nbkc partners with Acorns as Kansas City bank deposits expanded fintech focus

January 25, 2023 | Startland News Staff

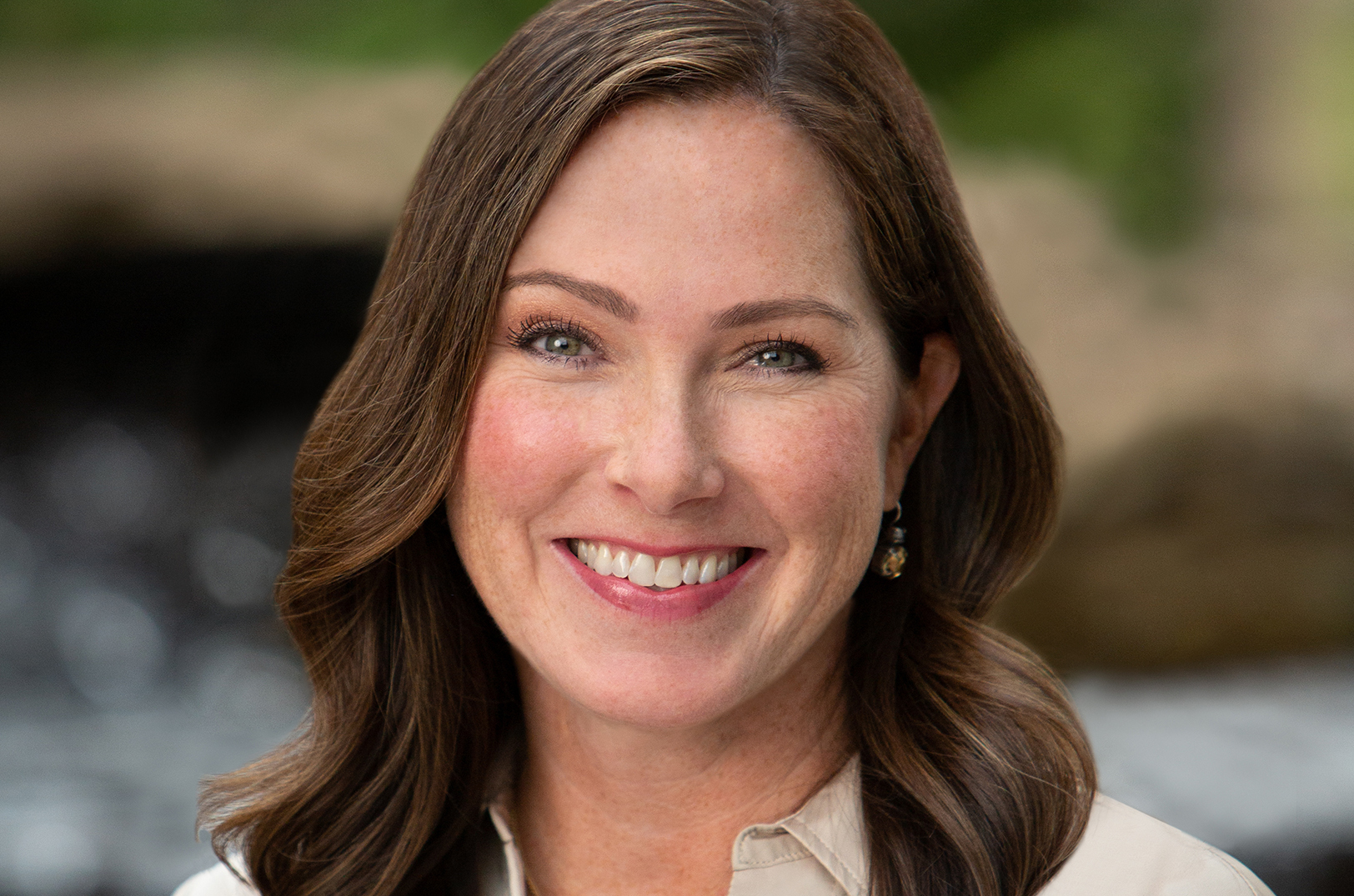

A move by nbkc bank to provide Banking as a Service (BaaS) solutions to Acorns — a leading saving and investing app — is part of a broader strategy to invest in fintech companies without bank charters, said Melissa Eggleston.

“We see a lot of potential as fintechs are taking off around the country. These startups want to offer banking products to their customers in addition to their investment offerings,” continued Eggleston, chief deposit officer for nbkc bank. “We are getting a lot of traction in the market as a reliable bank of record, and it’s allowing us to scale rapidly and grow our business.”

Irvine, California-based Acorns has helped millions of Americans save and invest $15 billion to date, she noted of the bank’s latest portfolio addition.

“[Acorns’] choice of nbkc as a partner reflects our strong reputation and growing business within the fintech space, which has been a principal focus for us,” Eggleston added.

Click here to learn more about nbkc’s approach to fintech.

Through its Acorns partnership, nbkc will provide Acorns-branded checking accounts and debit cards to qualifying Acorns customers so they can spend smarter and save and invest more. Onboarding customers can access checking accounts and debit cards during the account application process.

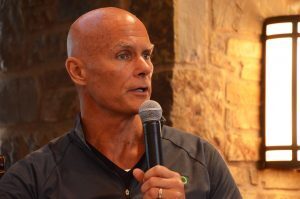

“The core of Acorns is our mission to look after the financial best interest of the up-and-coming,” said Brent Williams, general manager of banking at Acorns. “nbkc is a mission-aligned partner providing strategic support as we continue to help millions of everyday Americans spend smarter and save and invest more.”

With Acorns Checking, subscribers can invest spare change with every swipe and invest a piece of each paycheck automatically.

“We understand fintech companies because we are integrated with emerging financial technologies,” said Eggleston. “Banking as a service to fintechs has been a very logical and productive way for us to expand our banking business and provide real value to fintechs and their customers.”

Formed in 1999, nbkc offers nationwide, online home lending and consumer banking, as well as community and commercial banking throughout its home region of Kansas City — in addition to banking-as-a-service to fintech companies across the U.S.

“We are also looking to work with other strong Kansas City entrepreneurs,” said Eggleston. “Whether supporting small business with our loan programs or investing in exciting new markets like fintech, our door is open to new possibilities.”

The bank previously created the Fountain City Fintech accelerator, which graduated high-profile cohorts in 2018 and 2019 before being discontinued.

2023 Startups to Watch

stats here

Related Posts on Startland News

Ready to ghost summer? Boozy ‘spookeasy’ pop-up concepts pour ‘horror movies in a cup’

A graveyard smash is expected to sweep the metro this fall as two Kansas City hotspots prepare to unleash new pop-up bar concepts for Halloween. “Ever since I watched ‘The Simpsons Treehouse of Horror’ when I was like 8, I have been into, in some manner, scary things,” said Edward Schmalz, founder of Pawn and…

Zohr takes startup lessons on the road as on-demand tire service expands to Dallas streets

As Zohr drives toward national expansion, the on-demand tire services startup is already finding success in Dallas, replicating the metro-wide experience it made popular in hometown Kansas City, said Komal Choong. “We’re getting great responses from our early adopters,” the Zohr co-founder and CEO said. “So we’re very optimistic that it’ll continue to grow, just…

C2FO’s $200M challenge: Prove the fintech startup is worthy of KC’s biggest investments

A record-busting $200 million investment announced Wednesday easily tops C2FO’s previous headline-grabbing funding rounds, but now the Kansas City fintech mega startup must live up to the hype, said Sandy Kemper. “Investments are always forward-looking,” said Kemper, founder and CEO of C2FO. “Our job is to make sure that we’re living up to our ability…

BREAKING: C2FO closes $200M investment led by backer of WeWork, Uber, Slack

Startup giant C2FO continues its climb to the top, having secured a new $200 million investment — and doubling the amount of its once-record funding raise in fewer than two years. “We are very fortunate to have a team who, for years, has delivered industry-leading unit economics, extraordinary customer satisfaction, and strong global growth,” Sandy…