ROI from PayIt’s recent $90M investment displays value of MTC’s early support, agency says

August 12, 2022 | Startland News Staff

Marquee successes for two Show Me state companies — including a massive funding round for one rapidly growing Kansas City govtech scaleup — show the value of Missouri Technology Corporation’s early stage investment programs, said state and agency officials Thursday.

A key example, they touted: PayIt, a SaaS platform that simplifies interactions between government agencies and the public, which last week announced a $90 million growth investment from Macquarie Capital — a move MTC said resulted in Kansas City-built PayIt buying out some of its earlier investors.

Click here to read more about PayIt’s funding announcement.

MTC first invested in PayIt in 2016 and made an additional, smaller investment in 2018. PayIt has grown to employ more than 100 people at its downtown Kansas City headquarters and is a leader in the region’s emerging GovTech sector, which includes companies like TicketRx, Daupler, and mySidewalk.

“MTC’s investment was instrumental in PayIt’s early growth and product development, bringing us to readiness for the recent growth equity investment we received,” said Mike Plunkett, co-founder, COO, and CFO at PayIt. “We are proud to be a part of the dynamic tech community here in Missouri and to contribute to the state’s continued economic development.”

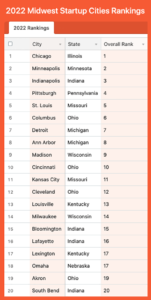

A new report by Chicago-based M25 — the 2022 Midwest Startup Cities Ranking — saw Kansas City rise from No. 12 to No. 11, in large part because of the State of Missouri’s renewed commitment to entrepreneur and startup support. (St. Louis continues to hold a strong position at No. 5.)

Click here to read more about Kansas City’s ranking, along with commentary on the ecosystems of Columbia, Missouri, and neighboring Wichita and Topeka.

In addition to signing a budget that allocates $31 million to MTC for the 2023 fiscal year, Missouri Gov. Mike Parson also designated the Department of Economic Development (DED) and MTC as the entities responsible for administering the state’s $97 million federal allocation through the State Small Business Credit Initiative (SSBCI). SSBCI is the only American Rescue Plan Act (ARPA)-funded program that allows states to invest in high-growth potential companies through a state-sponsored venture capital program.

On Aug. 1, Missouri’s ongoing strategy yielded ROI once again when 65 percent of St. Louis-based CCI — the developer of a rotational, oilseed cash crop to provide winter and spring soil cover between corn harvest and soybean planting — was acquired by Bayer.

MTC first invested in CCI in 2014 and has made a total of five investments in the company, including the 2021 Series B led by Bunge Ventures. (Following the Benson Hill initial public offering in 2021, Bayer’s acquisition of majority ownership in CCI represents another success for Missouri-based agtech investors, the agency noted.)

After the recent weeks’ news, MTC’s investments in PayIt and CCI generated a cumulative eightfold return on investment, the agency said, which will be used to support the continued growth of the state’s entrepreneurial capacity.

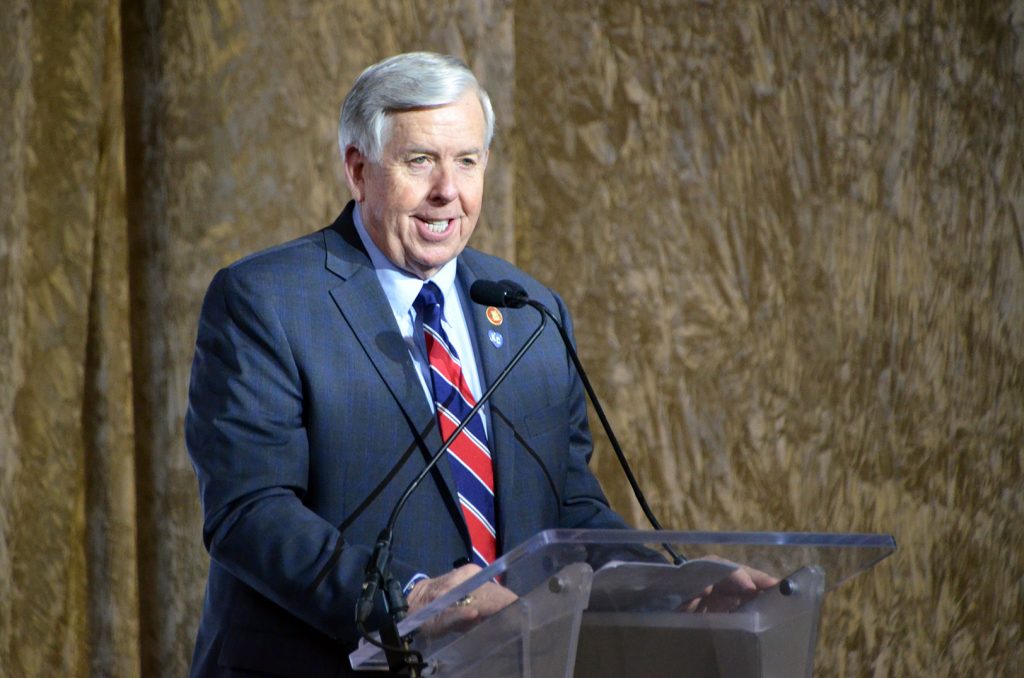

Gov. Mike Parson, R-Missouri, speaks at Union Station in March during the announcement of Meta’s new $800 million data center in Kansas City

“The Missouri Technology Corporation has a successful track record of driving innovation and entrepreneurship through its venture capital programs,” said Gov. Parson. “Strengthening our state’s technology sector is vital for the sustainability of our economy. We’re proud to see Missouri-made companies like CCI and PayIT find success, demonstrating the significant return on investment our state receives through supporting emerging high-tech businesses.”

MTC’s IDEA Co-Investment Program promotes the formation and growth of businesses using science and technology to create jobs. MTC requires a funding match to ensure that investments are made in Missouri’s most attractive early-stage investment opportunities.

The program also helps fund efforts like LaunchKC’s popular grants competition, which is set to return to Kansas City this fall for the first time since 2018.

Click here to learn more about the coming LaunchKC competition, which opens applications Aug. 15.

In the past decade, MTC has invested more than $45 million into nearly 140 emerging technology companies, which have raised more than $1.1 billion in additional capital. More than 65 percent of the companies invested in are still active. Based on annual reporting for FY 2021, the portfolio represented more than 1,000 full-time jobs, which includes more than 270 new jobs created in FY 2021.

“As identified in the Catalyzing Innovation Report published in February, MTC’s activities have had a strong impact on the state,” said Jack Scatizzi, executive director of MTC. “Most of that impact has been driven by successful direct investment activities through our state-sponsored venture capital program. The portfolio has created new and higher paying jobs for Missouri residents and has returned capital back to the organization to again be deployed throughout the state’s innovation and entrepreneurial ecosystems.”

Click here to learn more about MTC, a public-private partnership created to promote entrepreneurship and foster the growth of new and emerging high-tech companies.

Featured Business

2022 Startups to Watch

stats here

Related Posts on Startland News

KCultivator Q&A: Katie Kimbrell pushes reimagined education, equality for women

Editor’s note: KCultivators is a lighthearted profile series to highlight people who are meaningfully enriching Kansas City’s entrepreneurial ecosystem. The KCultivator Series is sponsored by WeWork Corrigan Station, a modern twist on Kansas City office space. MECA Challenge and Startland News are both programs of the Kansas City Startup Foundation, though the content below was produced…

Wild Way mobile coffee shop makes camp for winter in Crossroads warehouse

Winter weather has proven a little too wild for Christine Clutton’s coffee camper, the Wild Way founder said, revealing an indoor, seasonal home for the mobile coffee shop. “We are in a warehouse, but operate in a camper still,” she said of the Wild Way Winter Warehouse space at 708 E. 19th St. “We just…

Get in front of investors: Deadline nearing for InvestMidwest premier venture showcase

InvestMidwest presents more than just an opportunity for startups to pitch to a crowd from outside Kansas City, said Kyle FitzGerald. The event — which spotlights high-growth companies seeking at least $1 million — fosters real investor connections, he added. “It’s the region’s best chance to get in front of a high volume of very qualified…