C2FO: $10M investment from Starbucks CEO will unlock $100M in loans to small, diverse businesses

March 7, 2023 | Startland News Staff

One of Kansas City’s most successful scaling startups announced Tuesday a new initiative — funded by Sheri Schultz and Starbucks CEO Howard Schultz — to provide access to $100 million in working capital for small and diverse businesses.

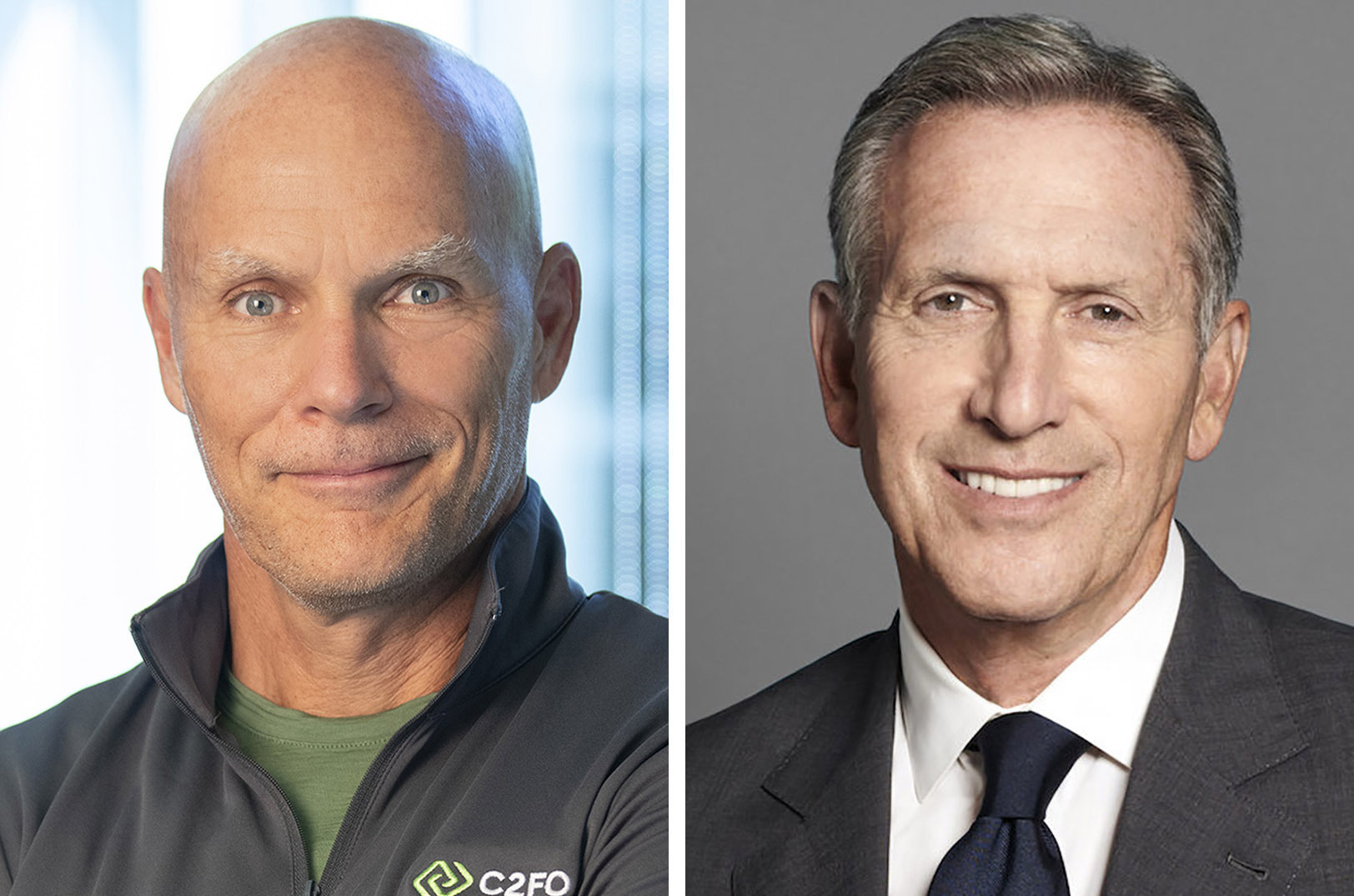

The partnership — designed to use Leawood-based C2FO’s innovative lending approach to deliver flexible, equitable access to loans at competitive rates — is enabled by a $10 million investment from the Schultz Family Foundation into C2FO’s lending program. It also publicly reunites collaborators Howard Schultz with Alexander “Sandy” Kemper, founder and CEO of C2FO, who previously joined a Startland News for a panel discussion on the importance of diversity and inclusion in the workplace.

Sheri Schultz and Howard Schultz, Schultz Family Foundation, speaking at an event with the Aspen Institute; photo courtesy of the Aspen Institute

Through the new initiative, C2FO will leverage the foundation’s Entrepreneurs Equity Fund investment to expand its existing funding capacity with impact credit firm Community Investment Management, enabling C2FO to expand its existing loan program and deliver an additional $100 million in projected loans in the next year, the company said.

Unlike products from banks and alternative lenders, each loan is based on each business’s unique potential, C2FO detailed in a press release, including growth and management team, rather than solely on the number of years it has been in business, last year’s profit, or last month’s accounts receivable balances.

Click here for more information about the partnership and C2FO’s loan application process.

The Schultz Family Foundation, established in 1996 by Sheri and Howard Schultz, interim CEO and chairman emeritus of Starbucks, creates pathways of opportunity for populations facing barriers to success, focusing on youth transitioning to adulthood and marginalized populations, including Black, Indigenous, and People of Color. By investing in scalable solutions and partnerships in communities across the country, the Foundation aims to help tackle the barriers and roadblocks that prevent individuals from reaching their full potential and, in doing so, strengthen our communities and our nation.

The Foundation’s Entrepreneurs Equity Fund (EEF) is a $100 million commitment to invest in diverse businesses as vehicles for fostering a more inclusive economy, creating jobs, and building wealth in historically marginalized communities.

“We are proud to partner with the Schultz Family Foundation. This is a fabulous opportunity for our two organizations to support small and diverse-owned businesses in a big way,” said Alexander “Sandy” Kemper, founder and CEO of C2FO. “We know that when businesses have equitable access to the capital they need — when a financial system is truly inclusive — we all win. Our partnership with the foundation will increase the number of loans we are able to give, supporting even more businesses than ever with easy, equitable and flexible access to capital.”

Such efforts are particularly worthwhile, Kemper said, because they enable businesses to expand their day-to-day operations without diluting diverse business owners’ equity ownership.

“America’s future rests on our entrepreneurial fire. But in recent years, the spark within many entrepreneurs has struggled to find the oxygen to burn bright,” said Howard Schultz. “The causes are many: predatory practices, lack of access to capital and social networks, the need for learning and community, and the systemic failures that lead some to not even try.”

“Providing working capital to help diverse businesses meet customer demand and scale has enormous potential to be a powerful economic catalyst for the country as a whole and historically marginalized communities in particular,” the Starbucks leader continued.

C2FO’s partnership with the Schultz Family Foundation is based on each organization’s mutual commitment to diverse-owned businesses, the two leaders shared. And it’s the most recent effort that builds on C2FO’s history of creating products and offerings that support businesses through innovative working capital solutions, the company said.

RELATED: New C2FO-powered payment hub unlocks capital for diverse-owned businesses

RELATED: C2FO donates all marketplace revenue it earned Friday to three KC nonprofits for Juneteenth

Because diverse-owned businesses have increasingly incorporated C2FO products and services into their cash management strategy, in 2022, the C2FO platform provided more than $4.7 billion in funding to minority- and women-owned businesses across the United States. This fueled business growth and enabled owners to invest in increased staffing, product or technology expansions, and more, the company said.

Check out a 2021 Startland News virtual panel discussion below that featured Sandy Kemper, Howard Schultz and Morgan Stanley executive Carla Harris sharing perspectives on diversity and inclusion initiatives in the workplace.

Featured Business

2023 Startups to Watch

stats here

Related Posts on Startland News

Novel Capital, Pipeline join forces to help members gain easier access to evasive non-dilutive capital

A fintech startup launched by two veteran founders is extending its services to members of the elite Pipeline network in a bid to make non-dilutive capital more accessible to startups across the region. Novel Capital, an Overland Park-based fintech growth platform that helps B2B businesses accelerate their growth, recently announced plans to help companies led…

United Way launching $2M fund with Kauffman to back nonprofits that serve people of color

A new Nonprofit Catalyst Fund is expected to help the United Way of Greater Kansas City invest in advancing small nonprofit organizations that serve Black, Latino, and other people of color in the community, said Essence Yancey. “We believe that small, nonprofit organizations within communities of color play a key role in addressing a range…

Kauffman funds help Holy Rosary pilot new lending model to boost equitable access to capital

When a traditional bank may not be able to justify lending additional funds to an entrepreneur struggling to get their business off the ground, Holy Rosary Credit Union is uniquely positioned to help people achieve that evasive upward mobility — regardless of race, gender, or geography, said Carole Wight. A $3.3 million grant from the…

Attention passengers: Prepare to fill your carry ons with local goods when KC’s new terminal opens

Local businesses are a significant part of Kansas City’s story, Tyler Enders said, and the new terminal at the Kansas City International Airport gives travelers coming into the city the perfect prologue. “Right when people land in Kansas City, they will be introduced to local artwork, local restaurants and local retail brands. When they go…