressed in this commentary are the author’s alone. Jy Maze is CEO of Maze Freight Solutions and a ForbesNext1000 2021 Honoree.

Kansas has seen much innovation over the past decade, but to continue that growth, we as a state need to look at new economic opportunities to drive business to our state.

These opportunities can come from the blockchain and digital asset industries, which could integrate into the state’s key sectors like manufacturing, agriculture, and energy. These industries would allow companies limited by the traditional banking system the opportunity to build a portfolio and grow.

The blockchain and digital asset industry is revolutionizing operations in finance, energy, agriculture, education, real estate, supply chain management, and more. And while some opposed would say these digital assets have led to increased scams, many people see these as innovative solutions to problems within traditional financial systems.

Sixteen percent of adult Americans have purchased digital assets. About seven million Americans do not have a bank account and another 24 million rely on costly non-bank services like check cashing and money orders for everyday needs. Digital assets and blockchains have the potential to empower individuals in underserved areas throughout all of our communities.

As these industries continue to grow, there needs to be some federal regulation to ensure no illegal activities occur. The protection and regulation of an open and inclusive digital financial infrastructure is a worthwhile starting point for federal regulatory efforts. It’s imperative that political leaders create an environment in which bad actors are held accountable and good actors are given the freedom to innovate.

There is a place for fintech and digital innovation in Kansas. With roughly 237 banks and 70 academic institutions that boast STEM research, state leaders should be on the front lines of efforts to improve federal regulation of digital assets and blockchains.

I believe it’s time for Kansas leaders to come to the forefront of attracting more companies that operate in this space to our state. These industries bring young professionals who would plant roots and contribute to our economy. We must be able to compete with surrounding states when it comes to innovation.

Jy Maze is the president and CEO of Certified Woman-Owned Maze Freight Solutions. She has been in transportation and supply chain management for 15 years. Her success with large and small companies, along with the lack of diversity in the industry, led to the founding of Maze Freight Solutions in 2017.

RELATED: How being Black, religion and mentors shaped Jy Maze, kept her startup from failing

2023 Startups to Watch

stats here

Related Posts on Startland News

Fashion meets cannabis: This KS-engineered, on-the-go rolling station blocks odors, makes smoking prep safer

Missouri voters legalized it; now cannabis accessories can cleanup in a newly de-stigmatized market A Kansas City cannabis lifestyle brand hopes this month’s legalization of recreational marijuana sales in Missouri will spark new interest in its products designed for on-the-go cannabis users, said Mohamed Dia. Gopack Station markets itself as “fashion meets cannabis,” said Dia,…

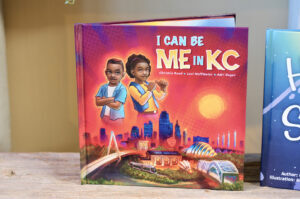

Children’s book tells KC entrepreneurs’ stories; challenging traditional pathways to success

Christle Reed wants Kansas City’s next wave of potential business builders to know they needn’t be bound to a mainstream plot line for wealth and happiness, the entrepreneur-turned-author shared. Her new children’s book about more than a dozen local entrepreneurs could help rewrite that narrative. “College isn’t the only way to success for kids,” she…

PMI Rate Pro pivots to tech solutions firm as pricing tool integrates with mortgage software solution

The mortgage industry is lagging behind in the current world of technology, Nomi Smith said; but PMI Rate Pro is innovating to become a one-stop shop for private mortgage insurance (PMI). “We began as a quoting service, so we developed an API (application programming interface) supporting another API. But we quickly realized that there needed…