Kauffman funds help Holy Rosary pilot new lending model to boost equitable access to capital

February 27, 2023 | Startland News Staff

When a traditional bank may not be able to justify lending additional funds to an entrepreneur struggling to get their business off the ground, Holy Rosary Credit Union is uniquely positioned to help people achieve that evasive upward mobility — regardless of race, gender, or geography, said Carole Wight.

[pullquote]

Founded in 1943, Holy Rosary Credit Union was a state-chartered credit union servicing just one Catholic parish. Today the credit union has assets of more than $37 million and has 6,000 members and 20 employees.

[/pullquote]

A $3.3 million grant from the Ewing Marion Kauffman Foundation in June 2022 is powering the initiative, through which Holy Rosary already has deployed $1.7 million to date to address common hurdles and deliver funds faster to the local small business community, said Wight, CEO of Holy Rosary Credit Union, a local community development financial institution (CDFI).

Editor’s note: The Ewing Marion Kauffman Foundation is a financial supporter of Startland News.

“The traditional lending system has failed too many entrepreneurs,” Wight added. “There are specific systemic barriers that have kept access to capital out of reach for too many, and with this grant we’re deploying new methods for overcoming those barriers that, based on the early results we’re seeing, can be a model for equitable access to capital.”

Click here to learn more about Holy Rosary Credit Union.

The Kauffman grant funding supports Holy Rosary Credit Union’s new approach to credit scoring that could potentially become a model for other lenders to use to evaluate risk and distribute capital in more equitable ways. This model provides access to microloans for new and small businesses, particularly those just starting out and in historically marginalized communities by using different criteria than traditional banking institutions.

“We are becoming more of a business lender rather than a consumer lender, and it is foundationally changing the way we do work,” said Wight.

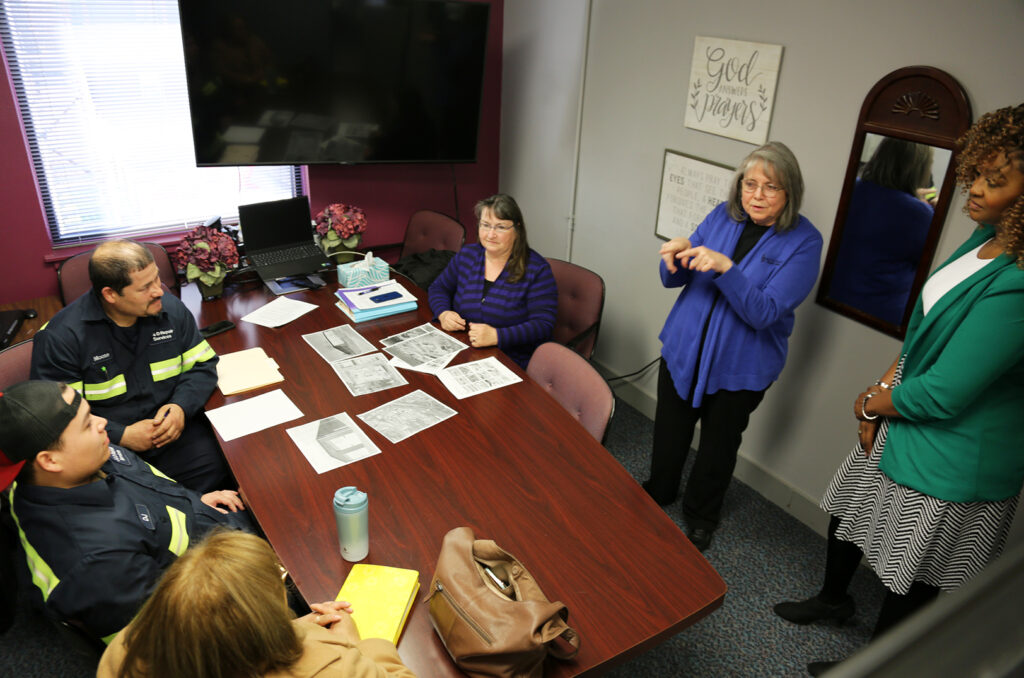

Holy Rosary Credit Union and Ewing Marion Kauffman Foundation officials, at right: Patricia Case, Holy Rosary; Shakia Web, Kauffman Foundation; and Carole Wight, Holy Rosary

In collaboration with such key financial institutions as Holy Rosary Credit Union, the Kauffman Foundation is working to understand and address the challenges entrepreneurs face when accessing capital. That includes identifying innovative capital models and deploying supportive grants that help create more equitable access to capital for underrepresented entrepreneurs.

The $3.3 million grant seeds a revolving loan fund of $3 million to provide alternative financing options to qualifying businesses in Kansas City. These options will assist small business owners in overcoming the obstacles and hurdles many entrepreneurs face when seeking traditional asset-based financing.

Holy Rosary Credit Union estimates that 7.5 percent of small businesses in Kansas City meet the requirements for a microloan of $50,000 or less; however, this only accounts for a fraction of the approximately 178,000 small Main Street enterprises that require access to finance.

“In Kansas City, there is an estimated market need of $134 million in small business funding, and yet, there are very real scenarios that traditional lending models don’t account for and as a result, entrepreneurs are seeing unequal access to capital,” said Shakia Webb, program officer, Kauffman Foundation.

The remaining $300,000 grant funding strengthens the organizational capacity of Holy Rosary and ensures solid internal controls, efficient underwriting, and appropriate technology infrastructure.

To date, the grant funds have enabled Holy Rosary Credit Union to provide 21 small businesses with financing ranging from $1,500 to $650,000 with little to no down payment. Funds also supported the creation of the Dream Builder program.

The Dream Builder program employs a holistic training approach to entrepreneurship financing by connecting new borrowers to the resources they need, ultimately allowing for more opportunities for them to qualify. Dream Builder borrowers have access to training seminars, individualized solutions to credit challenges, and a mentorship program to make invaluable peer connections in Kansas City. Similar to the Small Business Administration model, this program provides a one-time, three-month deferment option.

Dream Builder also uses a new approach to credit scoring, allowing Holy Rosary to process the loans more quickly and with a broader lens. The model improves the credit union’s ability to increase the volume of loans they process, dropping the average underwriting time from 16 hours to 30 minutes. This model centers on a borrower’s unique story and needs, and identifies indicators for success that are specific to that business in order to determine if it meets loan requirements.

Featured Business

2023 Startups to Watch

stats here

Related Posts on Startland News

Entrepreneur of the Year honorees stepped through a wormhole of fate: Here’s what they found in KC

The ultra successful all share one common influence, said Peter Mallouk: luck. And for the president and CEO of Creative Planning, good fortune has revolved around Kansas City. It all started when his parents left Egypt and ended up in Brookside, he told a crowd Wednesday evening during the 39th University of Missouri-Kansas City Entrepreneur…

How UMKC’s top student entrepreneur found shelter (and a path forward) as a founder

Shapree Marshall’s path began with shared struggle, re-routed to survival — and ultimately made a stop Wednesday evening at H&R Block’s World Headquarters where the startup founder was honored as UMKC’s 2025 Student Entrepreneur of the Year. “My journey into entrepreneurship did not begin with a business plan or a class project,” said Marshall, founder…

First look: Made in KC’s new Union Station shop boasts all the trimmings (and World Cup timing)

An influx of holiday shoppers is just the start for Made in KC’s newly-opened store inside Union Station — positioned to take advantage of coming FIFA World Cup traveler traffic — years after the local-first retailer’s owners first envisioned making the quintessential Kansas City destination a home for one of their shops. “We’ve been wanting…

KC Tech Council reboots its visual identity, teases plans to open new downtown HQ

It’ll be new year, new look for KC Tech Council as the regional tech advocate relocates to a collaborative headquarters space in downtown Kansas City, as well as embracing a bold brand update — all coded to better reflect a modern, tech-driven ecosystem. “As KCTC powers initiatives that further establish Kansas City as a premier,…