New C2FO-powered payment hub unlocks capital for diverse-owned businesses

August 19, 2022 | Startland News Staff

Editor’s note: C2FO is a financial supporter of Startland News’ nonprofit newsroom.

A just-launched strategic partnership between one of Kansas City’s largest startups and a Detroit-based minority-owned finance and diversity consulting firm aims to help more overlooked and under-capitalized businesses gain access to funds, the companies announced this week.

The deal is expected to see C2FO’s flexible, on-demand capital platform and patented technology used to launch the first Supplier Success Hub — powered by C2FO. The Supplier Success Hub is a specialized offering within the C2FO platform that will strengthen the corporate supply chain and help diverse-owned businesses thrive by giving them control over their cash flow.

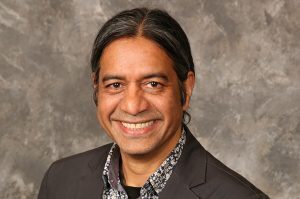

“Diverse businesses face serious working capital constraints that can limit their potential growth or jeopardize their livelihoods,” said Louis Green, CEO and founder of Supplier Success. “Through our partnership with C2FO, we can deliver favorable early payment relief to diverse suppliers at a truly global, and frankly, unprecedented scale. C2FO has repeatedly proven itself to be a leader in serving the diverse business marketplace.”

With corporations increasingly looking to retain and grow their diversity spending, focus has turned to offering differentiated early payment programs to diverse suppliers, the companies explained. The C2FO-Supplier Success partnership and Supplier Success Hub provide an unparalleled experience for diverse-owned businesses to accelerate invoices and explore additional working capital products to support their businesses, according to Green.

“We are thrilled to partner with Supplier Success, a proven market leader in the diversity and inclusion space, and further our mission to ensure every business has the capital needed to thrive,” added Allison Baker, senior vice president of partnerships for C2FO, the world’s largest platform for working capital. “The partnership creates a clear pathway for companies looking to immediately launch specialized working capital programs, unlock accelerated liquidity to diverse-owned suppliers, and increase access for these minority-, women-, LGBTQ+ and disability-owned businesses to low-cost and convenient working capital.”

Founded to ensure all businesses, particularly diverse-owned, have the capital needed to thrive, the C2FO platform has experienced exponential year-over-year growth in use by diverse-owned businesses. This growth highlights an ever-increasing demand for easy access to cash flow.

In 2021, minority- and women-owned businesses used the C2FO platform to secure funding 3.2 times more than other businesses. So far, in 2022, C2FO has accelerated more than $2.5 billion in early payments to diverse-owned businesses worldwide. These early payments become dollars that fuel business growth as owners can invest in increased staffing, product or technology expansions, and more.

Supplier Success and C2FO can offer highly focused working capital solutions to diverse suppliers of all shapes and sizes while supporting their buyers’ supplier diversity goals, the companies said. The partnership provides the added benefits of strengthening corporate balance sheets, minimizing supplier risk and increasing diverse spending opportunities.

2022 Startups to Watch

stats here

Related Posts on Startland News

Former Army intelligence analyst deploys expertise, entrepreneurship to the Market Base

Editor’s note: The following is part of a three-part series spotlighting U.S. military veterans who also are Kansas City entrepreneurs. Hustle runs deep for Jannae Gammage, she said, looking back on the one thing that’s been uniquely hers since childhood: entrepreneurship. “My first business was at 14,” said Gammage, founder and CEO of The Market…

Startup veterans hope to save community banks from fintech ‘feeding frenzy’

The future of small business lending has arrived — and it’s being built by a team of Kansas City tech veterans, at a critical time for the industry, said Hugh Khan. “Small financial institutions are dying; they’re going away. Since the Great Recession, 40 percent are gone,” added Khan, founder and principal of Highploom. “They’re not…

How two hungry vegan sisters went from making queso to their own storefront on Holmes

Arvelisha Woods and India Monique just wanted to style hair and eat nachos, the duo said, breaking into laughter. “It all started with being hungry,” Monique recalled, with Woods emphasizing the “hungry.” The sisters behind Mattie’s Foods went on a fast in 2015 as part of their mission work. They took what they loved the…

As seen on Troost (and Ellen): Plus-size thrift store owner uses momentum to inspire others

Alesha Bowman had plans March 15 to celebrate the two-year anniversary of her plus-size thrift store, UnLESHed+, by opening a new storefront on the historic Troost Avenue. But on March 14, a nationwide pandemic forced Bowman’s plans to be entirely reworked. “You just have to pivot,” Bowman said, noting that she used Facebook and Instagram…